How to Trade on Bybit: Starting your trading journey on Bybit can feel overwhelming with all the charts, tools, and risks. As a beginner, you may wonder where to begin to trade safely and profitably. This guide breaks down complex steps into clear, actionable strategies—helping you understand how to trade on Bybit with confidence, whether you’re making your first move or exploring advanced features.

Setting Up Your Bybit Account for Trading Success

Before diving into the world of trading, the first step is creating a secure, fully functional account. Here’s a clear roadmap to get that done efficiently—no guesswork, just actionable steps.

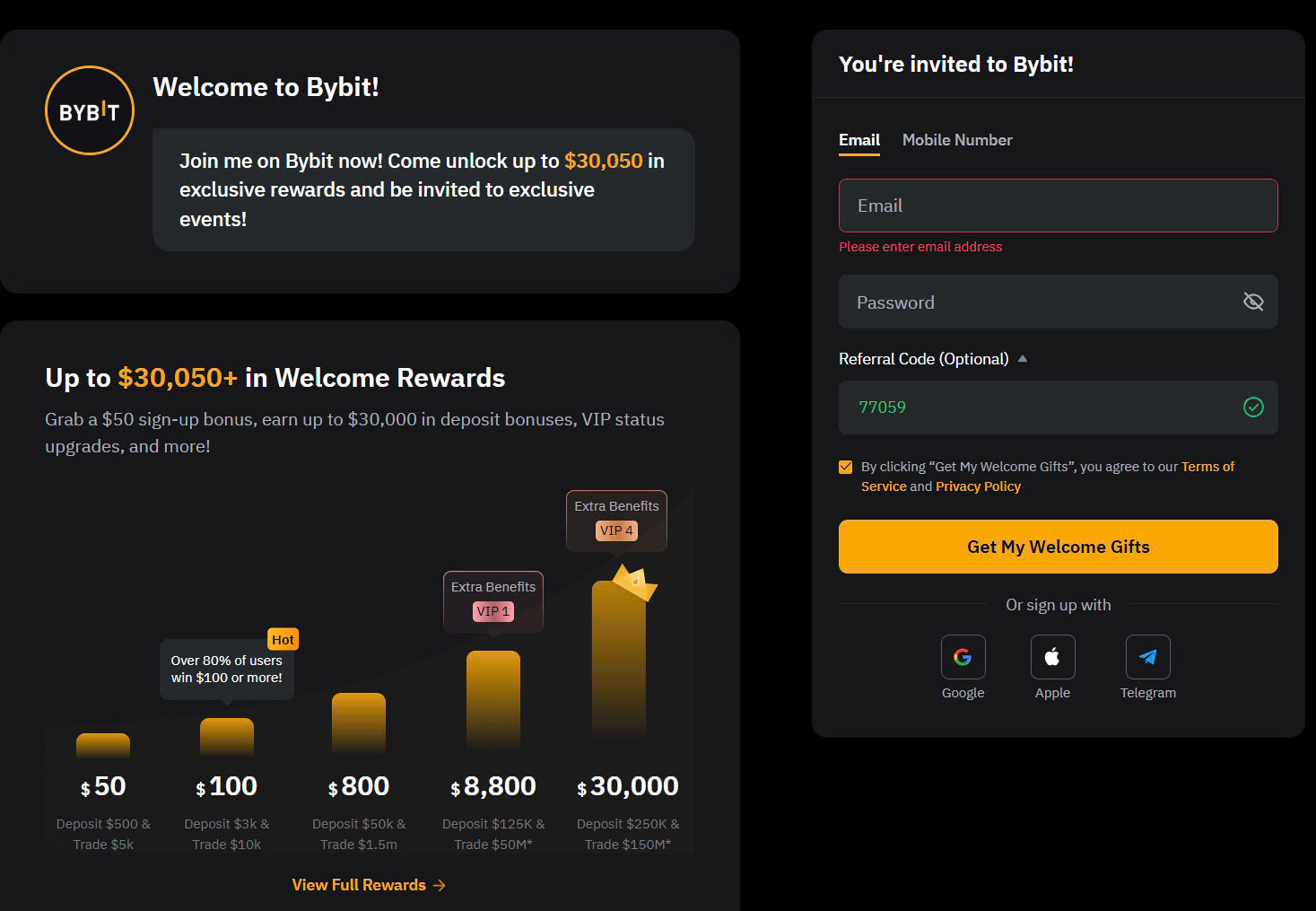

1. Create Your Account

- Visit the platform’s website or app and find the “Sign Up” option.

- Provide your email address or mobile number—whichever feels more manageable for you.

- Set a strong password. Think complex here: a mix of letters, numbers, and symbols. Avoid easy-to-guess words like birthdays or pet names.

- Submit your details. You’ll likely receive a verification code via email or text; enter it to activate your account.

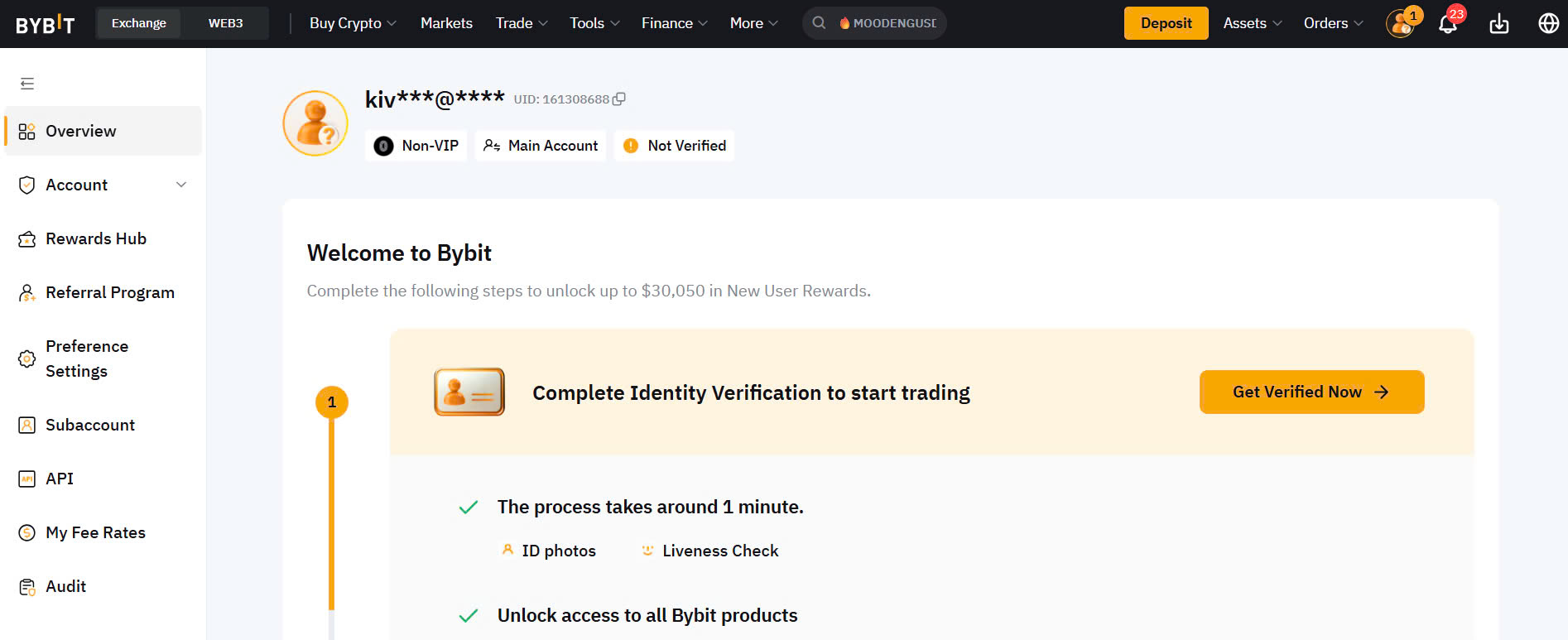

2. Complete the Identity Verification Process

Most modern trading platforms require identity verification to comply with regulations. Here’s how you can breeze through it:

- Go to the “Verification” or “KYC” section in your account settings.

- Provide a valid ID, such as a passport or driver’s license. Make sure it’s readable and matches your details.

- Some platforms ask for a selfie or video verification to confirm you’re the document holder. It’s normal, so don’t sweat it.

- The review process typically takes a few hours, but it can sometimes be quicker. Once verified, you’ll have access to more features.

3. Enhance Security: Don’t Skip This

A secure account isn’t optional—it’s essential. Follow these steps for peace of mind:

Enable Two-Factor Authentication (2FA)

- Find the security section in your account settings.

- Choose a 2FA app like Google Authenticator or Authy. This adds an extra verification step every time you log in or make changes.

- Scan the QR code provided, or enter the secret key to sync your trading account with the app.

- Test it. Make sure your 2FA is working by logging out and back in before you proceed.

Use a Strong, Unique Password

- Never reuse passwords from other accounts. Trading platforms target finances—breaking in could mean losses.

- Use a password manager if needed. It simplifies creating, storing, and managing strong passwords.

Monitor Account Activity

Check your account log filters for any unknown activity. Some systems allow you to get notifications for logins from unfamiliar devices—turn this on if available.

Securing your account through these steps ensures you can trade with confidence, knowing your funds and personal information are safe. With your account properly set up and verified, you’re ready for the next step: understanding trading strategies and tools to maximize your success.

Understanding Bybit’s Features and Tools

Navigating a new trading platform can feel overwhelming at first, but breaking it down into its core features makes it manageable. Knowing the tools at your disposal is critical to making informed decisions in your trades. Here’s how to familiarize yourself with the key components of Bybit’s platform.

The Dashboard

This is the command center for everything. It’s where you’ll monitor your assets, positions, and market data. Most dashboards are designed to be visually intuitive, giving you quick access to what matters:

- Account overview: Check your wallet balance and transaction history within seconds.

- Market summary: Live updates on price movements, trading pairs, and volume trends.

- Open positions panel: Stay updated on how your active trades are performing without digging around.

- Order history: Review your past trades to refine your strategy based on your performance.

Take some time to customize your view if that’s an option—it ensures you can focus on what’s meaningful to you.

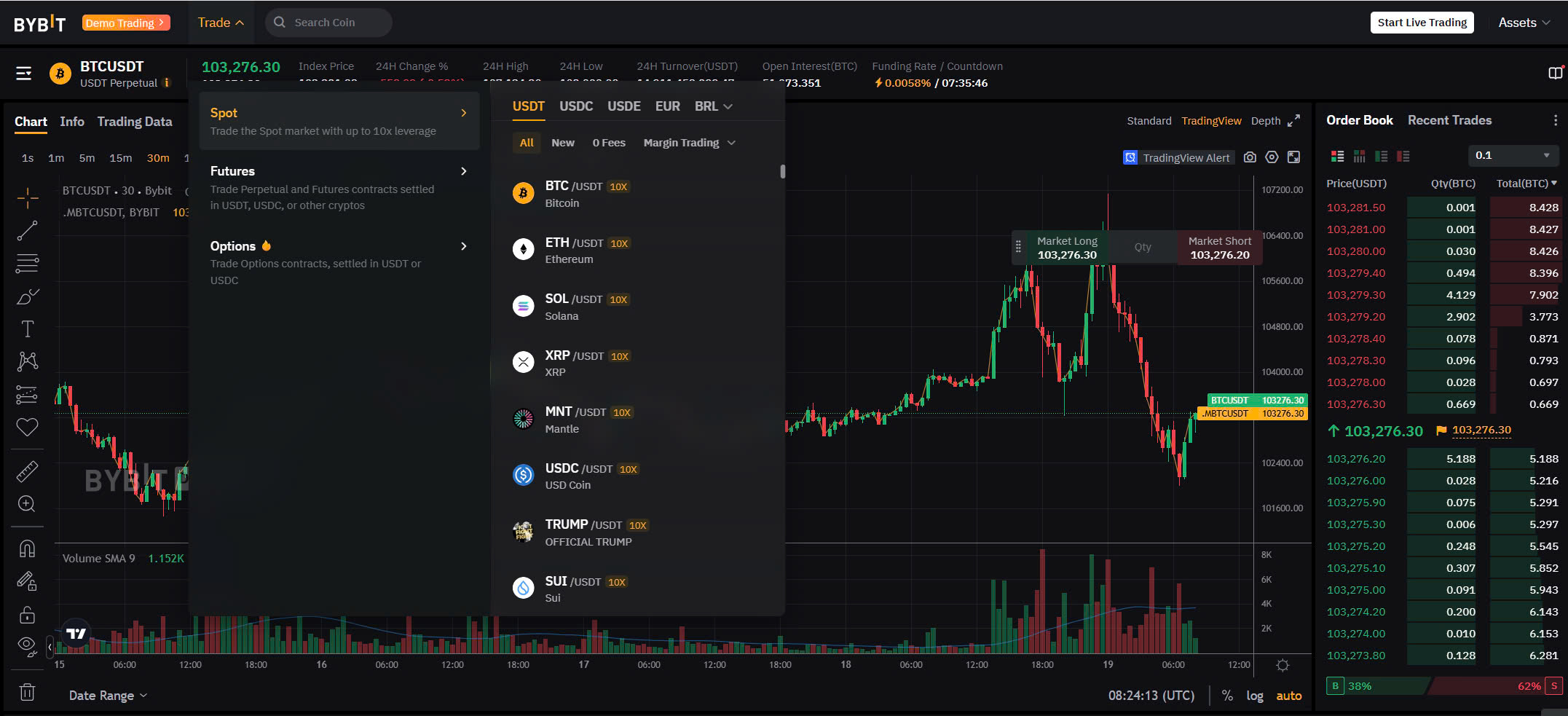

Trading Pairs

One of the first things to understand when trading is how pairs work. Trading pairs represent two currencies that you can exchange for one another. For example, you might see pairs like BTC/USDT, which means you can trade Bitcoin for USDT and vice versa. Here’s what new users need to grasp:

- Major pairs vs. altcoin pairs: Major pairs typically involve large-scale currencies or stablecoins, while altcoin pairs focus on specific tokens.

- Liquidity considerations: Higher liquidity pairs have tighter spreads and allow for faster trades, making them ideal for beginners.

- Volatility: Some pairs are more stable, while emerging ones may see significant price swings.

Stick to pairs with strong daily trading volumes initially. They’ll be easier to trade and less prone to wild, unpredictable price fluctuations.

Leverage Options

Leverage is both a friend and a foe. It allows you to control larger positions with a smaller upfront investment. For instance, with 10x leverage, your $100 can now control $1,000 worth of assets. However, this amplifies both potential gains and losses.

- Adjustable leverage: You can often choose your leverage multiplier based on your risk appetite.

- Isolated vs. Cross Margin:

- Isolated margin: Limits your risk to the amount invested in a specific position.

- Cross margin: Shares your total account balance to cover losses on trades.

- Risk management: High leverage is tempting but can liquidate your entire position quickly. Beginners should start small—try using lower leverage until you’re comfortable.

Market Types

Trading platforms typically offer different types of markets to cater to varying needs. Each has unique advantages worth exploring:

- Spot Trading: This is the simplest form of trading. You buy or sell an asset at its current price and own it outright. It’s a great way to get started without overcomplicating things.

- Pro Tip: Spot trading is less risky since you’re not borrowing funds to enhance your position.

- Futures Trading: Ideal for those looking to profit from price movements without owning the underlying asset.

- Enter long positions if you believe the price will rise.

- Opt for short positions if you think the price will drop.

- Futures often include the added complexity of expiry dates and funding fees.

- Options Markets (if available): These are contracts that give you the right, but not the obligation, to buy or sell an asset at a predetermined price in the future. They come with more risk but also high reward potential.

Understand the unique structure of each market before diving in. Experienced traders may blend market types for diversified strategies, but beginners should focus on one market for simplicity.

Extra Tools Worth Exploring

Most platforms come equipped with additional tools to give traders an edge. Knowing which ones to start with can save you hours of trial and error.

- Price alerts: Set up alerts to avoid staring at charts all day. These notify you when critical price levels are hit.

- Charting tools: Use candlestick charts, trendlines, and indicators like RSI or MACD to spot patterns.

- Order types: Beyond market orders, you’ll find tools like limit orders and stop-loss orders to manage risk automatically.

Familiarize yourself with these features early on. They’re invaluable for refining your strategy and taking the emotional guesswork out of trading.

Exploring Different Trading Strategies

Spot Trading: Simplicity at Its Core

Spot trading is where most beginners gain their footing. It’s straightforward—buy low and sell high. You own the asset outright, and there’s no borrowing or lending involved. Bybit excels in providing a user-friendly platform for spot trading with real-time price updates.

Here’s how to approach it:

- Start Small: Stick to small trades to learn the ropes without risking too much.

- Keep It Familiar: Trade assets you understand or can research. Unknown assets can be volatile and unpredictable.

- Set a Target: Always decide on an exit price. Know when you’ll take profits or cut losses.

Spot trading thrives on simplicity, but don’t confuse simple with easy. Keeping emotions in check when prices fluctuate is easier said than done.

Swing Trading: Timing the Market’s Rhythms

Swing trading is a step up in complexity. Here, traders aim to profit from short-to-medium-term price swings over days or weeks. It requires patience and a decent understanding of market trends.

Here’s a beginner-friendly approach to swing trading:

- Study Charts: Learn to read candlestick patterns and other basic charting techniques to identify trends.

- Use Stop-Loss Orders: A safety net to close your trade automatically if prices move against you.

- Stick to a Strategy: Jumping from one tactic to another leads to confusion and losses.

Swing trading teaches discipline. You can’t check prices constantly so instead, trust your strategy and timing. By avoiding the noise, you stick to well-thought-out plans rather than emotional gut reactions.

Margin Trading: Amplify Gains (and Risks)

Margin trading is for traders ready to take on higher risk. It allows borrowing funds to make trades larger than your account balance. While this can significantly amplify profits, it also heightens losses.

To navigate margin trading intelligently:

- Manage Leverage: Use lower leverage until you’re highly confident in your positions. Higher leverage magnifies outcomes—both good and bad.

- Monitor Closely: With margin trading, small price movements can have a massive impact on your position.

- Cap Your Risk: Never trade more than you’re willing to lose. Keep emotions in check, especially when the market doesn’t favor you.

Margin trading is powerful but unforgiving. Enter the space carefully. Test strategies on small positions before scaling up.

Tailoring Your Approach

Every strategy has its strengths and fits different trader personalities. Decide based on your risk tolerance, available time, and experience. For beginners, spot and swing trading are safer starting points. More advanced users might find margin trading rewarding, but only with proper caution and preparation.

Placing Your First Trade on Bybit

Once your account is set up and funded, it’s time to take the next step: making your first trade. It might feel intimidating at first, but breaking it into simple steps makes it manageable. Here’s how to get started confidently.

Understand Order Types

Before placing a trade, you need to know how orders work. There are three main types, and each serves a unique purpose:

- Market Order: This executes your trade immediately at the best available price. It’s quick and simple but can sometimes cost more due to price fluctuations.

- Limit Order: With this, you set the price. The trade only happens if the market matches your price target. While slower, it gives you total control over your costs.

- Conditional Order: Think of this as an automated order based on specific rules. When certain conditions are met (like a price crossing a threshold), the trade triggers. It’s powerful for managing risk but needs planning.

Steps to Place Your First Trade

Here’s a straightforward process:

- Pick Your Pair: Head to your trading interface and select the trading pair (e.g., BTC/USDT). This links the two currencies you want to trade.

- Choose Order Type: Based on your goal, pick between market, limit, or conditional orders. If you’re unsure, start with a market order; it’s the easiest for beginners.

- Enter Position Size: This determines how much of the currency you’re buying or selling. Start small to minimize risks.

- Set Leverage (Optional): Leverage allows you to control a larger position with less money. For instance, 10x leverage means a $100 deposit lets you trade $1,000. While tempting, it’s risky. Over-leveraging can result in huge losses. Always use leverage cautiously, especially when starting.

- Review and Confirm: Double-check every detail before confirming your trade. Ensure the order type, size, and leverage are correct.

- Place the Trade: Click the button, and you’ve officially made your first move.

Using Leverage Responsibly

Leverage is a double-edged sword. Here’s how to stay on the safe side:

- Start Small: Begin with low leverage (e.g., 2x–5x). Higher leverage amplifies risks, not just rewards.

- Set Stop-Loss Orders: Always use stop-loss orders to cap potential losses. For example, if you buy at $20,000, set a stop-loss at $19,500.

- Manage Margin Requirements: Keep an eye on your margin. If the market moves against you, having extra funds prevents liquidation.

Focus more on learning and less on gains. Once you master the basics, leverage becomes a friend, not a foe.

Key Takeaways

Placing your first trade is about clarity and control. Choose the right order type, start with small amounts, and approach leverage cautiously. Over time, precision and practice will make you a confident trader.

Mitigating Risks: Bybit’s Risk Management Tools

The ability to navigate the ups and downs of the market doesn’t just hinge on strategy. Skillful risk management keeps your balance safe, and emotions in check. It’s like wearing a seatbelt on a winding road—not optional. Here’s how you can take control of your trades using robust risk management tools.

Take-Profit: Lock in Gains

Imagine you’ve entered a trade, riding the momentum of a market trend. But what if you suddenly step away and the market peaks while you’re gone? You can miss out on locking in profits. A take-profit order does the work for you.

This tool automatically closes your trade once the price reaches a preset level. It secures your gains without you needing to monitor every second. Think of it as setting a realistic goal, cashing out when you’ve hit it, and resisting the urge to be greedy.

- Pro Tip: Avoid setting take-profits unrealistically high. The market rarely hits extreme peaks, so aim for reasonable targets aligned with support/resistance levels.

Stop-Loss: The Safety Net You Need

If take-profit is a seatbelt, stop-loss is the airbag. It’s designed to minimize damage. When a trade moves against your expectations, a stop-loss cuts your losses by closing the position at a predetermined point.

This prevents a bad situation from spiraling. Without it, you risk letting emotions dictate your decisions hoping for a reversal that might never come. Discipline beats hope every time.

- Key Tip: Avoid setting stop-losses too close. Market volatility can trigger them unnecessarily. Leave room for natural price fluctuations.

Position Sizing: Don’t Go All In

Before pressing that buy or sell button, ask yourself: How much can I afford to lose? This is where position sizing becomes a lifesaver. It ensures you’re not risking everything on a single trade.

Instead of betting it all, allocate only a small percentage of your balance to one trade. A common rule? 2% risk per trade. This way, even a losing streak won’t cripple you.

Here’s a simple breakdown:

- Calculate your total account balance.

- Decide your risk tolerance (e.g., 2%).

- Factor in your stop-loss distance to determine trade size. A wide stop-loss allows smaller positions; a tighter one can handle slightly larger positions (but with care).

Building a Partnership with Risk Tools

Using these tools isn’t just about avoiding losses. It’s about letting strategy guide your actions instead of panic.

When stop-loss, take-profit, and position sizing work together, they create a firewall against emotional mistakes. Over time, these small, calculated steps build up into consistent success. After all, the goal isn’t just to win the next trade—it’s to stay in the game for the long haul.

Tips for Maximizing Your Experience on Bybit

Optimize Trading Costs by Tracking Fees

Every trade carries a cost, so pay attention to fees. Even small percentages add up, especially if you trade often. Understand the difference between maker fees and taker fees. Makers add liquidity, while takers remove it and the fee structures for each are different. Aim to position your trades as maker orders whenever possible to save on costs.

Here’s a simple tip: Use limit orders for strategic entries or exits. They are more likely to qualify as maker trades. Watch your fee reports by reviewing the trading history tab frequently. This will help you spot trends where fees might be eating into your profits.

Leverage the Mobile App for Speed and Flexibility

Trading doesn’t have to tie you to a desk. Mobile apps are designed to keep you in the loop, whether you’re commuting, waiting in line, or on a break. Use the app to track real-time data and manage open positions without missing opportunities.

Enable push notifications for price alerts. Want to enter a position when a specific price is hit? Set an alert, and let it handle the heavy lifting. In volatile markets, seconds matter, so having quick access on your phone can be a game-changer.

Pro tip: Always double-check your orders on mobile. It’s easy to make small mistakes on a smaller screen.

Practice Without Risk Using Demo Accounts

Practical experience is priceless. With demo accounts, you can simulate trades using virtual funds in real market conditions. Use this as your playground to refine strategies, test ideas, and understand how different order types work under various scenarios.

Start by trying out advanced tools like stop-limit or trailing stop orders in this risk-free environment. Monitor how changes in leverage affect your margins or potential losses. Treat this demo experience like real trading: focus on discipline, track results, and learn from mistakes.

Once you feel confident, replicate your winning strategies in live trades. Practicing here will help you avoid costly errors later.

Organize and Review Your Metrics Often

Track everything—gains, losses, fees, and trading patterns. Use a basic spreadsheet or trading journal to document your actions and outcomes. The goal is to pinpoint what works and eliminate what doesn’t. Trends will begin to emerge once you’ve logged 20 to 30 trades.

Review your logs weekly or monthly. Did impulsive trades wipe out disciplined gains? Did certain times of day yield better results? Analyzing this data will help you optimize both your strategy and mindset.

By combining these tools—fee awareness, mobile trading, and practice sessions—you’ll improve your confidence and profitability quickly. Stay disciplined, informed, and ready to adapt as you grow.

Final words

Bybit offers a robust platform for cryptocurrency enthusiasts, but a thoughtful approach ensures success. From securing your account to leveraging advanced tools, this guide equips you to trade with confidence. Remember that trading always involves risk, so use Bybit’s features, like stop-loss orders, to protect your investments. As you grow, experiment with different strategies and continue learning. Cryptocurrency trading is dynamic, and Bybit’s constantly evolving features make it a standout platform for beginners and seasoned traders alike. Embark on this journey with diligence, and your efforts can lead to substantial rewards.

Start trading with confidence on Bybit today!

Learn more: https://cryplinker.com/

About us

Crypto Linker is committed to simplifying your entry into the cryptocurrency world. We provide users with actionable guides, expert resources, and tools to succeed on platforms like Bybit. With us, navigating crypto trading becomes easy and profitable.