Just signed up for Bybit and ready to trade? Don’t let limited transactions or withdrawal restrictions catch you off guard. Without completing Bybit KYC, many features stay locked. In today’s crypto landscape, KYC isn’t optional it’s essential for security, compliance, and full access. This quick guide walks you through simple steps to complete Bybit KYC, explains its importance, and helps you unlock your account’s full potential. Let’s get started and trade with confidence.

Understanding Bybit KYC: Why It Matters

Think of KYC as a security pass. It’s the system designed to ensure that your trading experience is both safe and legitimate. You may be wondering why this simple verification has become non-negotiable when opening a trading account. Let’s break it down.

KYC is about protecting you. It acts as a safeguard against fraud, misrepresentation, and unauthorized activity. Imagine having your account hacked because the platform didn’t verify the identities of its users. That’s the kind of chaos KYC aims to prevent.

A barrier to fraudsters: When platforms verify user details, they make it exponentially harder for cybercriminals to create fake accounts or manipulate systems. Without this layer of verification, illicit activities such as money laundering or account takeovers could skyrocket.

Legal compliance ensures longevity. Financial platforms are bound by international regulations. These rules require businesses to verify the identity of their users, preventing illegal activities like tax evasion or terrorism financing. If platforms don’t comply, they face fines, shutdowns, or restrictions. For you, this compliance guarantees trust and sustainable operations over the long term.

Now think about what could happen if you skip completing your verification. At first, everything might seem fine. But you’d be operating under restricted privileges. Many platforms impose account limitations on unverified users, such as capped withdrawal amounts, blocked features, or frozen funds during suspicious activity. Worse still, skipping KYC might leave you vulnerable if someone breaches your account, as recovery processes often rely on verified identification.

In short, by completing KYC, you’re not just ticking off a requirement you’re unlocking a secure, unrestricted, and compliant trading experience. If you’re curious about how to prepare or complete your verification quickly, check out this detailed guide on trading account setups and tips.

Step-by-Step Guide to Completing Bybit KYC

Navigating the KYC verification process can feel confusing at first, but it’s surprisingly straightforward when broken down into steps. Follow this guide to quickly and confidently complete your verification.

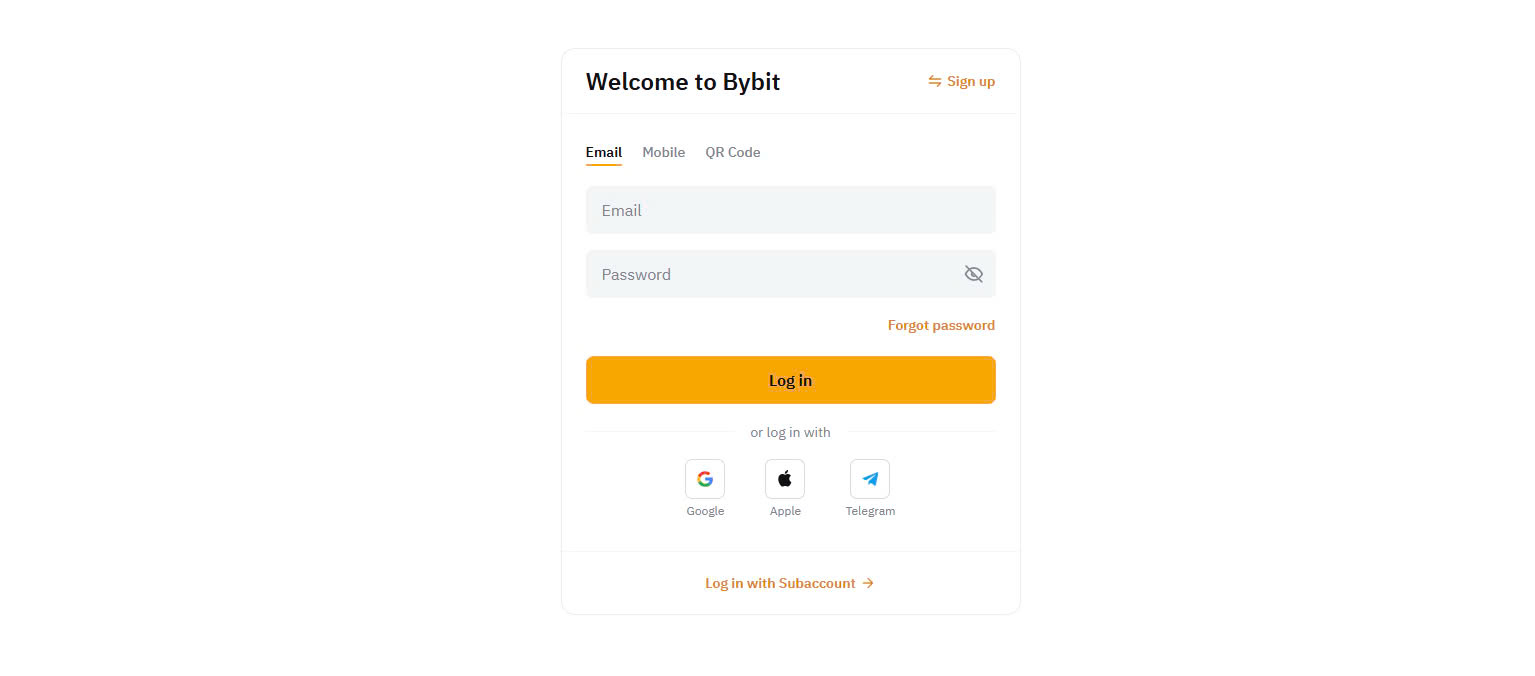

Step 1: Log into Your Account

Start by accessing your trading account via the official platform. Use your email and password to log in securely. If you’ve activated additional security layers like two-factor authentication, make sure to verify your login as prompted.

Tip: Double-check that you’re on the official site to avoid phishing risks.

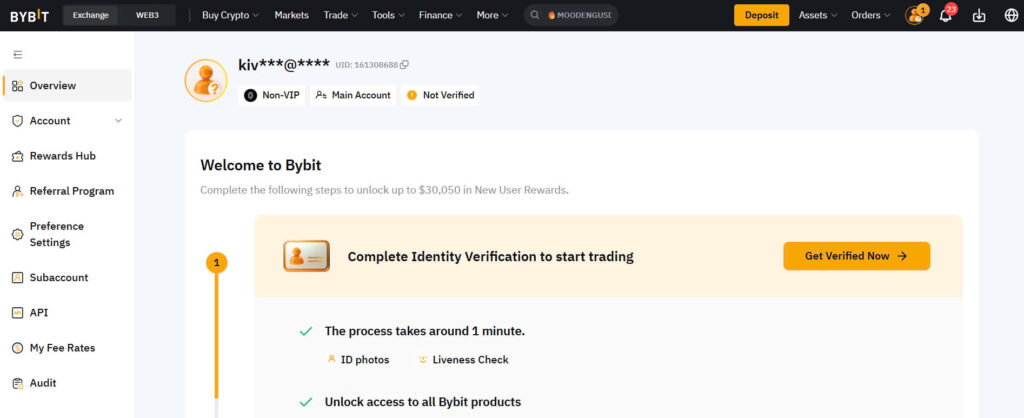

Step 2: Locate the KYC Section

Once you’re logged in, go to your profile or account settings. This is usually found in the top-right corner of the dashboard. Look for an option labeled something like Verification or Identity Verification.

From there, you’ll see the status of your current verification level and the benefits unlocked by completing KYC. Click the option to start your verification process.

Reminder: Many features remain restricted until verification is complete.

Step 3: Upload Required Documents

Prepare the documents you’ll need before starting. Common requirements include:

- Government-issued ID: Passport, driver’s license, or national ID card.

- Proof of address: A recent utility bill, bank statement, or other document showing your name and address clearly.

Follow the instructions to submit your documents. Most platforms guide you to upload clear photos or scans. Ensure your ID image is sharp, with no glare or obstruction. For proof of address, make sure all text and dates are legible.

Quick Tip: Avoid uploading expired documents; these typically get rejected.

Step 4: Verify Your Identity

Some platforms also require live verification as part of their procedure. This might involve recording a short video or taking a selfie in real time via your webcam or phone. Simply follow the on-screen prompts. Ensure good lighting and a neutral background to prevent issues in this step.

Pro Tip: If you’re asked to hold your ID during this step, make sure both your face and the ID are clearly visible in the frame.

Step 5: Finalization and Confirmation

Once you’ve submitted everything, the platform will process your application. This can take a few minutes to 24 hours, depending on the workload or document quality. You’ll receive an email or notification once your KYC is approved or additional information if corrections are required.

Heads-Up: If processing seems delayed beyond expectations, double-check your documents for errors or contact support to avoid prolonged issues.

For more tips on seamless platform use, check out this simple trading guide.

Common Roadblocks and How to Overcome Them

Even though verification processes are designed to be straightforward, a few bumps in the road can appear. These roadblocks can cause delays or rejections but they’re easy to tackle if you know what to watch out for.

Document Rejection

One of the most common challenges is having your document rejected. The reasons can vary, but they often come down to small, easily fixable mistakes:

- Blurry Photos or Scans: If your document photo is unclear, verification teams can’t review it properly. Always ensure excellent lighting and focus when capturing the image.

- Mismatched Details: The name, date of birth, or other details on your document must match the ones you provided during signup. Even a minor typo can lead to rejection.

- Expired Documents: All identification documents submitted must be current. Anything expired will be flagged immediately.

Fix this: Double-check all your document details before uploading. Take your photo in good lighting with no glare or shadows. If in doubt, compare your submission to examples given in guidelines.

Unclear Submission Guidelines

Sometimes the process might seem vague. You might wonder: How do I hold my ID properly? How should my selfie look?

Here’s what usually needs to be done:

- Selfie Uploads: Your selfie should include your whole face, clearly visible, without any obstruction (e.g., hair, sunglasses, etc.).

- ID Photographs: Ensure the entire document fits within the frame, including all details like edges, numbers, and holograms.

- Additional Documentation: If you’re asked for proof of address, use utility bills, bank statements, or similar documents issued within recent months.

Fix this: Read every instruction carefully. If you’re unsure about a step, most platforms have help sections or live support to guide you.

Processing Delays

Sometimes, even when you’ve done everything right, verification can take longer than expected. This is usually due to a spike in applications or manual reviews.

Here’s how to handle delays:

- Check Your Progress: Most platforms provide tracking tools to show the status of your application. Use this feature to stay informed.

- Avoid Resubmitting Prematurely: Constantly re-uploading documents can confuse the system and slow down the process further. Wait out the review time before taking any action.

- Reach Out for Support: If the delay extends beyond the normal review window, contact customer support to check on the issue.

Fix this: Stay patient and keep tabs on your verification timeline. Reaching out too soon can just add noise but if delays drag beyond expectations, polite inquiries usually help.

Understanding these potential roadblocks and how to navigate them puts you in control. With some attention to detail and a little patience, your account can get verified without unnecessary stress.

For an in-depth guide on trading fundamentals once you’ve cleared verification, check out how to trade efficiently.

The Benefits Unlocked After Passing Bybit KYC

Higher Withdrawal Limits

One of the most immediate rewards you unlock is increased withdrawal limits. Without KYC, you’re often stuck with bare-minimum caps. For traders managing larger portfolios or seizing short-term opportunities, those restrictions can be frustrating. Completing verification ensures you can move substantial funds seamlessly when it matters most. No delays, no compromises.

Access to Advanced Trading Features

Passing KYC is like unlocking the VIP section of trading. It opens up advanced options, such as higher leverage, additional financial products, and exclusive tools tailored for seasoned traders. Even if you’re just exploring, these features position you to grow and experiment more confidently.

Promotions and Bonus Opportunities

Trading platforms often reserve their most attractive promotions and bonuses for verified users. From cashback offers to trading credits, verified accounts are usually eligible for perks that can significantly enhance your trading efficiency. Think of it as a loyalty program, but you’ve got to qualify first.

Enhanced Security

KYC doesn’t just benefit the platform it’s got your back too. By submitting verification details, extra security layers are put in place for your account. If any suspicious activity pops up, verified accounts often enjoy faster recovery processes. Plus, it significantly reduces the chances of unauthorized access or fraud. Peace of mind? It’s part of the package.

If you’re wondering what additional trading techniques these features can unlock, understanding core strategies often goes hand-in-hand with limits-free trading. This guide on how to trade effectively (here) offers great insights for beginners and experts alike.

Pro Tips to Streamline Your Bybit KYC Process

Double-check your documents before uploading. Any mismatched, blurry, or low-quality ID image can lead to delays. Make sure your ID is valid, unexpired, and matches the criteria provided in the platform’s guidelines this often means no crops or edits. Clear and accurate files reduce the chance of rejections.

Use precise and up-to-date information. Even small discrepancies, like a misspelled name or outdated address, can trigger verification issues. Cross-check your entries with your official documents to ensure consistency.

Scan in proper lighting. Dim lighting or glare can affect the document’s clarity. Use natural light when possible or a well-lit indoor area to snap crisp images.

Avoid overloading your connection. A spotty or congested network can interrupt the upload process. Connect to a stable Wi-Fi network. This minimizes upload errors and ensures faster processing.

- Use the right file format: Stick to the supported types like JPEG or PNG, and avoid overly large file sizes.

- Capture front and back: If required, provide both sides of your ID in the best quality possible.

- Prepare a secondary document: Some platforms may ask for additional proof, like a utility bill or bank statement, so keep these handy.

Timing matters too. Submit your documents during less busy hours for quicker approval. Platform traffic during peak times could stall your progress.

Finally, consistency is key. An efficient process on one platform often mirrors another. Want to dig deeper? Check out this guide for step-by-step KYC success. Following these steps will pave the way for a seamless verification experience.

Final words

Completing Bybit KYC isn’t just a security requirement it’s your gateway to experiencing the full benefits of this leading crypto-trading platform. From standard account protections to unlocking advanced trading features, a verified account ensures smoother, uninterrupted transactions and enhanced peace of mind. By following our step-by-step guide and expert tips, you can navigate the process efficiently, sidestep common hurdles, and focus on achieving your trading goals. Remember, each document submitted strengthens both your account security and your trading potential. Take action today and transform your trading experience.

KYC Your Bybit Account Now

Learn more: https://cryplinker.com/

About us

Crypto Linker provides cutting-edge tools and educational resources to streamline your cryptocurrency trading journey, making it simple and secure.