Complete KYC MEXC quickly with Cryplinker – clear, secure, and detailed guidance to help you trade safely and efficiently.

What is KYC Verification?

KYC (Know Your Customer) Verification refers to thoroughly understanding the user of a given service.

Completing KYC helps protect your account and asset security, effectively mitigating risks such as fraud, corruption, and money laundering.

Additionally, KYC information can assist in quickly recovering your account if you accidentally lose your password or other security credentials.

Why is KYC Verification Necessary?

Completing KYC allows you to enjoy a smooth and seamless trading experience, enhancing overall service convenience and security.

- Improves the security level of your account assets.

- Increases the transaction limits for buying and withdrawing funds.

- Unlocks corresponding trading permissions.

- Grants access to KYC-related events

MEXC KYC Levels and Benefits

MEXC provides users with three distinct levels of KYC verification: Primary, Advanced, and Institutional.

| KYC Level | Crypto Deposit | Withdrawal Limits | Fiat Trading | Spot/Futures Trading | Platform Events |

| No KYC (Default) | Unlimited | 10 BTC per day | No | Yes | Yes |

| Primary KYC | Unlimited | 80 BTC per day | No | Yes | Yes |

| Advanced KYC (Recommended) | Unlimited | 200 BTC / $20,000 USD per day | Yes | Yes | Yes |

How long before KYC on MEXC gets approved?

The verification results are typically available within 24 hours, but for Primary KYC check-ups, they can be as quick as 10 minutes.

Is MEXC Safe to Use Without KYC?

MEXC prioritizes user fund security, even without KYC. Their Proof of Reserves system, launched February 22, 2023, lets users verify on-chain assets against user balances, confirming solvency.

By avoiding financial management services, DeFi mining, lending, and leveraged investments, MEXC minimizes mismanagement risk, offering a secure trading environment balancing convenience and safety

Documents You’ll Need to Verify Your Mexc Account

To ensure a secure trading environment, MEXC implements KYC (Know Your Customer) verification for users seeking enhanced platform access and higher withdrawal limits. The process requires valid identification and follows strict guidelines to maintain compliance with global regulatory standards.

MEXC supports the following government-issued identification documents for verification:

- ID Card

- Passport

- Driver’s License

Important Notes:

- Residence permits are not accepted.

- Documents must be valid and unexpired.

- Photos must be clear, unaltered, and taken from original documents. Edited or processed images are not permitted.

- Users must meet the legal age requirement to enter binding contracts.

Step-by-Step Guide to Completing KYC on MEXC

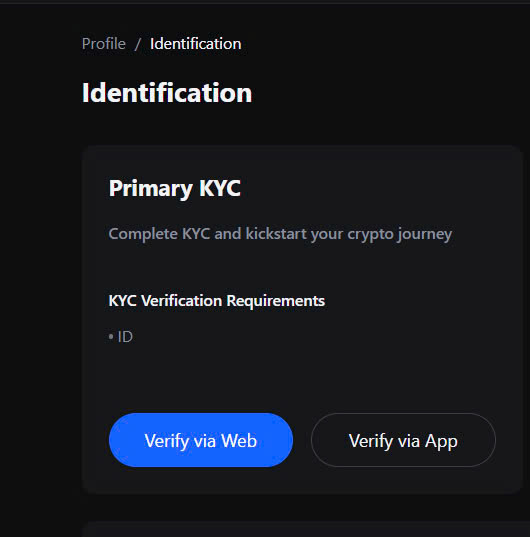

Primary KYC

Primary KYC: Requires submitting an ID for verification. Successful completion unlocks enhanced withdrawal limits and platform features.

- Log In: Access the Mexc official website and log in.

- Navigate to KYC: Click on the user icon, then select [Identification].

- Verify: Next to “Primary KYC”, click on [Verify].

- Enter Information: Select your country/region, ID type, and enter your personal details.

- Upload ID: Take and upload clear photos of the front and back of your ID.

- Submit for Review: Click [Submit for Review]. The result will be available in 24 hours

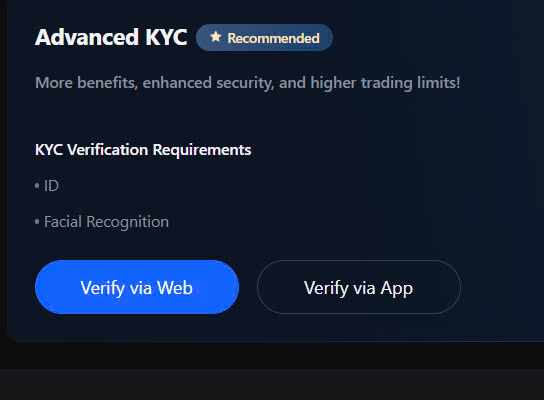

Advanced KYC

Advanced KYC (Recommended): Requires ID verification and facial recognition for additional security and increased withdrawal limits.

- Access KYC Section: Follow the initial steps as in Primary KYC to reach the KYC section.

- Start Verification: Next to “Advanced KYC”, click on [Verify] then [Start Verification].

- Document Upload: Upload clear photos of your ID as instructed.

- Facial Recognition: Perform facial verification as per the on-screen instructions.

- Submit and Wait: The verification result will be available within 24 hours.

Institutional Verification Process

The procedure includes five key steps:

- Document Preparation

- Data Entry

- Member Information Submission

- File Upload

- Verification Review

Required Documents for Institutional KYC

- Businesses must provide the following documentation:

- Board Resolution Document Formal approval for account creation (template available).

- Memorandum and Articles of Association Legal structure and operational framework of the company.

- Company Registration Certificate Proof of business registration.

- Shareholder Register Details of current and former shareholders.

- Directors Register list of directors elected by shareholders.

- Identification Documents Passports of directors, authorized representatives, and individuals managing or holding 25% or more of the company’s shares.

- Ownership Structure Chart Visual representation of the company’s ultimate beneficiaries (template available).

- Screenshot of Company Registration Information must include the inquiry date and be retrievable from a government website.

Tips for Successful Verification

- Ensure all personal information is accurate and matches the submitted document.

- Use valid, original documents to avoid verification failure.

- For assistance with failed verifications or other issues, contact MEXC customer service or submit a support ticket for help.

Common Issues and Solutions

Before attempting to upload your KYC documents, ensure that your images meet the following criteria:

- Image Format: Acceptable formats include JPG, JPEG, or PNG.

- Image Size: The file size must be less than 5 MB.

- Valid ID: You must use a personal and original ID, such as a driver’s license or passport.

- Country Restrictions: Your valid ID must be from a country that does not restrict trading on MEXC, as detailed in the Mexc user agreement, specifically under the section “II. Know-Your-Customer and Anti-Money-Laundering Policy” – “Trade Supervision”.

Troubleshooting Steps

If your documents meet the above specifications and you still face issues, consider the following steps to resolve the problem:

- Network Connection: Sometimes, issues may arise due to temporary network problems. Wait a while before attempting to resubmit your KYC application.

- Clear Cache: Clear your browser and terminal cache to remove any stored data that may be causing the issue.

- Submission Platform: Try submitting your application through both the MEXC website and the mobile app to see if one works better than the other.

- Browser Compatibility: Use different browsers to submit your application. Compatibility issues with certain browsers can hinder the upload process.

- Update the App: Ensure that your MEXC app is updated to the latest version, as this can resolve many operational bugs.

Withdrawal Limits for Different KYC Types

| Type | 24-Hour Withdrawal Limit | Other Trading Permissions |

| No KYC | 10 BTC | No OTC transactions. |

| Primary KYC | 80 BTC | Limited access to OTC transactions. |

| Advanced KYC | 200 BTC | Unlimited access to OTC transactions. |

| Institutional KYC | 400 BTC | No OTC translations. |

Note: In some countries/regions, users without KYC verification may face a combined deposit and withdrawal limit of 1,000 USDT.

FAQs

Does MEXC require KYC?

MEXC does not strictly enforce KYC verification. Users can access key features, such as spot and futures trading, unlimited crypto deposits, and platform events without verification.

Unverified accounts or those with different verification levels will have varying withdrawal limits and platform access.

Is MEXC legit?

Yes, MEXC is a legitimate exchange prioritizing user security and transparency. The platform launched a Proof of Reserves system to verify that sufficient on-chain assets cover user balances.

MEXC refrains from high-risk financial services such as DeFi mining, third-party lending, or leveraged investments, reducing the potential for fund mismanagement.

What are MEXC’s withdrawal limits?

MEXC offers tiered withdrawal limits based on the user’s KYC status:

Unverified (Default) – Up to 10 BTC per day

Primary KYC – Up to 80 BTC per day

Advanced KYC – Up to 200 BTC or $20,000 per day

Crypto deposits remain unlimited at all KYC levels, while fiat trading is available only to verified users. Users can choose the verification level that best aligns with their trading needs.