Bybit Review: Starting on a cryptocurrency trading platform like Bybit can feel overwhelming, especially if you’re new to the world of crypto. Questions about fees, security, and how to execute trades effectively may leave you feeling unsure about taking the first step. With cryptocurrency continuing to gain traction worldwide, understanding how to leverage platforms like Bybit is a crucial step toward financial growth. Whether you’re eyeing Bitcoin or exploring altcoin markets, knowing what Bybit offers is vital to making smart trades. By the end of this guide, you’ll have a professional-level understanding of Bybit’s features, earning strategies, and security protocols, empowering you to confidently begin your crypto trading journey.

What Makes Bybit the Perfect Platform for Beginners?

One of the biggest hurdles for new traders is navigating platforms that feel overly complex or intimidating. Starting out should feel empowering, not overwhelming. That’s where this platform really shines—it’s built with simplicity and accessibility in mind.

Why a user-friendly interface matters

The first thing you notice is how intuitive everything feels. Buttons, menus, and tools are where you’d expect them to be. There’s no guessing which feature works how; the navigation allows even the least tech-savvy user to find their way. Instead of flooding the screen with options and graphs that scare newcomers, the platform organizes essential features clearly and minimizes clutter.

This is vital because as a beginner, you want to focus on learning, not wrestling with complexity. A simple, clean interface builds your confidence and lets you take those first steps without hesitation.

Risk-free practice makes perfect

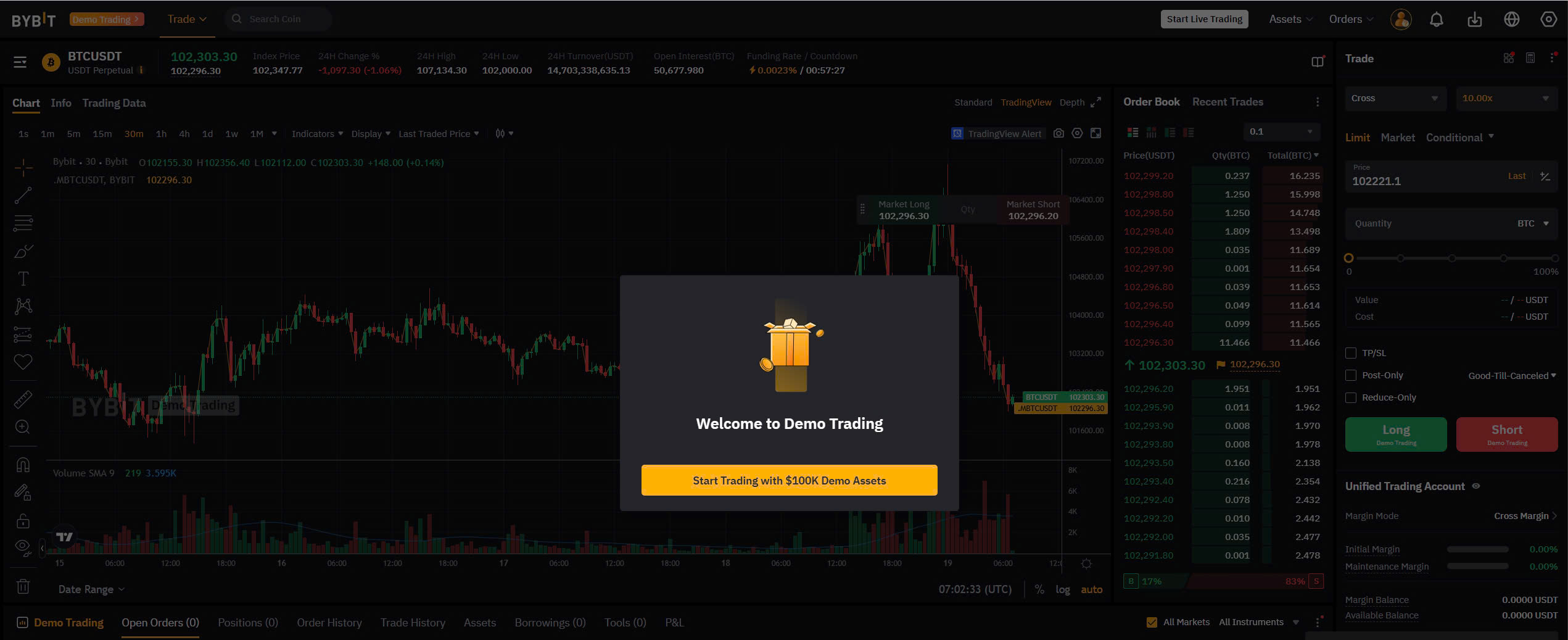

Before jumping in with actual funds, there’s an option for demo trading. This feature mimics live market conditions but uses virtual money instead of real funds. Think of it as a practice playground. No matter how many mistakes you make, there’s no actual financial risk involved.

Why is this so important? Because trading isn’t just watching numbers go up and down. You’ll need to experiment with strategies, learn to set proper entry and exit points, and understand how leverage works. The ability to do all this without consequence lets you build foundational skills in a safe environment. For a beginner, this kind of setup is a game-changer.

Saving more with competitive fees

When starting out, fees can eat into profits faster than you realize. Platforms with complicated, high-cost structures often become frustrating for beginners, as it feels like you’re losing money before you even see returns. Here, the fee system is transparent and fair. Whether it’s transaction charges or withdrawal fees, you’ll find yourself paying less compared to many competitors.

Lower costs mean more breathing room to learn and grow. Small trades won’t feel punitive, and you won’t stress about breaking even due to disproportionate charges. Beginners can take their time learning without feeling nickel-and-dimed along the way.

A strong combination for new users

These features—an easy-to-use interface, risk-free demo trading, and competitive fees—combine into a stress-free environment for beginners. Instead of feeling rushed by markets or discouraged by mistakes, you’ll have the tools and space to build confidence at your pace. And for someone just starting out, there’s nothing more important than gaining that early traction with a platform that’s got your back.

Breaking Down Bybit’s Core Features

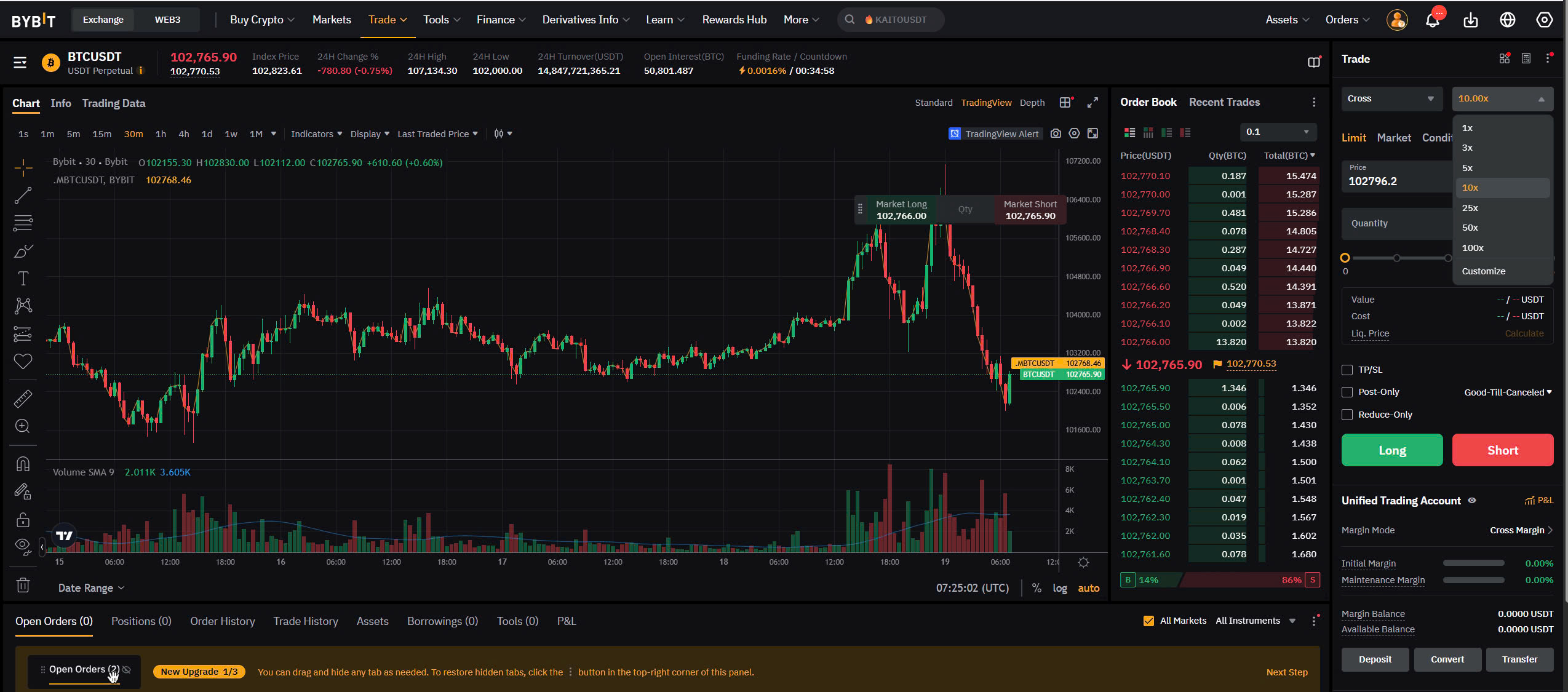

Leverage Trading: Amplify Your Potential

Leverage trading allows you to amplify your exposure to the market using borrowed funds. Instead of needing large capital, you can control a sizable position with just a fraction of the cost. For instance, a 10x leverage means you control $10,000 worth of assets with only $1,000 upfront. The upside is the potential for higher returns; the downside is increased risk. Your losses can exceed your initial investment, so use leverage cautiously.

For new users, it’s best to start small. Begin with low leverage—1x to 3x—until you’re comfortable with how price movements affect your position. Also, keep an eye on margin requirements. If the market moves against you, an insufficient margin balance might result in liquidation.

Perpetual Contracts: No Expiry, Endless Opportunity

Perpetual contracts are derivatives that let you trade on future price movements of an asset without an expiration date. Unlike traditional futures contracts, there’s no need to roll over positions as each contract remains open indefinitely.

What makes this feature unique is the funding rate mechanism. Payments between long and short positions help keep contract prices close to the underlying asset’s value. For example:

- If demand is higher for long positions, longs pay a funding fee to shorts.

- Conversely, if shorts dominate, short positions pay fees to longs.

Stay mindful of this funding rate, especially if holding positions for longer periods—it can add unexpected costs or benefits.

Fee Structure: Competitive, But Know the Details

Understanding the platform’s fees helps you strategize better. Trading fees usually come in two forms: maker and taker fees.

- Maker fees apply when you add liquidity to the order book by placing limit orders that aren’t immediately executed.

- Taker fees apply when you remove liquidity by filling existing market orders.

Maker fees are often lower or even rewarded with rebates in some cases, as they stabilize the market. If you’re mindful of costs, opt for limit orders to save on taker fees.

Beyond trading fees, watch for withdrawal fees or low-tier account limitations. Knowing these ahead of time avoids surprises that eat into your profits.

In every feature, the key to success is strategy. Start modestly, assess the fee impact, and experiment with features one step at a time. Gaining confidence and experience will help you unlock your full trading potential.

How to Set Up Your Bybit Account Step-by-Step

Getting started is easy, but doing it right ensures a seamless experience. Follow these steps to set up your account safely and efficiently:

1. Start with Registration

Head over to the platform’s homepage and locate the sign-up button, usually prominent near the top. Here’s how to nail this step:

- Use a reliable email address that you regularly check. This ensures you don’t miss critical updates or security notifications.

- For mobile users, registration via your phone number is also an option. Make sure your number is active and capable of receiving SMS for verification.

- Choose a password that is long, random, and unique. Avoid using personal info, like birthdays or pets’ names. A mix of uppercase, lowercase, numbers, and symbols strengthens your defenses.

Once you fill in the details, hit submit. You’ll immediately receive a verification code via email or SMS. Enter the code to confirm your details.

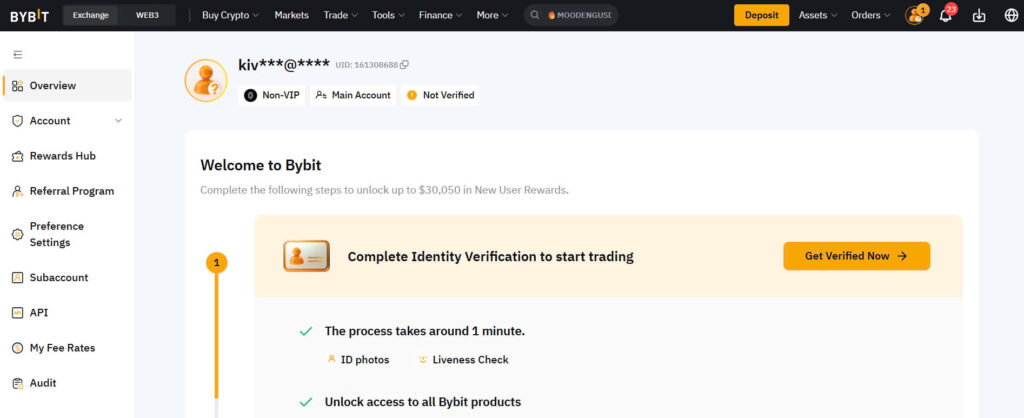

2. Verify Your Identity (KYC)

This is where things get serious. Verification is more than just a formality it’s about keeping your account secure and adhering to global regulations.

- Step 1: Upload your proof of ID (passport, driving license, or national ID). Ensure your document is valid and all text is legible. Avoid cropped or blurry images.

- Step 2: Complete a facial scan. This involves a live photo or video selfie to confirm you’re the real deal.

- Tip: Do this in a well-lit room with a neutral background to avoid rejections.

The system typically processes verification quickly anywhere between a few minutes to a couple of hours. Keep an eye on your email for updates.

3. Strengthen Your Security

Once verified, don’t overlook account safety. It’s tempting to dive into trading immediately, but a couple of extra steps can save you from headaches later:

- Enable Two-Factor Authentication (2FA): Links your account to an external authentication app. Every log-in attempt will require a time-sensitive code from the app, adding an extra layer of protection.

- Set Up an Anti-Phishing Code: An optional feature where the platform sends you a pre-selected code with every email. If the email doesn’t include your code, it’s likely a scam.

- Review Login Logs: Check your account settings for recent activity. If you spot unknown devices or locations, change your password immediately and notify support.

4. Adjust Personal Preferences

Once the basics are locked in, customize your experience:

- Set your preferred trading interface theme light or dark mode.

- Choose your base currency for transactions. This will help simplify future deposits and withdrawals.

- Review notification settings to balance security alerts and transaction updates without feeling overwhelmed.

Starting the right way builds confidence. Once you’ve set everything up, take a moment to familiarize yourself with the dashboard before entering the world of trading. It’s worth investing that time upfront to avoid costly errors later.

Pro Tips for Using Bybit’s Tools Effectively

Mastering Bybit’s trading tools can drastically improve your experience, even as a beginner. Here’s how to make them work for you.

Leveraging Technical Indicators without Overwhelm

Indicators don’t predict the future they give you context. Think of them as traffic signals on the road of trading. The magic happens when you use them wisely. Here are some must-know tips:

- Don’t overload your chart. Start with one or two reliable indicators like moving averages or RSI (Relative Strength Index). Too much information can paralyze your decision making.

- Use timeframes strategically. A 1-hour chart is great for spotting trends. If you’re making quick trades, try shorter intervals like 5 minutes. Looking at the bigger picture? Check daily or weekly charts.

- Combine multiple confirmations. An uptrend on one indicator? Confirm it with another tool, like volume. Trust trends backed by multiple data points.

Choosing the Right Order Type for Your Goal

Order types are your command buttons, tailored for every situation. Knowing when and how to use them can help you lock in profits or protect yourself from losses. Here’s the breakdown:

- Market Orders: Quick but precise

- Perfect for executing trades instantly at the current price. Use these only if exact timing is critical.

- Limit Orders: Your safety net

- Want to buy lower or sell higher? Use a limit order. The trade triggers only if the price hits your target.

- Stop-Loss Orders: Non-negotiable for safety

- Always set a stop loss. It’s your exit strategy if the market goes against you. Getting out at the right point saves money and sanity.

- Take-Profit Orders: Celebrate, then repeat

- These close your position automatically when your desired gain is reached. Plan your wins in advance.

Pro tip: Match your order type with your risk appetite. Risk-taking is fine, but reckless is not.

Building a Rock-Solid Risk Management Plan

The dream of big profits fades fast without a firm handle on risk. It’s not about winning every trade — it’s about surviving to trade another day.

- Stick to the 1-2% Rule. Never risk more than 1-2% of your account on a single trade. A few bad trades won’t wipe you out.

- Use the calculator. Before entering a trade, calculate position size based on your account size and stop-loss level. Many tools offer a position size calculator — take the guesswork out.

- Set emotional guard rails. Lost four trades in a row? Pause. Overconfidence after a win streak? Pause. A steady mindset outlasts emotional swings.

- Diversify exposure. Don’t put all your funds into one asset. A bad move on a single trade shouldn’t dictate your entire account balance.

- Know when to take a break. Burnout sneaks up fast. If the market feels like noise, step back and reset. Always trade with clarity.

By mastering these tools step by step, you’ll build confidence to tackle the complexities of trading. Each action builds a safer and smarter approach for your journey.

Ensuring Security with Bybit: What You Need to Know

Keeping your crypto safe isn’t optional—it’s essential. That’s why understanding security protocols is the first step to confident trading.

1. Two-Factor Authentication: Your Account’s First Line of Defense

Passwords alone aren’t enough. Two-Factor Authentication (2FA) adds an extra layer of protection. Here’s how it works:

- After entering your password, you’ll need a second code typically from an authenticator app.

- This code changes every 30 seconds, making it nearly impossible for hackers to access your account remotely without your device.

Why it matters: Even if someone guesses or steals your password, they’re stuck without the second code. Hackers hate hurdles.

2. Cold Wallet Storage: Keeping Funds Beyond the Internet’s Reach

Imagine storing your valuables in a safe that’s completely offline, where no one can hack into it. That’s what cold wallet storage does for your crypto.

- Only a small portion of funds is connected to the internet (hot wallets) for daily trading.

- The majority remains secured offline in cold wallets safe from online threats.

Why it matters: Cold wallets significantly reduce exposure to cyberattacks. If hackers can’t get online access, they can’t get your coins.

3. DDoS Protection: Fighting Off Overwhelming Attacks

Distributed Denial of Service (DDoS) attacks flood systems with fake traffic to disrupt services. Platforms with weak defenses can crash, and users can’t access their funds or trades.

Top platforms implement strong DDoS mitigation measures to prevent such disruptions:

- Monitoring networks for abnormal traffic patterns.

- Filtering out fake requests to keep genuine users online.

Why it matters: Without these protections, your access to the platform could be blocked during crucial moments. Nothing’s worse than missing out because of a preventable disruption.

How These Work Together for You

These protocols aren’t just individual features—they layer together to create a tough, multi-dimensional security system. 2FA protects accounts. Cold storage shields funds. DDoS protection keeps the platform stable. By combining these, a robust safety net is created for your assets.

Pro Tip: Always activate 2FA immediately and verify how the platform secures its cold wallets. Trust is earned, not given.

How to Lower Fees and Maximize Financial Returns on Bybit

Fees are inevitable in trading, but they don’t need to eat into your profits. With some smart strategies, you can reduce them significantly while boosting your overall returns.

1. Optimize Your Trades to Avoid Excessive Fees

Trading fees can stack up quickly, especially if you’re making high-frequency trades or managing large volumes. Here’s how you can cut down:

- Trade Less, but Trade Bigger: Instead of jumping in and out of multiple small trades, consolidate your positions. Larger, well-planned trades mean fewer fees overall.

- Check Fee Structures Beforehand: Platforms usually have maker and taker fees. Opt for trades where you earn maker fees (often lower), rather than taker fees.

- Leverage Fee Discounts: Many exchanges offer discounts to traders who use the native platform or loyalty tokens. Check if this applies and incorporate it into your strategy.

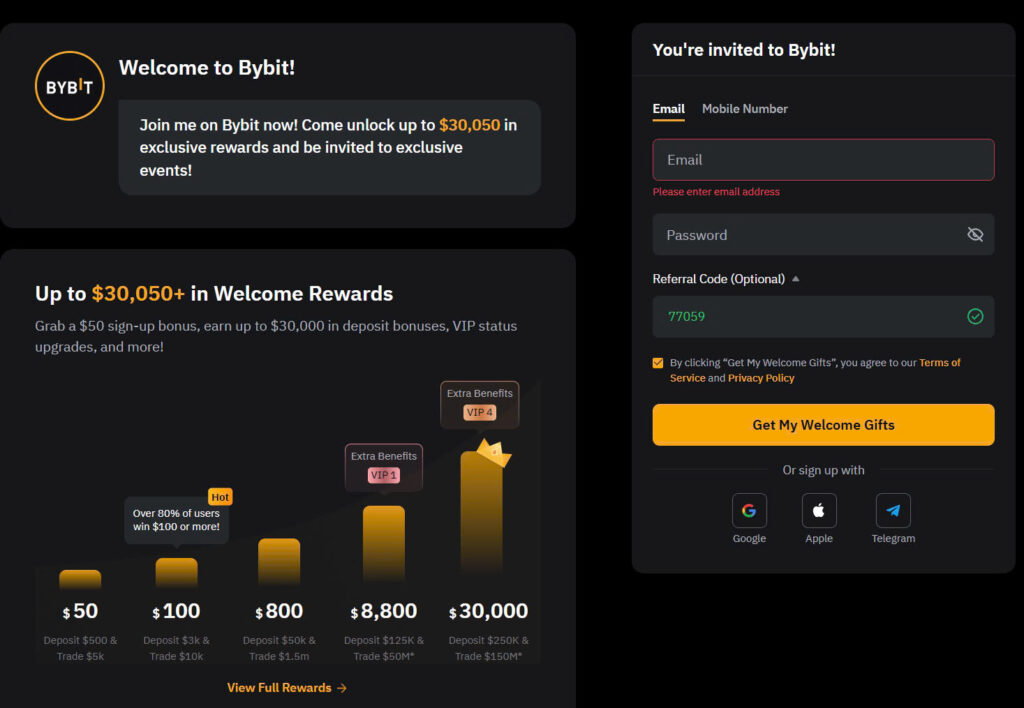

2. Make Use of Sign-Up and Deposit Bonuses

New users can unlock valuable rewards in the form of sign-up bonuses or deposit matches. While these incentives won’t directly reduce fees, they can give you extra capital to offset them. Follow these steps:

- Claim Sign-Up Promotions: Ensure you’ve met all the conditions (such as verifying your account) to secure the full bonus.

- Use Bonuses Strategically: Apply these funds towards less risky trades to preserve them. This way, you create a cushion while learning the market.

- Understand Terms: Carefully read the rules for withdrawing these bonuses or their profits. Most platforms have specific conditions attached.

3. Participate in Trading Competitions

Trading competitions are not just for seasoned investors. New users can also benefit greatly. These events often offer huge rewards, ranging from cash prizes to zero-fee trading for a limited time.

- Start Small: Join competitions with lower entry requirements or beginner tiers. These are often less competitive, giving you a fair chance.

- Focus on Risk-Free Prizes: Some competitions reward users just for participation or hitting basic milestones, with no extra cost.

- Track Leaderboards: Even if you’re not at the top, being in the running often unlocks minor incentives like discounts or extra bonuses.

4. Maximize Leverage Without Overcommitting

Leverage is a double-edged sword. It can amplify returns but also increase potential losses if misused. Keep these principles in mind:

- Begin Conservatively: Start with lower leverage ratios (e.g., 2x or 3x). New users are better off balancing potential gains with risk exposure.

- Monitor Margin Costs: Using leverage often incurs additional margin fees. Plan trades to avoid holding leveraged positions for extended periods.

- Calculate Break-Even Points: Always know the price movement needed to cover your fees and start making a profit.

5. Take Advantage of Referral Systems

Many platforms reward users for bringing in referrals. While this might not directly correlate to trading, it’s an easy way to build extra funds alongside your trades.

- Invite Friends Actively: Share referral codes with like-minded individuals. Platforms often reward both parties with fee rebates or bonuses.

- Reinvest Rewards: Any bonus or rebate earned through referrals can go straight back into your portfolio.

Conclusion: Small Efforts, Big Savings

By strategically lowering fees and tapping into bonuses and competitions, you can significantly optimize your trading returns. It requires attention to detail, planning, and making the most of every opportunity presented.

Why Bybit’s Customer Support Stands Out

Navigating a new crypto trading platform can feel overwhelming, especially if you’re unsure where to start. This is where exceptional customer service becomes more than just a convenience it’s a lifeline.

What sets Bybit apart is its emphasis on support accessibility for all users. Their 24/7 live chat feature is a standout. Whether you’re solving a technical glitch or clarifying a trading question, you’re connected with a real person, not an endless loop of automated responses. For new traders, this immediacy can make or break their first experience.

Global Reach with Multi-Language Support

Languages create barriers. Crypto trading involves technical terms that even fluent speakers might struggle to understand. But with multi-language support, those barriers disappear. By providing service in multiple languages, the platform ensures beginners from different regions feel confident that their questions will be understood and answered clearly.

Language accessibility isn’t just a perk; it’s a bridge to deeper engagement. For many first-time users, knowing they can get help in their native tongue eliminates hesitation. This builds trust the foundation of any good trading experience.

Efficient Resolution of Problems

The best support teams don’t just listen; they solve. Whether it’s about delayed transactions, account verification hiccups, or navigating platform features, prompt responses give you peace of mind. For new users, this reassurance means they can focus on learning to trade rather than troubleshooting.

Beyond speed, accuracy is equally critical. A quick but incomplete answer can create confusion, especially for rookie traders. But when the team handles issues with care and clarity, it reduces mistakes and unnecessary losses.

Why This Matters for Beginners

Starting out in crypto trading is intimidating enough without roadblocks. Hidden fees, incorrect button clicks, or even doubts about how secure your funds are—all of this can erode confidence. Knowing a reliable support team has your back brings a unique level of comfort.

It’s not just about solving issues—it’s about fostering a sense of belonging. A platform that ‘gets’ its users through real-time, personalized interactions makes learning and trading a much smoother journey.

In the end, customer support is not an auxiliary service; for new traders, it’s a safety net. When you feel stuck, having instant clarity reinforces your confidence to keep moving forward.

Final Words: Is Bybit the Right Platform for You?

Whether this platform suits you depends on how well it aligns with your trading goals and experience level. For new users, the platform provides significant benefits that make it appealing.

What makes it stand out?

- Ease of Use: The interface feels intuitive. Tools are cleanly laid out, so you’re not overwhelmed.

- Education-Friendly: They offer resources to help you learn the ropes, making your early trading steps less intimidating.

- Competitive Features: Low fees and innovative tools are always a bonus for beginners.

However, there are trade-offs to consider:

- Complex Products: Some features may feel advanced. If you’re new, sticking to simpler strategies is wiser.

- Market Risks: No matter how user-friendly, crypto trading carries risks. Use safeguards to minimize potential losses.

Should you commit to it?

Ask yourself these two questions:

- Am I willing to invest the time to learn how to trade effectively?

- Am I okay with the risks inherent to crypto markets?

If your answer is yes to both, this platform could serve you well. It’s designed for users like you—those eager to grow but cautious enough to avoid reckless moves.

Keep in mind, tools alone don’t guarantee success in trading. What matters is how you use them. Educate yourself, start small, and stay disciplined. That’s how you’ll unlock its full potential.

Final words

Bybit offers a robust, beginner-friendly platform for crypto trading with ample tools, reliable security, and competitive fees. As a new user, leveraging Bybit’s advanced features and resources can position you for consistent growth in the cryptocurrency space. However, success requires studying the platform and practicing with its demo options. Bybit bridges the gap between professional and beginner traders, making it a great starting point for building your crypto portfolio. Ready to embark on your trading journey? Sign up today and begin trading with confidence.

Sign up for Bybit now and start your crypto trading journey!

Learn more: https://cryplinker.com/

About us

Crypto Linker simplifies cryptocurrency trading by guiding users through platforms like Bybit, offering expert strategies and insights to maximize success.