Signing up on BingX is exciting until you hit a snag with BingX KYC verification. For many new users, it feels like a frustrating hurdle. But in today’s regulated crypto world, completing KYC is essential for secure trading. This quick guide breaks down why BingX KYC matters and shows you how to get verified quickly and smoothly. With the right steps, you’ll be fully verified and ready to trade in no time.

What Is BingX KYC and Why It Matters

KYC stands for “Know Your Customer.” It’s a process used by financial platforms to confirm the identity of their users. If you’ve ever signed up for a bank account or even a streaming service that requires payment, you’ve likely encountered KYC requirements think documents, verifications, and identity checks.

But why does KYC matter so much, and why is it a top priority for platforms that deal with trading or cryptocurrencies? The answer lies in two key areas: security and compliance. Without KYC, financial services could become a playground for fraud, scams, and even criminal activity.

Here’s why KYC is so important for trading platforms:

- Regulatory Compliance: Almost every country enforces laws to prevent money laundering, identity theft, and other financial crimes. KYC is how companies comply with those laws. This safeguards the integrity of the platform and keeps it operational worldwide.

- Fraud Prevention: By verifying a user’s identity, platforms can prevent unauthorized access to accounts, reducing the risk of fraud, hacking, or phony profiles.

- Safer Transactions: Imagine trading or transferring money without knowing who you’re dealing with. KYC ensures that both parties involved are verified individuals, adding another layer of trust.

For users, KYC isn’t just about security; it also unlocks features that aren’t available to unverified accounts. Here are a few benefits you’ll see once you complete the process:

- Higher Withdrawal Limits: Many platforms limit how much you can move or trade without verifying your identity. Completing KYC removes these barriers.

- Access to Special Features: Account verification often enables advanced trading options, such as leveraged trading, completing withdrawals in different currencies, or even participating in promotions and bonuses.

- Peace of Mind: A verified account is inherently more secure. Even if someone tries to hack it, they’d need your verified credentials to cause any real damage.

In the case of trading platforms, KYC helps foster trust and transparency in what can often feel like a high-risk environment. While some users might see it as a hassle, the benefits far outweigh the cons. Ensuring safety and access to advanced tools ultimately makes the trading experience smoother and more reliable.

If you’re new to trading, mastering the KYC process can feel daunting. To make things easier, you can check out this guide for beginners to learn more about navigating the platform and its features efficiently.

Step-by-Step Guide to Completing BingX KYC

Verifying your identity doesn’t have to be complicated. Here’s exactly how you can complete KYC in just a few simple steps without the usual hiccups.

1. Start with the Basics

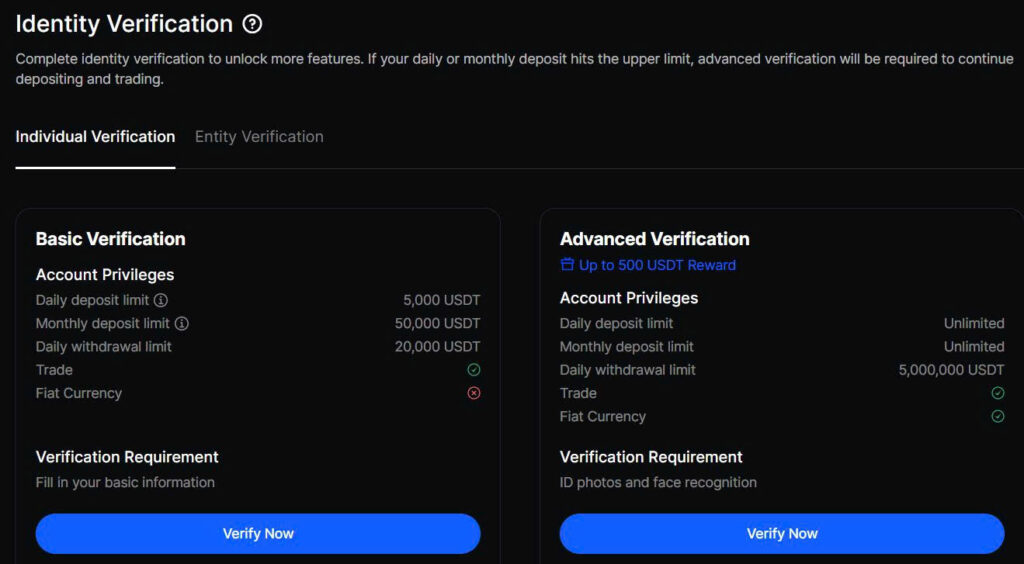

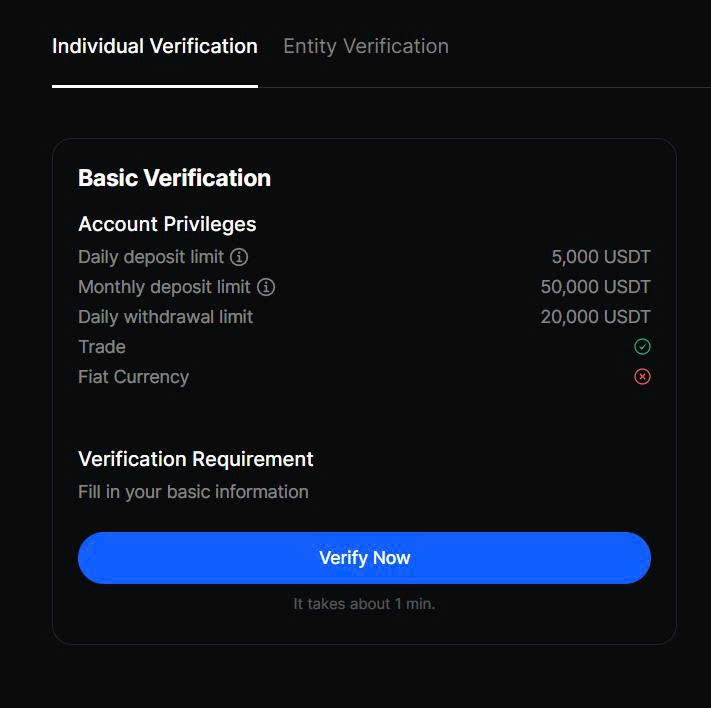

First, log into your account and head directly to the verification section. Look for the option labeled “Identity Verification” or something similar it’s usually easy to spot.

Once there, you’ll see different levels or stages of verification. Start with Level 1, as it’s the foundation for unlocking core features.

2. Documents You’ll Need

Prepare these before you begin:

- A Government-Issued ID: Passport, driver’s license, or national ID card works well. Make sure it’s valid and not expired.

- A Utility Bill or Bank Statement: This is typically required for address verification. The document should be recent (within the last three months).

- A Selfie: Expect to upload a live photo of yourself for biometric verification. No old vacation pictures, please!

Pro Tip: Check that your documents are readable. Blurry images are among the top reasons for failed verifications.

3. Uploading Your Documents

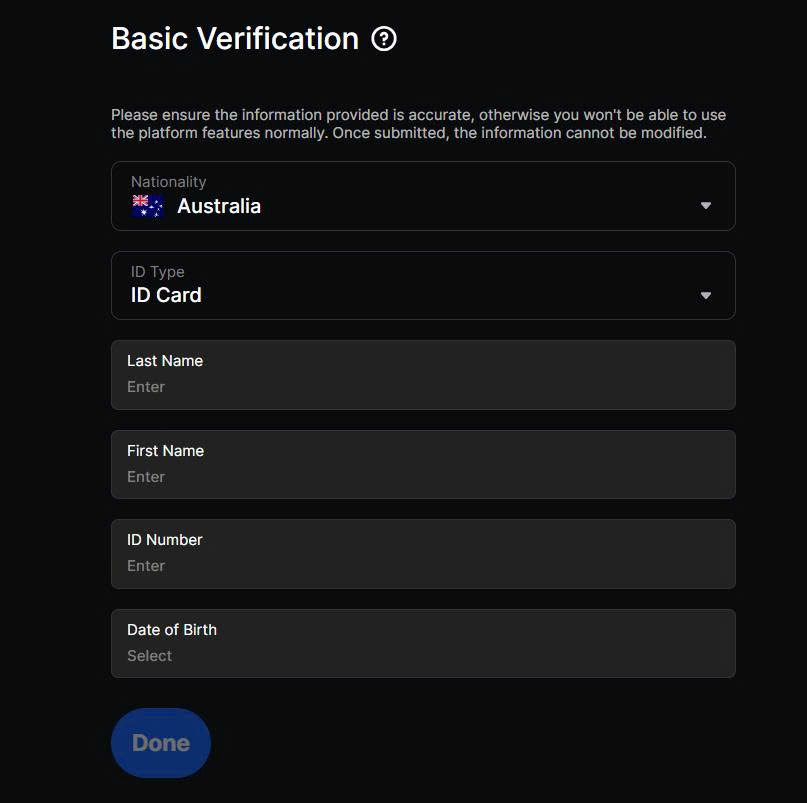

- Step 1: Choose the type of document you want to submit. For example, select “Passport” if that’s what you’re uploading.

- Step 2: Take a clear photo. Ensure:

- All edges of the document are visible.

- There are no shadows or flash reflections on the text.

- Text is in focus and readable.

- Step 3: Upload the front and (if applicable) back of the document.

- Step 4: Complete your selfie. Usually, the platform will guide you to center your face and may ask for specific expressions (e.g., blinking). Follow these instructions carefully to avoid retakes.

4. Common Mistakes to Avoid

Even small errors can stall your progress. Keep these in mind:

- Using Nicknames: The name on your account must perfectly match your ID. No mismatches allowed.

- Submitting Expired Documents: Always double-check expiry dates.

- Poor Lighting: The selfie stage needs good lighting. Avoid dim or overly bright environments.

- Ignoring Special Instructions: If asked to perform a specific action (like tilting your head), follow the directions precisely.

5. Submitting & Waiting

Once all documents are uploaded, submit your application and wait. Verifications can take anywhere from a few minutes to 24 hours. Be patient, but also keep an eye on your email. If something’s wrong, they’ll likely notify you there.

With these steps, you should breeze through the verification process. For additional tips on simplifying KYC and related topics, check out this guide to trading platforms.

Common Errors During KYC and How to Fix Them

Mistakes during the KYC process can waste valuable time and stall your account verification. The good news? Most of these errors are easy to avoid or fix. Here’s what to watch out for and how to resolve them.

1. Blurry or Low-Quality Document Uploads

A common oversight is submitting fuzzy or pixelated images. Clear documentation is essential to confirm your identity.

- Why it happens: Poor lighting, shaky hands, or using an outdated camera can lead to unreadable uploads.

- How to fix it:

- Use your smartphone instead of a webcam. Most smartphones have high-resolution cameras.

- Place your document flat on a contrasting surface (like a white table or dark background).

- Ensure the lighting is even natural daylight near a window works great.

- Hold your phone steady, or better yet, prop it up to avoid motion blur.

- Pro Tip: Double-check the image before hitting upload. If you can’t read every letter and number, neither can the system.

2. Mismatched Personal Information

Mistakes in your name, date of birth, or address can cause rejections. The details you submit must match your official documents perfectly.

- Why it happens: Typos, rushing through the form, or accidentally using nicknames (e.g., writing “Mike” instead of “Michael”).

- How to fix it:

- Pull out your ID beforehand and double-check every field before submitting.

- If your ID shows your legal full name but you commonly use a nickname, make sure to use the full version.

- Copy and paste your email or other details carefully to avoid clerical errors.

- Pro Tip: If your details don’t match because of a legal name change, provide additional supporting documents, like a marriage certificate, where requested.

3. Expired or Invalid Documents

Another frequent error is uploading expired documents or ones that are not accepted during identity verification.

- Why it happens: You might not realize your ID has expired, or you submit something less official, like a library card.

- How to fix it:

- Check the expiry date of your ID. If it’s expired, renew it before proceeding.

- Stick to accepted documents usually a passport, national ID, or driver’s license. Avoid using unconventional cards or uncertified copies.

- Make sure the entire document (including the edges) is visible in the image.

- Pro Tip: If your ID has expired and you’re in the process of renewing it, contact customer support to let them know. Many platforms allow for temporary identification alternatives.

4. Cropping or Cutting Off Parts of Your Document

Partial uploads are a no-go. If your name, photo, or signature gets cropped out, the system will flag your upload as incomplete.

- Why it happens: You might accidentally zoom in too much or frame the image poorly during capture.

- How to fix it:

- Center the entire document in the shot. Leave a small margin around the edges so nothing gets cut off.

- Avoid zooming in unnecessarily most platforms allow you to crop after uploading if needed.

- Make sure any critical information isn’t covered by glare or reflections.

- Pro Tip: A scanning app on your phone can help you capture clear, complete scans if you’re struggling with photos.

5. Ignoring the Selfie Verification Step

Many platforms now require you to take a selfie holding your ID. This step proves that you’re the real owner of the document.

- Why it happens: Users might skip this step, upload someone else’s ID, or send a blurry selfie that doesn’t match the ID photo.

- How to fix it:

- Follow the instructions exactly if they ask you to hold your ID next to your face, do it.

- Ensure your face and the document are both well-lit and fully visible.

- Avoid wearing sunglasses, hats, or anything that obscures your face.

- Pro Tip: Look directly at the camera. Smiling can help make the image more natural and matchable.

For more insights on related topics, check out this detailed guide on account registration and KYC best practices. Being precise saves time and ensures you have a hassle-free trading experience.

By understanding and resolving these common mistakes, you’ll breeze through verification faster and unlock your account’s potential sooner. Pay close attention to details upfront it’s worth it.

Benefits of KYC Verification on BingX

When you complete the identity verification process, your account unlocks a new layer of possibilities. It’s not just about ticking a box there are real, tangible advantages. Here’s why it’s worth the effort:

1. Higher Withdrawal Limits

One of the biggest perks is the ability to withdraw more. With verification, your daily and monthly withdrawal caps increase significantly. This means you can move funds quickly when the markets shift. Imagine spotting an opportunity and not being held back by arbitrary limits that’s the freedom verification offers.

2. Access to Advanced Features

Verified accounts come with tools and features that unverified users can’t access. From advanced trading options to better portfolio management tools, a verified account feels more like owning a set of keys to a secure vault. These features are designed to make trading not just seamless, but also more dynamic.

3. Enhanced Security

Verification layers your account with additional security. By confirming your identity, you make it harder for malicious actors to gain access. This isn’t just about passwords; it’s about ensuring that only you can control your assets. With identity confirmed, any unusual activity would instantly be flagged, keeping your funds safer.

4. Regulatory Compliance

While it might sound technical, complying with identity verification norms also means you’re using a platform that aligns with global regulations. This adds credibility and longevity to your trading activities. You’re assured that you’re navigating on a regulated, trusted platform.

So, whether it’s about withdrawing larger sums, accessing exclusive tools, or boosting account safety, completing verification sets you up for a smoother experience. If you’re ready to start or want a detailed breakdown of what this platform offers, check out this full review guide.

Expert Tips for Fast KYC Approval

When it comes to getting your account verified quickly, organization is everything. Following a few simple steps can save you hours of frustration and ensure a smooth process.

1. Prepare All Documents in Advance

Having the right documents ready before starting makes a huge difference. Here’s a quick checklist to help:

- Government-issued ID: This could be your passport, national ID, or driver’s license. Double-check it’s not expired.

- Proof of Address: Utility bills, bank statements, or rental agreements are commonly accepted. Make sure they’re recent usually no older than three months.

- Selfie or live verification: Practice snapping a clear, well-lit selfie. Most platforms may request this as a step.

Having these ready to go will help you sail through without needing delays caused by incomplete submissions.

2. Use High-Quality Scans or Photos

Blurry or low-quality images are a top reason for KYC rejections. Here’s how to avoid this pitfall:

- Use a flat surface and proper lighting when taking photos of your documents. Avoid glare.

- Scan or snap your IDs in full color, ensuring all edges are visible.

- Check that the text is sharp and readable no smudges or shadows hiding key details like your name.

A clear submission means fewer back-and-forths with reviewers.

3. Ensure Information Matches Exactly

Tiny mismatches like differing name formats can cause annoying bottlenecks. Ensure the name, address, and other details on your submitted documents exactly match the info you entered during registration. For instance, if your official ID uses your full middle name, don’t skip it.

4. Choose the Right Browser or Device

Sometimes the verification process behaves differently depending on the device or browser you use. Here’s how to pick the safest option:

- Use a modern browser like Chrome or Firefox to avoid compatibility issues.

- Complete KYC on a desktop or laptop if possible; they’re often better for uploading and handling documents compared to smartphones.

Glitches from outdated browsers or unsupported devices can make the process trickier than it needs to be.

5. Don’t Rush the Review Step

Take a moment to review your submission before hitting the final button. Ask yourself:

- Are the uploaded files clear and complete?

- Does all the personal information align?

Catching mistakes here can stop issues later.

Learn From Experienced Users

Seasoned traders often advise being patient and avoiding retries too quickly. If your first submission is rejected, don’t rush to re-upload the same documents or use a different set just yet. Instead, look for the reason given and address it directly. Steady adjustments typically lead to a quicker resolution.

If you’d like to further refine your trading journey once your account is verified, you can check out this detailed review guide for more insights on navigating opportunities in the platform.

Following these tips can cut down on approval time, save effort, and get you trading faster.

Final words

As a new user, completing KYC on BingX doesn’t have to be a daunting experience. With this guide, you now understand the importance of verification and how it establishes trust, ensures compliance, and enhances your access to trading features. By following simple steps and avoiding common errors, you’ll sail through the process quickly and securely. Remember, fast approval requires preparedness, precision, and attention to detail. Once verified, the gateway to BingX’s vast trading opportunities opens for you. Embrace the process as an essential step towards safe, seamless, and successful cryptocurrency trading.

Verify your BingX account today and start trading smarter. KYC now to unlock secure and advanced features.

Learn more: https://cryplinker.com/

About us

Crypto Linker offers seamless solutions and accessible resources to simplify your BingX journey. Trust us to elevate your crypto trading experience.