Feeling overwhelmed by crypto trading? You’re not alone. Many beginners struggle with the complexity and risk. Bybit Copy Trading solves this by letting you follow expert traders and mirror their strategies no experience needed. It’s a smarter, faster way to trade, helping you save time, reduce risk, and build confidence from day one. Ready to trade with ease? Let’s explore how Bybit Copy Trading works.

What is Bybit Copy Trading, and Why It Matters

Imagine you could borrow the skills of a seasoned crypto trader, following their moves step-by-step, without needing to study hours of market charts or trends. That’s essentially what copy trading allows you to do. Copy trading is a unique feature that lets beginners mirror the trading strategies of experienced traders. Instead of fumbling around and making costly mistakes, you start with a head start, leveraging the knowledge and expertise of someone who has already mastered the game.

When it comes to trading on complex platforms, indecision and lack of expertise can be huge barriers. This is where copy trading shines it bridges that knowledge gap, making trading far more accessible for first-timers. You don’t need to be a pro to begin. All it takes is the ability to choose the right trader to follow. Once you’ve selected someone whose track record fits your goals, their trades are automatically replicated in your account.

Here’s why this matters: not everyone has the time, patience, or expertise to analyze price charts, stay on top of market news, or confidently take risky positions. Even the smallest errors in manual trading can cost you. Copy trading simplifies this by offering a truly hands-off experience, where pros do the work, and you benefit from their decisions.

Some key aspects make it especially valuable for beginners:

- No Prior Knowledge Required: You don’t need to understand advanced trading techniques or strategies.

- Learning Opportunity: By following skilled traders, you can observe their decisions and learn over time.

- Efficiency: Saves you time compared to researching and executing trades yourself.

- Diversification: You can follow multiple traders to spread your risk, rather than putting all your eggs in one basket.

If you’re wondering how to get started, selecting a trader whose goals and risk level match yours is crucial. Platforms usually offer performance stats, win rates, and other data to help you make a decision. And don’t forget — you retain control. Many systems let you adjust trade size, set limits, or even stop copy trading anytime if things aren’t going as expected.

Whether you’re brand new to trading or simply looking for a more passive way to invest, copy trading is a powerful tool. It combines accessibility, convenience, and the chance to learn by seeing experts in action. If you’re curious about broader trading basics before diving into this feature, check out this beginner’s guide to understand the essentials of trading and how platforms operate.

How Bybit Copy Trading Works for Beginners

Copy trading simplifies crypto trading by letting you replicate the strategies of experienced traders. Here’s how you can start:

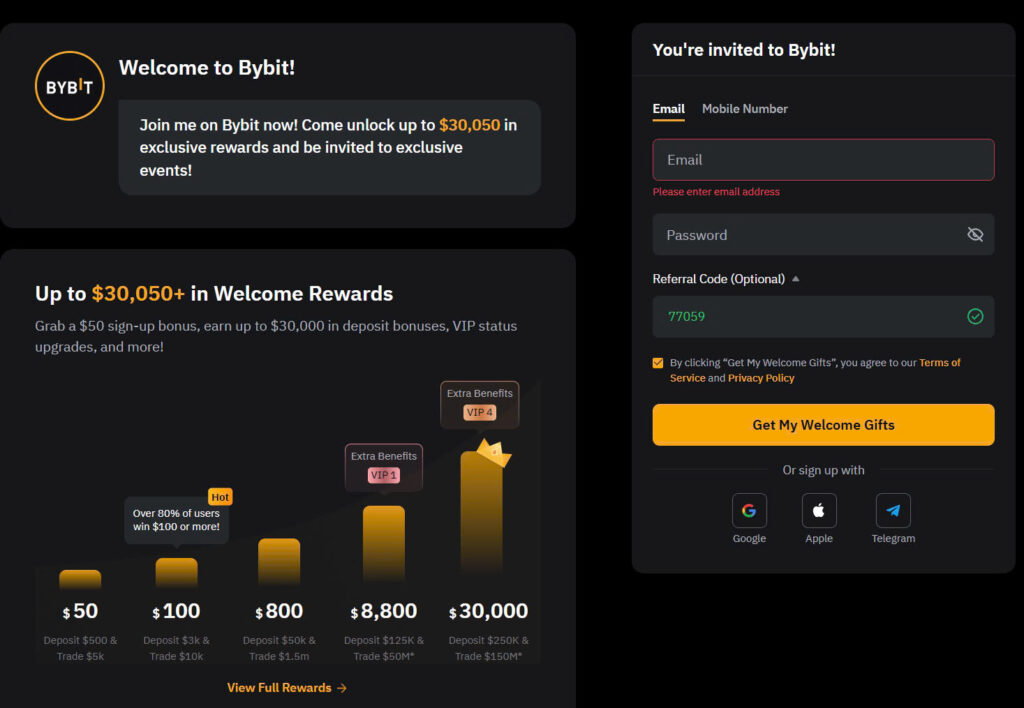

Step 1: Create and Verify Your Account

Before you can begin, you’ll need an account on the platform. Registration involves inputting your basic details, setting up security measures like two-factor authentication, and completing KYC (Know Your Customer) verification. If you’re unsure how to navigate the KYC process, check out a guide online to streamline it.

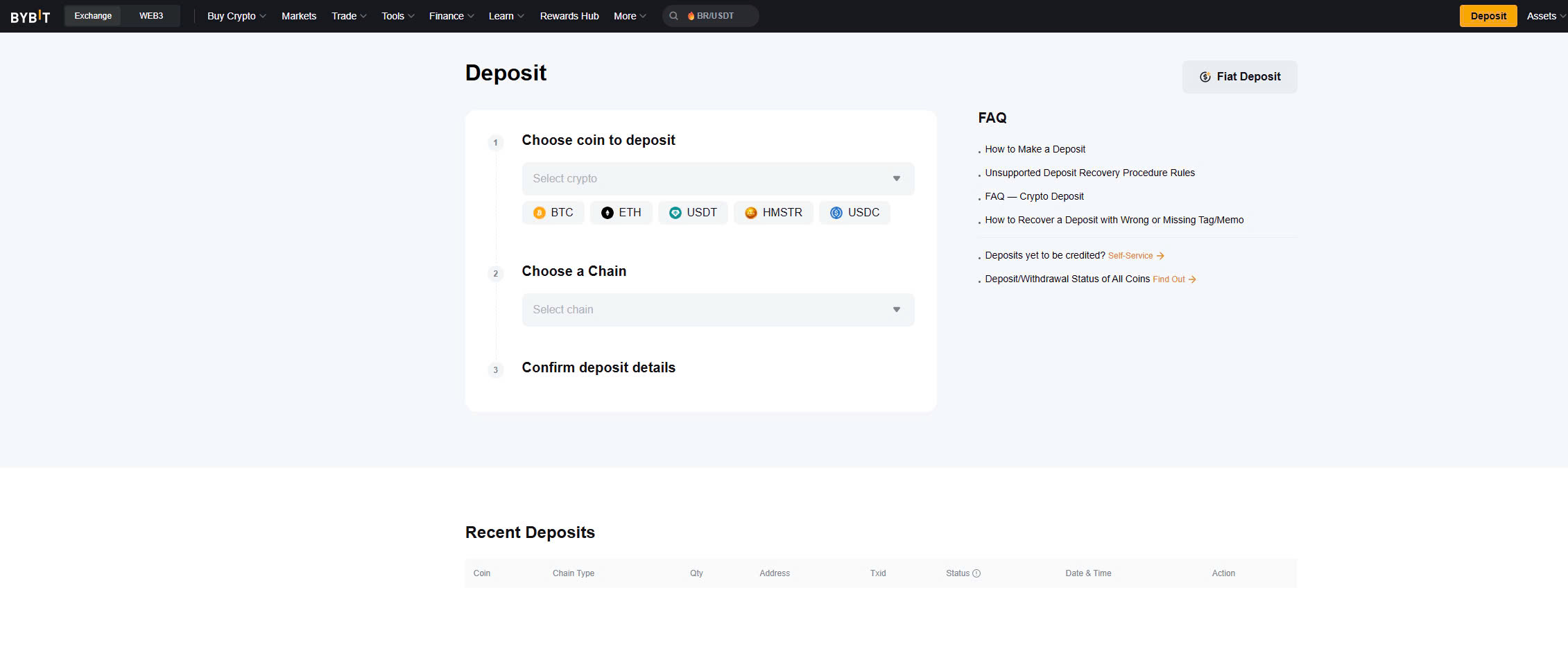

Step 2: Deposit Funds into Your Account

Once your account is set up, add funds. You’ll typically need to transfer cryptocurrency or fiat money into your trading wallet. Make sure you know the minimum amount required to trade. This keeps things smooth and avoids surprises once you start.

Step 3: Navigate to the Copy Trading Section

Every platform will have a dedicated area for copy trading. Look for an easily accessible dashboard. This is where you’ll find key features like lists of traders to copy and options to monitor your performance.

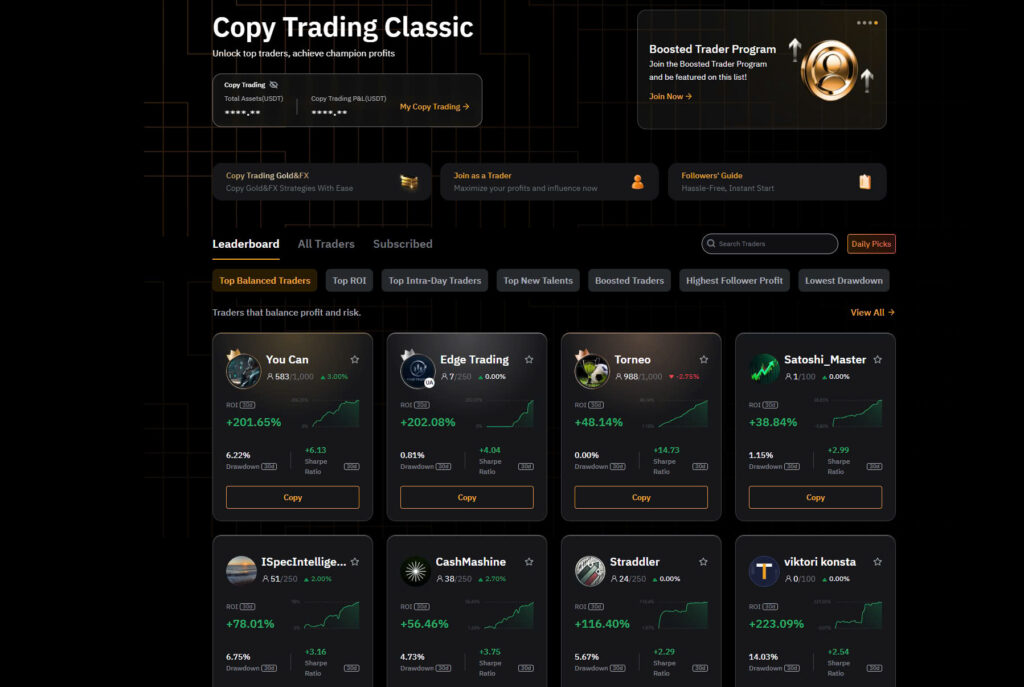

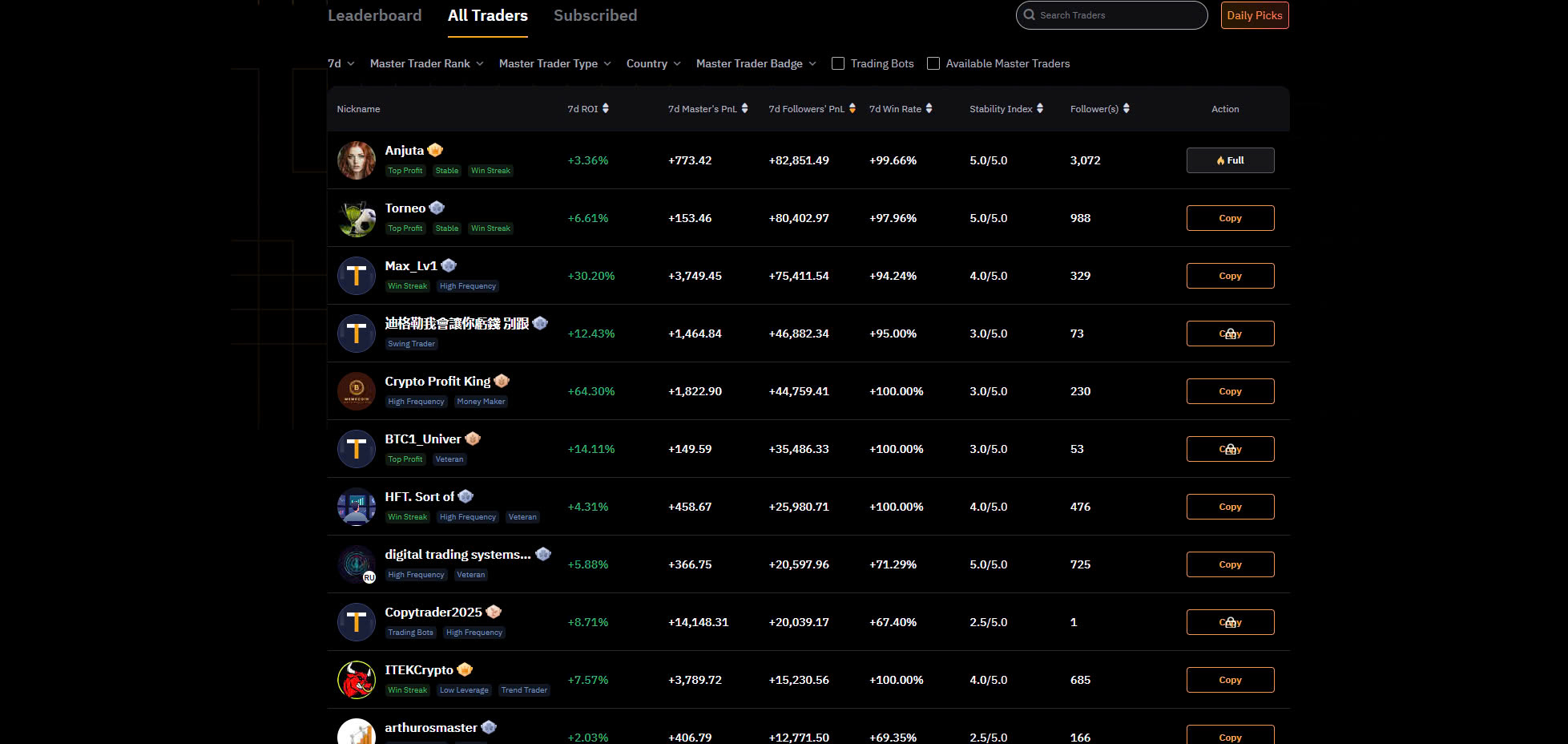

Step 4: Choose a Suitable Trader

This is the most crucial part. Scroll through a list of available experts. Sort by metrics like:

- Profitability over time.

- Risk levels they typically take.

- Total followers copying their trades.

Tip: Just because someone has high earnings doesn’t mean they’re the best fit. Read their trading history carefully to ensure it matches your risk tolerance.

Step 5: Configure Your Copy Settings

After selecting a trader, set up the copy parameters. This includes:

- Investment Amount: Decide how much you want to allocate to follow their trades.

- Stop-Loss Limits: Protect your funds by setting a maximum loss threshold.

- Take-Profit Levels: Define when you want the system to close positions and lock in profits.

Pro Tip: Start small. Test things out with a manageable initial investment to gauge how their strategy performs for you.

Step 6: Monitor and Manage Ongoing Trades

Once trades are active, you can watch them unfold in real time. Key actions include:

- Reviewing trade outcomes in your dashboard.

- Adjusting your investment amount if you’re satisfied with the trader’s performance.

- Stopping copying any trader if their strategy no longer aligns with your goals.

Regular reviews keep you in control and help refine your overall strategy.

The Final Thought on Monitoring: Remember, while it’s tempting to let the system handle everything, staying engaged helps you learn. It also ensures you can pivot in case market conditions change unexpectedly.

For detailed insights into starting your trading journey, consider resources like this guide on trading fundamentals. They’ll provide foundational knowledge to complement your copy trading efforts.

Benefits of Bybit Copy Trading for New Users

Copy trading can be a game-changer for beginners. It’s like following a skilled guide while you’re learning a new skill. Here’s why it’s so effective:

- Saving Time: For most new traders, research and strategy-building are time-consuming. Copy trading skips this. Instead of spending hours analyzing charts or market news, you simply follow the strategies of seasoned traders. This turns trading into a passive and manageable activity, freeing your schedule.

- Reducing Risk: A lack of experience can lead to poor decisions. Here’s the beauty of copy trading — you get access to strategies proven by others. While no trading strategy guarantees success, leveraging the expertise of pros significantly reduces the chance of costly beginner errors. It’s like a safety net for your learning phase.

- Hands-On Learning: Watching and copying winning trades offers more than potential profits. It’s an invaluable way to learn techniques and habits that work in real scenarios. Over time, you’ll start to understand patterns and strategies, all while earning (or at least minimizing losses). Think of it as trading school that pays you.

- Wider Accessibility: Trading platforms make it surprisingly simple. You don’t need to be a tech wizard or a financial expert. With minimal setup and a user-friendly interface, even complete beginners can dive in. This lets anyone participate in markets that once felt out of reach.

To get started, you’ll need to set up your trading account correctly. If you’re still working on the basics, check out this step-by-step guide to trading setup to make sure your account and tools are ready to go.

Choosing the Right Trader to Copy

Copy trading can feel like a shortcut to success, but it all boils down to one decision: Whom should you trust with your money? Your chosen trader plays a massive role in your outcomes, so making an informed choice is critical. Here’s how to narrow down the best fit for you.

1. Performance History: Look Beyond the Numbers

Historical returns can be flashy, but they don’t tell the full story. Pay close attention to consistency, not just the peak numbers. A trader with steady, moderate gains across several months may be more reliable than someone whose chart shows wild spikes and plunges. Those spikes often mean huge risks—which might not end well.

Tip: Check their win rate. A solid percentage (e.g., above 60–70%) shows their strategies hold up over time.

2. Risk Level: Align It with Your Comfort Zone

Every trader has a risk appetite. Some prefer safer, low-return trades, while others thrive on high-risk, high-reward strategies. You’ll often see metrics like drawdown—a fancy way of showing how much they’ve lost in a bad streak.

Ask yourself: Would I feel panicky watching my balance drop 30% for a chance at bigger gains later? If that answer makes you queasy, stick with lower-risk traders. The best match balances your goals with how much risk you’re truly okay living with.

3. Expertise: Study Their Niche

Different traders might focus on different crypto markets. Some follow major coins like Bitcoin, while others excel in emerging altcoins or derivatives. Knowing their area of expertise matters. Copying someone great at Bitcoin futures won’t help you much if you’re betting on small-cap altcoins.

Questions to ask: Do they specialize in the areas you care about? Do they have a track record that proves their expertise in that space?

4. Trading Strategy Transparency

A good trader doesn’t just win; their strategy feels logical and consistent. Many platforms show how traders operate, whether they use technical indicators, trend-following systems, or something else entirely. The key? Clarity. If their method seems random or erratic, that could signal trouble.

Some traders take on high positions relative to their balance, exposing them to liquidation risks. Always review their approach to position sizing to ensure it aligns with a sustainable strategy.

5. Engagement and Communication

Active traders who engage with their followers often offer insights into their decisions. This isn’t mandatory but can be helpful, especially for learning purposes. Check if they provide updates about their moves, reasoning, or market shifts. Silent traders may leave you feeling disconnected from what’s happening.

6. Beware of Overcrowded Traders

A trader with too many followers sometimes faces inefficiencies. Liquidity can become a problem, especially for those making trades on smaller, less liquid coins. If most of their audience jumps in on the same trades, it can lead to slippage, affecting your returns. Keep an eye on how many people are copying their moves relative to their trading style.

To wrap up, your choice should be a mix of head and heart: the data-driven analysis of their past decisions and the gut check that their approach feels right for you. Once you’ve picked, learn more about how to execute your first trades seamlessly here. This will help you jump in fully prepared.

Pro Tips for Maximizing Success with Copy Trading

Diversify Your Traders to Spread Risk

Don’t put all your eggs in one basket. Following just one trader might feel safe if they’ve had consistent success, but no one’s perfect. Even the best traders face losing streaks. Diversify by choosing multiple traders with distinct trading styles. This way, if one strategy falters, the others can balance it out. Think of it as building a team different strengths, better overall results.

Set Clear Profit and Loss Limits

Automate your safety nets. Many platforms let you control how much you’re willing to win—or lose—before a trade is stopped. Overconfidence can tempt you into “letting it ride,” but this is dangerous. Set a profit target and a maximum loss you’re okay with. For instance, if your stop-loss is 5% per day, stick to it. This discipline protects your capital and your mindset.

Prioritize Traders with Proven Track Records

Past performance isn’t a guarantee, but it’s your best guide. Look for traders with consistent monthly returns, not erratic one-offs. Big but random spikes, followed by losses, can signal risky strategies. Instead, focus on traders with steady averages over three months or more, even if their numbers seem modest. Slow and steady often finishes better in this game.

Watch for Overleveraging

Leverage boosts gains and losses. Avoid copying highly leveraged trades unless you’re prepared for the rollercoaster. Some traders use heavy leverage to amplify results, knowing their followers will bear the risk. This is a red flag. Opt for traders who keep leverage reasonable; their strategy is likely safer long term.

Review and Adjust Regularly

Copy trading isn’t “set and forget.” Commit to reviewing your performance weekly or monthly. Are the traders you’re following still delivering results? Has their strategy changed? If trends suggest they’re off-track, don’t hesitate to unfollow and seek new ones. Regular reviews keep you aligned with your goals and ahead of losses.

Link to Detailed Trading Guide

If you’re unsure about tools or setups, refresher guides can be lifesavers. Learn essential trading basics to complement your copy-trading strategy by exploring this detailed guide. A little extra knowledge can make a huge difference in how you manage trades.

Common Mistakes to Avoid in Bybit Copy Trading

Copy trading offers a chance to follow skilled traders, but it’s not foolproof. Many newcomers make costly errors. Here are common mistakes to avoid and how to stay on the right track.

1. Blindly Following High-performing Traders

Not every trader with flashy stats is worth following. A trader might have a strong track record, but their strategy could carry high risk. Past performance isn’t always a guarantee of future success. Think critically about why a trader is successful. Are they trading conservatively, or taking huge risks that happened to pay off?

Fix: Carefully review a trader’s historical performance. Look for consistency and examine their win/loss ratio versus their risk level. Diversify by following multiple traders instead of pouring all your funds into one.

2. Over-leveraging on Positions

Leverage amplifies your buying power but also magnifies losses. New traders often get tempted by aggressive leverage, expecting big returns. But one wrong move can wipe out your account.

Fix: Stay conservative with leverage, especially when starting. A lower multiplier keeps risk manageable while you learn the platform.

3. Ignoring Your Portfolio

Copy trading isn’t “set it and forget it.” Market conditions and trader performance can change rapidly. If you’re not monitoring your portfolio, losses can sneak up on you.

Fix: Build a habit of checking your portfolio daily. Set alerts for significant changes in value or a trader’s performance. If a trader starts underperforming, reassess your strategy.

4. Going All-in on One Strategy

No single strategy works forever. Markets are dynamic, and every trader has a breaking point. Relying on just one person’s trades is like putting all your eggs in one basket—it’s risky.

Fix: Spread funds across multiple traders who use different styles (e.g., day trading, swing trading, scalping). This decreases your reliance on one strategy.

5. Failing to Understand Fees

Every trade involves fees—spreads, commissions, or funding rates. These can eat into your profits, especially if you’re taking frequent trades.

Fix: Learn about all associated costs on the platform before committing funds. Check if the traders you’re copying have strategies that involve low trading fees.

6. Not Researching the Platform

Jumping into trading without fully understanding the tools can lead to mistakes. For example, many new users overlook platform-specific features like stop-loss tools or portfolio limits. This kind of oversight increases risk.

Fix: Take time to research how trading works. Start small until you’re confident. You can find a step-by-step guide here.

Final thoughts on avoiding mistakes

Avoid common pitfalls by staying cautious, diversifying strategies, and continually educating yourself. Copy trading is powerful, but it only rewards users who trade smart.

Final words

Bybit Copy Trading bridges the gap between inexperience and profitability, offering an accessible way for new traders to enter the cryptocurrency market confidently. By choosing the right traders to follow, staying disciplined with risk management, and continuously learning from the process, you can maximize your potential while minimizing common pitfalls. Now is the perfect moment to start your journey with Bybit Copy Trading and gain hands-on experience with minimal risk. Remember, every seasoned trader once started as a beginner—this could be your first step toward success.

Start trading smarter with Bybit Copy Trading today.

Learn more: https://cryplinker.com/

About us

Crypto Linker provides tools and resources to help individuals start and succeed with cryptocurrency trading, including simplified guides and expert analyses.