Getting started with crypto can feel overwhelming, but BingX trading makes it easier than ever. With beginner-friendly tools and an intuitive interface, BingX helps you take your first steps with confidence. This guide gives you essential tips to create your account, make your first trade, and build a smart foundation. Start your journey today and unlock the full potential of BingX trading.

Why BingX is Perfect for New Traders

When starting out in crypto trading, simplicity and clarity can make or break the experience. What matters most is having the right tools and confidence to make decisions. This is where BingX shines, offering features that cater perfectly to those just stepping into the world of digital assets.

Intuitive Navigation for a Smooth Start

Getting bogged down by overly complex dashboards and unnecessary technicalities can be overwhelming for beginners. BingX tackles this by offering a clean, organized interface that focuses on the essentials. Menus and charts are uncluttered, making it easy to find key functionalities without frustration. Even if this is your first foray into trading, you won’t feel lost.

Think of it like walking into a well-designed coffee shop you know exactly where to go for what you need. Need to check market trends? One click. Want to execute a trade? Simplified tools get it done without layers of complexity. Navigation flows logically, which means even with zero experience, you’ll feel confident clicking through options.

Risk-Free Learning Through Demo Trading

It’s no secret trial and error is a priceless teacher in trading. But wouldn’t it be great if you could learn without burning real money? That’s what demo trading provides. BingX offers aspiring traders the chance to practice on realistic market scenarios using virtual funds. Think of it as a safe sandbox to test strategies, get comfortable with market movements, and refine decision-making without risking anything.

Imagine being able to rewind and reset mistakes. Demo trading bridges the transition from theory to practice, helping you develop competence before jumping in for real. It’s like using flight simulation before piloting an actual plane providing that extra layer of preparedness.

Safety First: Trade With Peace of Mind

For first-timers, trust is a big barrier in crypto. Trading often involves sharing sensitive information or holding significant amounts of digital assets, making security a top priority. Here, BingX excels with robust safety protocols aimed at protecting your funds and data.

Features like two-factor authentication (2FA) prevent unauthorized access to accounts. They’ve also built a strong reputation for employing industry-grade encryption to secure data exchanges keeping your private details and trading activity off the radar of potential threats. As a beginner, knowing you’re operating in a secure environment is invaluable.

Guiding You Toward Confident Decisions

BingX doesn’t stop at just providing the tools; it builds an ecosystem where learning and adapting feel natural. By lowering the entry barriers with an easy-to-use platform, risk-free demo environments, and thoughtful security measures, it’s designed to help you focus on what matters: trading smarter, not harder.

If you’re looking for a detailed review of these features and how they measure up against competitors, this BingX review guide has all the insights you need to go deeper into the specifics.

How to Set Up and Secure Your BingX Account

Creating, verifying, and securing your account is the foundation of confident crypto trading. Follow these simple steps to get started right and safeguard your assets.

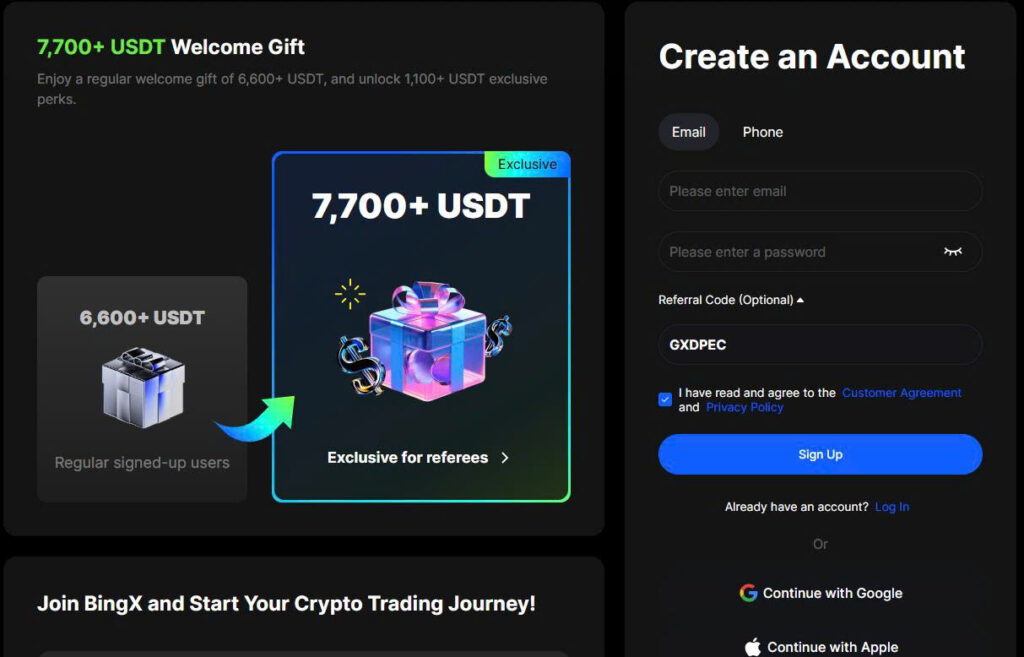

Step 1: Sign Up

- Head to the official site. Look for the ‘Sign Up’ button in the top corner.

- Choose your method. You can register with an email, phone number, or third-party login option. Email is straightforward and easy to manage.

- Enter your credentials. Use a strong and unique password. A mix of upper and lowercase letters, numbers, and special characters works best.

- Check your inbox. A confirmation email will arrive. Click the link to verify your email address.

- Congratulations you’re in! But there’s more to do before you trade confidently.

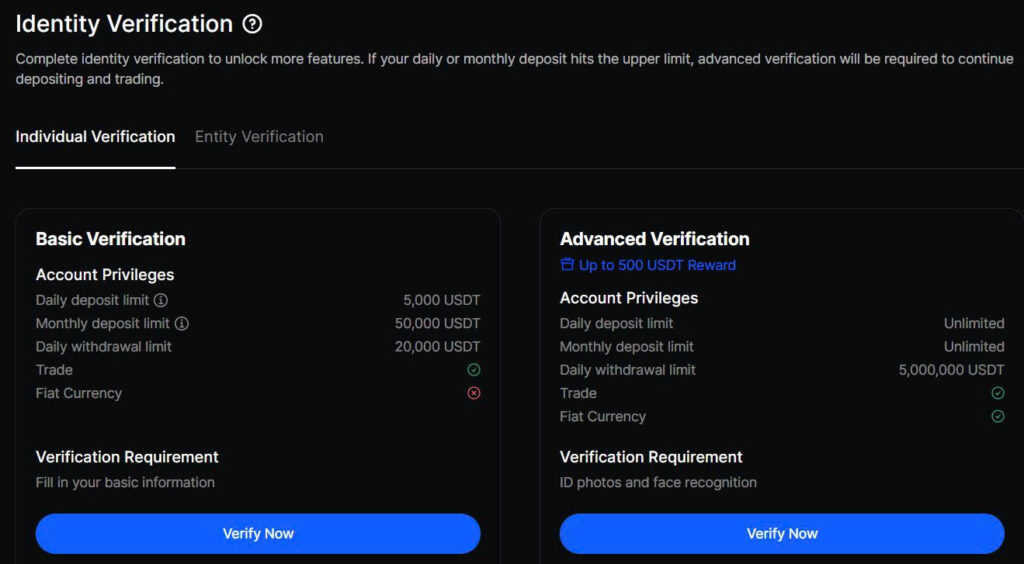

Step 2: Verify Your Identity (KYC Process)

- Why bother? Verifying your identity not only secures your account but also unlocks platform features.

- What do you need? Have your ID, passport, or driver’s license ready. A clear, readable copy is crucial.

Here’s the KYC process in three steps:

- Go to your account settings and find the section labeled Verification.

- Upload your ID and follow the on-screen prompts. You might be asked for a live selfie—this confirms you’re the rightful user.

- Wait for approval. Verification generally takes a few hours but can vary depending on platform activity.

Tip: Avoid delays by ensuring your document matches your provided information.

Step 3: Enable Two-Factor Authentication (2FA)

Securing your account with 2FA is non-negotiable. It adds another layer of protection, keeping attackers at bay even if they guess your password.

- Why you need it: Passwords alone can be compromised, but 2FA requires a second form of verification (like a code from your phone).

- How to set it up:

- Go to your account’s Security section.

- Look for the Two-Factor Authentication option and click Enable.

- Download an authenticator app on your phone. Popular ones work just fine.

- Scan the QR code provided and save your recovery codes. This step is critical in case you lose your device.

- Enter the time-sensitive code generated by your app to confirm it’s set up.

Your account now has a fortress-level defense.

Pro Tip: Monitor Account Activity

Check your login history periodically. If something looks off like a strange location or timestamp lock your account and update your credentials immediately.

To dive deeper into how platforms ensure safety and compliance, check out this guide on account verification processes.

Navigating the BingX Dashboard

The trading dashboard is where it all happens. Knowing your way around is crucial to making informed decisions. Here’s how to navigate the essentials:

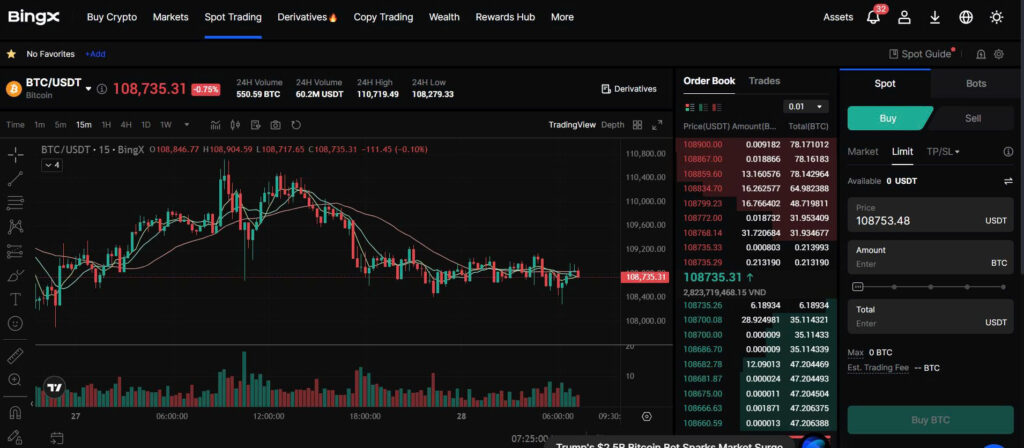

Spot Trading: Your Starting Point

Spot trading is where you directly buy and sell tokens. To find this, check the navigation bar. Look for an option like “Spot” or “Trade.” Once you’re in:

- Market Overview: At the top, you’ll see a search function to find your desired cryptocurrency pairs (e.g., BTC/USDT).

- Price Chart: Right below, there’s a price chart that shows the token’s movement over time. You can tweak the timeframe to see trends more clearly.

- Buy and Sell Options: Below the chart, there are clear boxes for setting your buy or sell prices. If you’re unsure, start simple—use the market order to execute trades instantly at current prices.

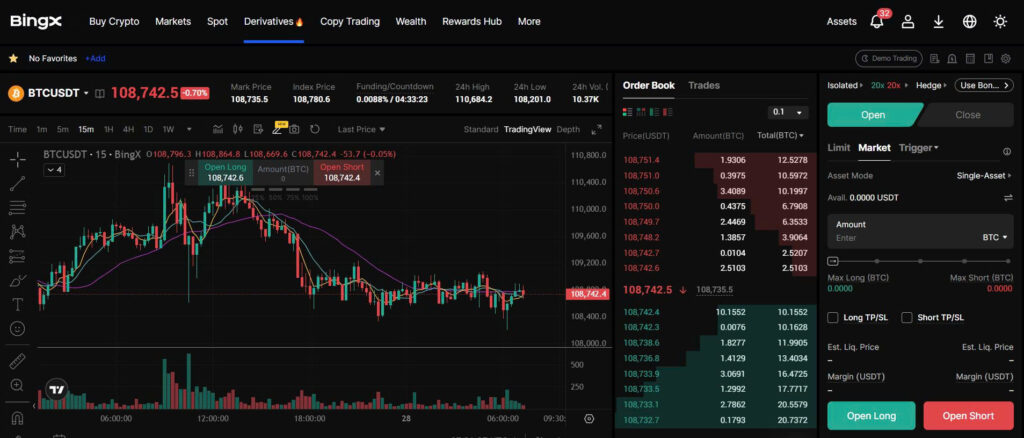

Futures Trading: Amplify Your Moves

Futures trading lets you speculate on price movements, whether it’s going up or down. On the dashboard, look for a “Futures” section or something labeled “Derivatives.”

- Leverage Settings: One of the first things you’ll notice is the leverage option. Be careful leverage amplifies both gains and losses.

- Positions Overview: Once you open a trade, it appears in the positions panel. This is your command center, showing profit, loss, and liquidation prices.

- Risk Management Tools: Many platforms include stop-loss and take-profit features here. Use them to limit risks especially if you’re new.

Copy Trading: Learn While You Earn

Copy trading simplifies investing by mirroring the actions of experienced traders. Locate the “Copy Trading” tab it’s often highlighted due to its popularity.

- Trader Profiles: Browse through profiles of seasoned traders. Pay attention to their win rate, trading history, and risk score.

- Performance Metrics: Each trader has detailed analytics showing past returns and the tokens they typically trade.

- Auto-Copy Setup: Once you pick a trader, enable auto-copy. The platform takes care of duplicating their trades in your account.

Market Data: Real-Time Insights

Market data is like the heartbeat of the platform. You’ll find it in a dedicated “Markets” section. Here’s what to focus on:

- Trending Pairs: Look for tokens with significant price change. These often present opportunities.

- Volume Leaders: High trading volume can signal strong interest and potential for movement.

- Market News: Some dashboards include a news feed. Stay updated on global events that may affect your trades.

A Quick Tip for Smooth Navigation

Bookmark the key sections or use the platform’s mobile app for quicker access. Consistently reviewing market data and trends, even when not trading, builds familiarity and sharpens your instincts.

Looking for more guidance? Check out this detailed guide on getting started in crypto: Beginner’s Guide to Trading Platforms.

Understanding Crypto Trading on BingX

When stepping into crypto trading, the first thing to understand is this: not all trading is the same. There are different approaches, all defined by the tools you use and your goals.

Spot Trading vs. Futures Trading

Here’s the deal:

- Spot Trading is simple. You buy cryptocurrencies at their current price, hoping their value will rise over time. Imagine buying Bitcoin when it’s $20,000 and selling it at $30,000. You own the asset and profit when its price goes up.

- For beginners: This is straightforward and less risky.

- Important note: Losses happen only if you sell for less than what you paid.

- Futures Trading is for those ready to take bigger bets. Here, you don’t own the cryptocurrency. Instead, you speculate on its future price will it rise or fall?

- Upside: You can profit in both market directions (up or down).

- Downside: Leverage (borrowed funds) can amplify your losses.

Think of Spot Trading like buying apples to eat or sell later. Futures Trading? It’s like betting on next month’s apple prices but not owning any apples yourself.

Key Tools That Make Trading Easier

Trading can feel overwhelming at first, but platforms simplify a lot. Here are a few features designed to help:

- Live Price Charts: Real-time price data to track trends. Green candles? Prices are rising. Red candles? They’re falling.

- Preset Stop-Loss & Take-Profit Orders: These help you cap losses or lock in profits automatically.

- Example: Set a stop-loss order on Bitcoin at $25,000. If prices dip to this point, your trade closes cutting your losses.

- Depth Charts: A snapshot of supply and demand. Big green bars? Buyers are ready to push prices up. Big red ones? Sellers dominate.

- Demo Accounts: A practice zone where you trade with fake money. It’s perfect for mastering strategies without risking capital.

Each of these tools is about one thing control. They let you manage risk and trade smartly instead of blindly chasing profits.

Why Trading Feels Simple Here

As a beginner, what scares most people is execution how to actually press the buttons and trade. But good platforms anticipate this fear. The experience is often made beginner-friendly. Here’s how:

- Step-by-Step Interfaces: Want to buy Bitcoin? Enter the amount, preview the fees, then confirm. It’s as easy as shopping online.

- Clear Leverage Settings: If trading futures, set leverage (e.g., 2x or 5x) with simple sliders. Visual cues explain the risks.

- Account Insights: Instant profit-and-loss breakdowns. The second your trade closes, you see how much you gained or lost.

Even better, many platforms offer beginner guides and community support to make those first few trades feel less intimidating.

For those ready to dive deeper, a detailed trading guide can serve as an invaluable companion. Understanding how this works, even on other platforms, helps sharpen core skills.

Trading isn’t a game of guesswork. With simple tools and a clear understanding of how Spot vs. Futures trading works, you’re already ahead of the curve. Then, it’s all about practice.

Leveraging BingX Demo Trading to Build Confidence

Diving into trading for the first time can feel overwhelming. There’s a lot to learn, and every small decision holds weight. But what if you could rehearse every move risk-free? That’s where demo trading transforms your learning curve. It’s like a sandbox where you can build, test, and refine your skills without putting real money on the line.

Why Demo Trading is a Game-Changer

You wouldn’t run a marathon without training first, and trading is no different. Demo accounts are virtual environments that mimic the real market. The prices, charts, and tools look and behave just like they do in the live market. But the money you’re using is fake so, no stakes, only knowledge to gain.

Here’s why that matters:

- Mistakes become lessons – Without the fear of losing money, you’re free to misstep and learn. A loss in demo trading costs you nothing but teaches you everything.

- Confidence booster – By practicing repeatedly, you stop second-guessing your decisions. Confidence becomes a by-product of consistent effort.

- Tool familiarization – Every platform has features you’ll need to master. The demo mode lets you explore them all without pressure.

- Builds muscle memory – When markets move fast, instincts matter. Practice in the demo environment sharpens your reaction times.

How to Get Started

Here’s a simple ladder to climb from confused newbie to confident trader:

- Log into the demo environment: Once inside, look for the ‘Switch to Demo’ option usually found in the interface settings.

- Set clear intentions: Decide what skills you want to practice. Are you learning how to execute trades? Analyze trends? Manage risk? Always have a goal.

- Start small: Don’t pile on trades. Begin with simple, low-risk strategies. For example, try spotting patterns on trend lines before actually placing a trade.

- Use virtual funds wisely: Treat your practice funds like the real deal. Don’t make careless bets you’d never attempt with actual money.

- Review your trades: After each session, go back and evaluate. Where did you succeed? Where did things go wrong? This post-game analysis is critical.

What Skills to Sharpen in Demo Trading

Make the most out of your practice hours by focusing on these key areas:

- Entry and Exit Timing: Learn when to jump into a trade and, just as importantly, when to leave.

- Risk Management: Experiment with stop-loss and take-profit tools. Understand how to cap losses before they spiral.

- Understanding Indicators: Use tools like moving averages, RSI, and candlestick patterns to improve your predictions.

- Portfolio Balancing: Spread your funds across mock investments to ensure you’re not overly reliant on a single strategy.

Transitioning to Real-World Trading

When you’re ready to move out of the demo world, the habits you’ve built will shape how well you fare. Stick to disciplined practices like managing your risks and journaling trades. The experience you’ve gathered in a risk-free zone will serve as your safety net as you dive into the real thing.

For more on building effective trading strategies and understanding how different platforms stack up, check out this detailed guide.

Effective Strategies for Beginners on BingX

Starting small builds confidence. For beginners, the crypto market can feel like a stormy ocean. But with the right strategies, you learn to swim not get swept away. Here are practical approaches to make confident trades from day one.

1. Dollar-Cost Averaging (DCA): The Steady Builder

No one can time the market perfectly. Not even seasoned traders.

DCA is a straightforward method where you invest a fixed amount regularly, regardless of the price. Over time, this balances your entry points, reducing the risk of buying at a peak.

- How it works: Say you allocate $500 a month. Divide it into weekly $125 trades. Buy regularly, regardless of whether the asset’s price is up or down.

- Why it matters: It’s stress-free. Instead of fretting over sudden drops, dips can even become opportunities to accumulate more.

- Pro Tip: Choose assets you believe in long-term. DCA works better with solid cryptos, not volatile moonshots.

2. Trend-Following: Ride the Wave, Don’t Fight It

Trends reveal opportunity. In crypto, prices move in patterns over time upward, downward, or sideways.

Trend-following involves identifying these movements and aligning your trades with the market’s direction.

- Spot an uptrend: Look for higher highs and higher lows. Prices steadily climb.

- Spot a downtrend: Look for lower highs and lower lows. Prices are dropping.

- When to enter?: In an uptrend, consider entering after a minor pullback to ensure it continues.

Avoid fighting momentum. Many beginners lose by trying to “predict” trend reversals instead of flowing with the market. Follow what the chart tells you, not what you hope.

Pro Tip: Use simple tools like moving averages (e.g., 20-day or 50-day) to assist in spotting trends visually.

3. Risk Management: The Lifeboat Strategy

No matter how good a trade looks, protect your capital.

Here’s a golden rule: never risk more than 1-2% of your trading account on a single trade.

- Use stop-loss orders: Set a maximum loss point when entering trades. If the price drops too far, your trade closes automatically.

- Position sizing: Decide how much to trade based on your account size and risk level. Avoid “all-in” trades that can wipe out your funds.

Why it works: Risk doesn’t mean avoiding losses entirely; it means losing in small amounts when things don’t work out. A strong defense ensures you stay in the game for the next opportunity.

4. Emotional Control: Your Hidden Edge

The market preys on emotions fear when prices fall, greed when they surge. Beginner mistakes often stem from impulse decisions.

- Pause before acting: Check your strategy. Does it align with your plan?

- Take breaks: Obsessive monitoring can lead to panic-selling or over-trading.

Discipline matters more than talent. Sticking to your strategy is how small wins compound into long-term gains.

Key Takeaway

Confidence grows with strategy. Start small, manage risk, and lean into trends rather than fighting them. Want to dive deeper into trading strategies and tools? Check this detailed guide to navigate your next steps.

Avoiding Common Pitfalls: Mistakes New Traders Make

- One of the most common mistakes new traders make is letting their emotions rule their decisions. The excitement of potential profits can quickly turn into impulsive buying, while the fear of losses triggers panic selling. Emotional trading doesn’t just cloud judgment it’s a recipe for inconsistency. The market moves fast, and chasing every rise or retreat often leads to stepping straight into losses.

- Instead of reacting emotionally, focus on having clear plans. Using stop-loss and take-profit levels is like setting boundaries no second-guessing when the market wobbles. These tools are accessible even to beginners and help you stick to your strategy, not your gut.

- Another widespread oversight is diving in without enough research. Many beginners jump on the hype they see online, buying assets they don’t understand. Here’s the truth: if you can’t explain why you’re trading a particular coin, you’re gambling, not investing. Research gives you an edge. It helps you spot opportunities and avoid overvalued, risky projects. Fundamental insights about a coin’s purpose, community, and roadmap will give you confidence in your moves.

- For those just starting, demo accounts are invaluable. They let you practice trading with zero risks in real-time market conditions. Think of it as a flight simulator for investors a safe environment to learn the ropes. Practice until you understand how trades execute and how the market reacts.

- Timing is another trap. Many new traders get caught trying to predict the perfect entry or exit. Here’s the harsh reality: no one can consistently time markets, not even the pros. Instead of stressing over the perfect timing, focus on gradual, consistent steps. Dollar-cost averaging buying small amounts over time does wonders to smooth out the ups and downs.

- Lastly, over-leveraging is a silent killer of accounts. Trading with borrowed funds amplifies both gains and losses. While the lure of quick profits is strong, leverage adds immense risk. If you aren’t fully prepared for how quickly markets can move, it’s far better to start small and grow your skills. Managing risk and starting conservatively are trademarks of successful traders.

- For those ready to dive deeper into trading strategies, learn from comprehensive resources like this guide on trading platforms. It’s vital to choose tools and resources that match your level and goals, enhancing your chances to thrive in the crypto world.

- Trading isn’t about quick wins or adrenaline. It’s about calculated moves and learning from every small step. Avoid these pitfalls, and you’re already ahead of the curve.

Final words

BingX provides an accessible, beginner-friendly platform to confidently enter the world of cryptocurrency trading. With its intuitive interface, demo trading options, and effective strategies tailored for new users, this platform sets you up for success. Starting with secure account creation and gradually exploring Spot, Futures, and Copy Trading features, you can navigate every aspect with ease. Just remember to practice risk management and utilize demo trading to build confidence before diving into real transactions. The journey to being an informed and skilled trader starts here. Embrace the opportunities BingX offers, and turn trading into your vehicle for financial growth.

Ready to start trading? Create your BingX account today and begin your trading journey!

Learn more: https://cryplinker.com/

About us

Crypto Linker helps empower traders by providing comprehensive insights, tutorials, and tools focused on leveraging platforms like BingX efficiently.