Learn how to complete the MEXC KYC process quickly and easily to unlock higher withdrawal limits, enhanced security, and full compliance with global regulations.

Why Completing Your MEXC KYC Matters

Imagine you’re all set to dive into trading, but you hit a wall the platform limits your withdrawals, or worse, locks your account. This happens when users skip the crucial step of Know Your Customer (KYC) verification. Completing your KYC is more than just ticking a box; it can significantly enhance your trading experience.

Enhanced Account Security

Verification protects your account in ways you may not notice immediately. By verifying your identity, your account becomes far less vulnerable to unauthorized access. For example, if someone tries to hack into your account, the system can easily identify suspicious activity and block it, securing your funds. Think of it as adding a robust lock to the door of your trading vault.

Higher Withdrawal Limits

One of the most practical reasons to complete your KYC is the immediate benefit of unlocking higher withdrawal limits. Without verification, you’re limited to minimal activity, which can be frustrating if you’re handling larger trades. With KYC approved, these constraints are removed, giving freedom to move your funds whenever you need to. It’s like upgrading from a small container to a full sized safe for your assets.

Compliance and Accessibility

Global regulations are becoming stricter for virtual asset platforms. By verifying your account, you’re ensuring the platform complies with these legal standards. Why does this matter to you? Because it keeps the service available in your region and aligns with international financial laws. That regulatory shield helps maintain the stability and functionality of the platform you’re trading on.

By completing KYC, you’re doing more than following rules you’re investing in security, flexibility, and peace of mind. For a beginner-friendly guide to understanding KYC processes beyond this platform, check out this detailed walkthrough. It might broaden your understanding of verification across platforms and how it benefits traders globally.

Skipping this step leaves gaps in your trading setup. Lay the groundwork with KYC to trade seamlessly and securely.

Setting the Stage: Requirements for MEXC KYC

Getting ready for KYC verification is all about preparation. Knowing what’s required upfront can save you time and hassle. Here’s a breakdown of everything you’ll need to tick off this step efficiently.

Documents to Keep Handy:

To complete KYC verification, you’ll need some specific documents. Most of them are standard, but they must meet strict guidelines:

- Government-Issued ID:

- Passport, national ID, or driver’s license are typically accepted.

- Ensure it’s not expired and shows your full name, date of birth, and a clear photo.

- Proof of Residence:

- A utility bill, bank statement, or rental contract with your address.

- Documents should be from the past 3-6 months to remain valid.

- Selfie or Live Verification Photo:

- Often, you’ll need to upload a selfie holding your ID.

- For some setups, you’ll be asked to take a live picture during the process.

Information You’ll Share:

Aside from documents, you’ll also need to fill in details about yourself:

- Full legal name (as shown on your ID).

- Date of birth.

- Address (must match your proof of residence).

- Contact details like email and phone number.

Be accurate here. Any discrepancies can cause delays or even rejections.

Tips for Speeding Up the Process:

If you want to make your KYC setup smooth and quick, follow these steps:

- Check Image Quality: Photos of documents should be clear, with no glare or shadows. Use a well-lit area.

- Prepare Files Ahead: Convert docs into acceptable formats like JPG, PNG, or PDF. Many platforms also have a file size limit, so keep them compressed but legible.

- Use Accurate Info: Double-check that names, dates, and addresses match your ID and proof of residence exactly. Slight differences can create unnecessary holdups.

- Keep Response Times in Mind: Approval can take a few hours to several days. Try submitting during business hours to reduce wait times.

Adopting these habits ensures a seamless start to your journey while avoiding common pitfalls or delays. If you’re new to navigating similar processes, it helps to understand what other platforms require as well. For instance, platforms like Bybit follow similar principles when verifying identity. You can explore how they’ve structured their KYC requirements to get a broader picture.

Once your KYC verification is complete, the door to secure and unrestricted trading opens wide. Let’s take it a step further and explore… (continued in the next section!)

Step-by-Step Guide to Completing MEXC KYC

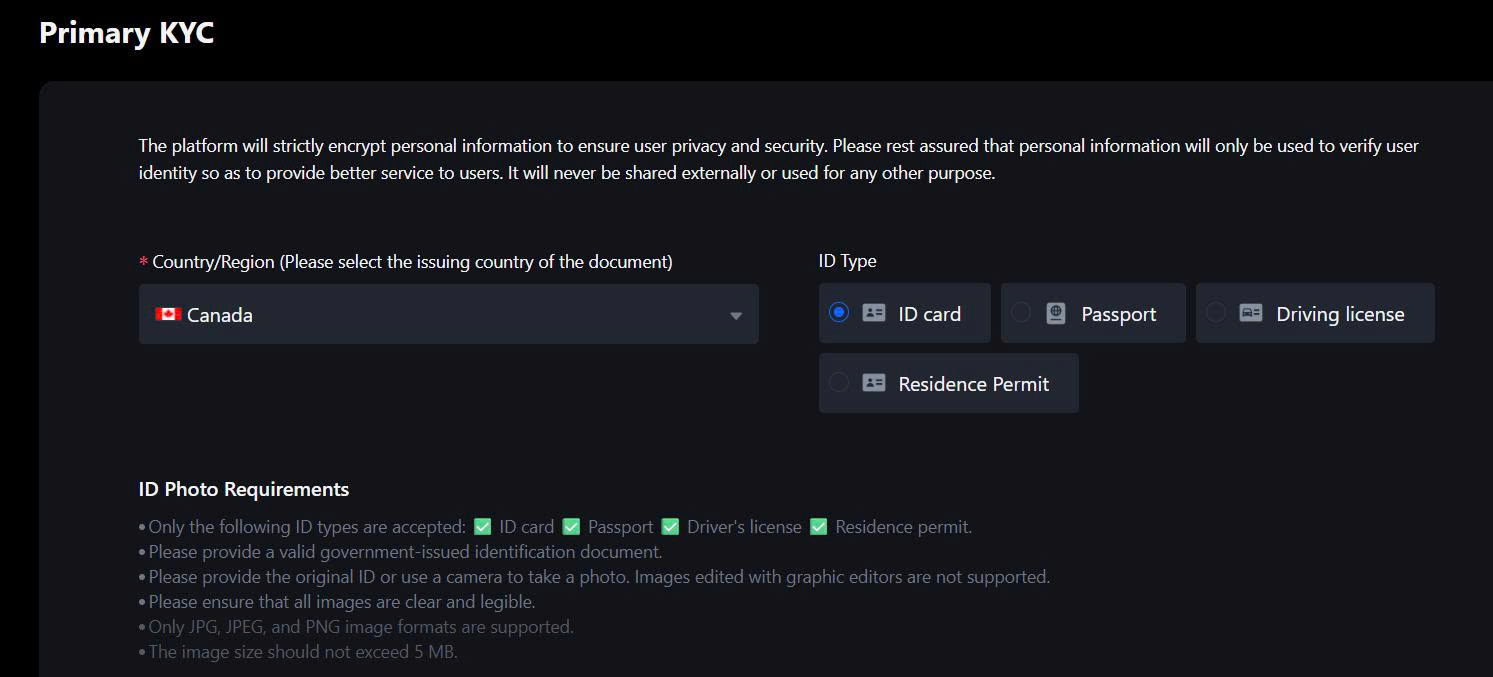

Starting the KYC Process

Kicking off your verification journey is simple. Once you’re logged into your account, head straight for the profile section. Look for the option labeled something like ‘Identity Verification’ or ‘KYC’. It’s often placed prominently to nudge users towards enhanced security and compliance.

Uploading Personal Documents

This step is where most people get stuck, but it’s easier than you think. You’ll usually be asked to upload two essential documents:

- A Government-Issued ID

- This can be your passport, driver’s license, or national identity card.

- Make sure the document is current (not expired) and captures all information clearly. Smudged or dark photos? They can get your application rejected.

- A Selfie with the ID or a Live Photo

- Follow the app’s instructions carefully. Typically, you hold your ID next to your face, ensuring both are visible.

- Some platforms might require you to write today’s date on a piece of paper and display it too.

Here’s an important tip: natural lighting and a neutral background are your best friends. Avoid wearing caps, sunglasses, or anything that obscures your face.

Filling Out Personal Information

After uploading your documents, you’ll type in personal details like:

- Full name (matching your submitted ID).

- Date of birth.

- Residential address.

- Contact information such as phone number and email.

Double-check everything! Even small typos can create delays.

Verification Submission

With everything filled out, it’s time to hit ‘Submit’. Here’s the deal: Some systems will review your application in minutes, while others may take a day or two. During this process, avoid submitting multiple applications that can cause confusion or rejection.

Checking Approval Status

Head back to the verification section to monitor progress. If approved, you’ll see a green ‘Verified’ badge or similar confirmation. If rejected, don’t panic. Carefully read the reason provided and correct the issue. Resubmit with the updated information, and chances are, you’ll get approved soon.

For a detailed comparison of how other platforms handle verification, check out this KYC guide. It offers helpful context if you’re balancing multiple platforms.

Final Thoughts

Completing your KYC is more than a formality it’s your gateway to secure and limit-free trading. With your verification done, enjoy a smoother, safer trading experience tailored just for you.

Common Mistakes and How to Avoid MEXC KYC Delays

Submitting KYC doesn’t have to be a headache, but small errors can cost time. Let’s break down common mistakes people make and tips for smooth sailing.

1. Uploading Unclear Documents

A blurry ID photo is a common culprit. The verification team needs to confirm details clearly. A poor-quality image can delay the process or even lead to outright rejection.

- What to do:

- Scan or photograph your ID in good lighting.

- Avoid glare, shadows, or cropped edges.

- Use the highest photo resolution possible.

2. Submitting Mismatched Information

Your details must match what you sign up with. For example, if the name on your ID doesn’t align exactly with what’s in your profile, the system will flag it.

- What to do:

- Double-check spelling, middle names, and order of names.

- Avoid nicknames or abbreviations stick with official details from your ID.

- If your ID uses non-Latin characters, provide an official translation if requested.

3. Expired or Invalid IDs

Providing expired documents is an easy-to-avoid but frequent error users make. Similarly, unsupported documents like certain regional IDs can lead to rejection.

- What to do:

- Use passports, driver’s licenses, or national IDs that are current.

- Review the platform’s list of approved documents beforehand.

- Ensure your ID covers all required details (photo, full name, date of birth, expiration, etc.).

4. Skipping the Selfie Verification Steps

Some think uploading an ID is enough but many platforms also require a selfie for facial verification. Skipping this step can leave your application hanging in limbo.

- What to do:

- Follow on-screen instructions for the live selfie or video (if required).

- Remove hats, glasses, or anything obstructing your face.

- Keep your phone or camera steady to avoid a blurry capture.

5. Ignoring File Format Requirements

Sending ID files in invalid formats (like .docx or even unsupported image types) delays your application and requires re-uploads.

- What to do:

- Check supported file types. JPEG, PNG, and PDF are often safe bets.

- Avoid compressed or overly edited files.

- Ensure file sizes meet requirements not too large, but not pixelated.

6. Using Fake or Manipulated Documents

Submitting fake or overly edited documents isn’t just risky it’s a surefire way to lose access to the platform entirely.

- What to do:

- Always provide legitimate, unaltered documentation.

- If you’ve legally changed your name, include supporting documents (like a marriage certificate).

7. Submitting in the Wrong Language

Some verification teams struggle with documents written in unsupported languages, leading to misunderstandings or delays.

- What to do:

- Check if your language is supported.

- For unsupported languages, attach certified translations to accompany your documents.

Bonus Tip: Patience Pays

Processing times can vary depending on platform volume. Sending support tickets too soon may actually slow things down.

- What to do:

- Wait for the stated review period (often 1-3 business days).

- If delays exceed this timeframe, only then reach out to support with polite, clear details.

If these mistakes sound familiar, don’t worry they’re easily corrected! For more beginner-friendly tips on navigating trading platforms, you might find this review helpful. Stay persistent, account verification is well worth the effort.

FAQs: Resolving Issues with MEXC KYC

How do I resubmit documents if my KYC application gets rejected?

Rejection isn’t the end of the road it’s more of a speed bump. Often, the rejection happens due to minor issues like blurry images or mismatched details. Here’s what you can do:

- Review the rejection details: Platforms usually provide feedback. Check for specific reasons like invalid IDs or missing information.

- Gather new documents: Ensure documents meet the requirements a valid ID, proof of address, or a selfie matching the provided ID. Focus on clarity, readability, and matching file formats. Avoid folded corners or heavy glare in photos.

- Check formatting: Some platforms have strict rules about file sizes and extensions (like JPEG, PNG). Don’t ignore these.

- Access the submission panel: Log into your account, head to the verification or KYC page, and locate the option to resubmit.

- Upload carefully: Double-check before hitting submit. Missteps here often lead to delays.

Ultimately, patience is key. Reviews usually take a few hours to a couple of days, depending on the queue.

How can I check the status of my KYC application?

Waiting for updates? Here’s how to stay on top of things without endlessly refreshing:

- Account dashboard: After logging in, the KYC section should show application progress. Look for terms like “Pending Review.”

- Email notifications: Many platforms send automated updates via email. Ensure you’ve checked your spam folder.

- Customer support: If it’s taking unusually long (e.g., beyond the standard processing time mentioned by the platform), contact support. Provide your application ID or email for faster resolution.

Remember: Delays can sometimes happen due to high user activity, especially during peak market conditions.

Why does my KYC application keep getting rejected?

If this feels like a recurring nightmare, understanding possible causes can ease the frustration:

- Name mismatches: Your submitted name must match your documents exactly.

- Expiration dates: Old IDs won’t work. Always use valid and up-to-date identification.

- Poor image quality: Blurry, cropped, or incomplete images are common culprits. Ensure documents are captured in good lighting.

- Document types not supported: Confirm that the provided identification is on the platform’s accepted list (e.g., government-issued IDs over student cards).

- Geographical restrictions: Some regions are blacklisted. Verify if your location supports KYC processes on the platform.

If issues persist after triple-checking these points, escalating through support channels is the best next step.

Looking for further insights on platform-specific KYC tips? You might find this guide to KYC verification helpful. It breaks down common do’s and don’ts to simplify the process on another popular platform, offering advice valid across many systems.

After KYC: What’s Next for MEXC Users

Completing your KYC isn’t just a box to check it’s a door to endless possibilities. Once verified, you’re no longer limited to the basic functions of the platform. What happens next? Here’s everything to know.

Access to Higher Trading Limits

One of the most immediate perks is the increase in trading limits. These limits often mean the difference between dabbling in crypto and actively building a diversified portfolio. For users dealing with substantial trades, verification ensures you can transact without frequent bottlenecks.

Why does this matter? Larger limits streamline transactions, allowing you to execute significant trades without artificial constraints. Whether you’re buying into a fast-rising token or pulling profits, the extra room that only verified users enjoy keeps your operations smooth and uninterrupted.

Advanced Features at Your Fingertips

A verified account unlocks advanced platform features designed for serious traders. Consider options like margin trading or enhanced API access. These tools are often restricted to accounts confirmed through KYC. They help not just in execution but strategy, giving you an edge that unverified accounts can’t replicate.

The Verdict: Verification doesn’t just expand your options it catapults you into new trading territories. Think precision, capability, and potential.

Enhanced Withdrawal Limits

Many platforms impose conservative daily withdrawal limits for unverified users to deter bad actors. Post-KYC, you’ll notice a dramatic increase in how much you can withdraw daily. This flexibility is crucial if you suddenly need to move funds be it to capitalize on an opportunity or respond to market conditions.

Without KYC? Those limits could mean missed opportunities as you wait for the next withdrawal window. With KYC? Funds move when you want, how you want.

Improved Security Confidence

Verification isn’t just about access; it’s also about peace of mind. With identity confirmed, the platform can help protect you against fraud or unauthorized use of your account. In case of suspicious activity, you’re better positioned to recover funds or resolve issues.

Think of it this way: KYC is like carrying proper ID. It gives both you and the platform confidence that actions in your account reflect your intent, not a malicious actor’s.

Tailored Customer Support

A verified account often receives faster and more targeted customer support. Why? Because your information is on record, making it easier for the platform to address your concerns. If something goes wrong like a missing deposit or a trade issue being verified fast-tracks the resolution process.

When trading moves fast, time is money. And having your concerns prioritized means less stress and fewer delays.

Pro Tip: Keep track of your platform benefits or verify your limits as they can vary. Want tips on enhancing your trading journey post-KYC? Check out this guide to beginner platform insights.

KYC isn’t just a procedural step it’s your ticket to unlocking trading freedom. Whether you’re interested in security, functionality, or just more options, the benefits speak for themselves. Prepare for the road ahead it’s smoother and more powerful than ever.

Final words

Completing MEXC’s KYC process is your gateway to a better, more secure trading experience. By verifying your account, you unlock higher limits, regulatory compliance, and greater peace of mind for your crypto operations. The steps might seem complex for beginners, but with the right strategy and information (as outlined here), the process becomes straightforward and rewarding. Don’t let the challenges of KYC deter you from achieving your trading goals. Embrace it as a necessary step to access the full potential of the MEXC platform. Remember: every verified trader is a step closer to more secure and optimized trading. Start your journey today with confidence!

Complete your MEXC KYC today and unlock secure trading opportunities!

Learn more: https://cryplinker.com/

About us

CrypLinker provides comprehensive tools, expert resources, and global connections to ensure your crypto trading experience on platforms like MEXC is seamless and secure.