Navigating crypto can be tough with volatile markets and risky tokens. That’s where USD1 Stablecoin steps in offering stability, transparency, and a 1:1 peg to the US dollar. As inflation rises and trust in traditional finance fades, USD1 provides a secure way to store value and transact confidently in the digital economy. Discover how USD1 Stablecoin is reshaping the future of stable digital assets.

What is USD1 – Stablecoin?

USD1 is a type of stablecoin, also known as a ‘stable digital currency’, pegged 1:1 to the US dollar. This means each USD1 is always guaranteed to be worth approximately 1 actual USD. It is an effective financial tool for those who want to enter the blockchain world without being affected by the dramatic fluctuations of typical cryptocurrencies.

Unlike volatile tokens, USD1 Stablecoin is designed with the primary goal of maintaining value stability and reducing risk for users.

Introduction to USD1: What Makes It Different?

USD1 sets itself apart in the crowded stablecoin market by focusing on three key pillars: robust dollar-pegging, transparency, and stability in unpredictable times. These traits make it more than just another cryptocurrency; they turn it into a tool for financial confidence.

Dollar-Pegging Done Right

At its core, USD1 is pegged to the US dollar. Every unit of this stablecoin directly represents one US dollar, maintaining a 1:1 ratio at all times. This ensures minimal volatility, which is crucial in a market where value swings can occur in seconds. But the real differentiator lies in its mechanisms to maintain this peg. By relying on real-world dollar reserves and audited protocols, USD1 doesn’t just claim stability it proves it.

This dollar backing removes guesswork from transactions. When you hold USD1, its value doesn’t fluctuate wildly year to year like traditional cryptocurrencies. Whether you’re sending money across borders or parking funds to avoid inflation, you get peace of mind that its worth will remain intact.

Unwavering Commitment to Transparency

For trust to thrive, transparency is non-negotiable. USD1 stands out because it actively demonstrates what backs it. Through scheduled audits by respected third-party firms, users can verify that every unit issued is covered by actual reserves. Imagine opening a vault and seeing exactly what’s promised that’s the ethos here.

Moreover, the technology underlying USD1 ensures traceability. Blockchain’s open ledger allows anyone to monitor transactions and validate its integrity. No blind trust is required; verification is built into the system.

A Stabilizer in Financial Chaos

Cryptocurrency markets often evoke chaos. Prices skyrocket and plummet unpredictably, leaving casual users confused and cautious. USD1 offers something rare in this storm: a calm harbor. Not only does it anchor itself to the reliable US dollar, but it also counters inflation risk by holding value with more consistency than many fiat currencies in inflation-prone nations.

For merchants, this creates an environment ripe for adoption. Customers can make payments with stable values, while businesses can avoid the headache of currency conversion losses. Stability isn’t just a benefit it’s a necessity for crypto’s broader utility.

A Market That Demands Clarity

In such volatile times, trust in financial systems wavers. Stablecoins like USD1 meet the moment by bringing together the best of blockchain technology and fiat stability. When it feels like the ground is shifting beneath you, having something reliable to stand on can make all the difference.

If you’re wondering how to integrate stablecoins into your financial activities, starting out on platforms like Bybit is an excellent stepping stone. Understanding how they operate will put you ahead in navigating this evolving world of digital payments.

How USD1 Ensures Stability in the Crypto Space

At its core, USD1’s anchoring to the US dollar rests on a simple but powerful principle: transparency and trust. People trust a stablecoin only if it delivers on what it promises a rock-solid value tied to real-world currency. Here’s how USD1 keeps everything stable while sidestepping the volatility often associated with cryptocurrencies.

1. Collateral-Backed Stability

The first line of defense comes in the form of collateral management. Every USD1 token is backed 1:1 by tangible reserves. Think of these reserves as the safety net that ensures USD1’s value doesn’t drift from the dollar.

But what’s in those reserves? Often, it’s a combination of fiat currency held in audited bank accounts and high-quality liquid assets like Treasury bills. The idea is to maintain a reserve worth at least the number of circulating tokens. If every user decided to cash out their USD1 at the same time, the system would still have enough assets to honor that.

This isn’t just guesswork transparency drives trust. Regular audits are conducted by third-party firms to ensure the reserves match the circulating supply. Seeing as reputation is everything in this space, knowing the books are balanced keeps users confident.

2. Smart Contracts: The Silent Guardians

Part of what makes USD1 different from traditional financial tools is how smart contracts come into play. Think of these as automated, tamper-proof agreements coded into the blockchain. Here’s the role they play:

- Supply Management: When a user buys USD1, the equivalent fiat backing is deposited into reserves while tokens are minted. When someone sells USD1, those tokens are burned, ensuring no token exists without backing.

- Prevention of Over-Issuance: Smart contracts ensure USD1 stays within its issuance limits. A rogue operator can’t suddenly flood the market with tokens and that’s a game-changer for trust.

- Auditability: Since blockchain transactions are public, anyone can verify these operations in real time. The transparency is built directly into the system.

3. Inflation Resilience through Safe-Haven Assets

One of USD1’s more underappreciated mechanisms is how it shields users from inflation. When the reserves include low-risk investments like short-term U.S. Treasury bonds, the system generates yield without risking stability. While inflation may weaken the general purchasing power of the dollar over time, this approach works behind the scenes to counteract that erosion. It’s not a perfect hedge, but it adds a layer of protection traditional hard cash doesn’t offer.

4. Crisis-Proof Protocols

The crypto space isn’t immune to black swan events think platform crashes or sudden regulatory crackdowns. USD1’s stability mechanisms hold firm even when markets are chaotic. Why? Because its peg doesn’t rely on speculative behaviors like arbitrage alone. The collateral base and smart contracts carry the weight, ensuring the peg stays intact regardless of external conditions.

Interestingly, many traders also leverage stablecoins like USD1 when navigating complex crypto markets. If unfamiliar with platforms supporting such trades, this Bybit review offers insights into reliable tools.

Bottom Line

Stability isn’t just a feature it’s everything. From its robust 1:1 collateralization to the use of smart contracts, USD1 proves that with the right systems in place, cryptocurrencies don’t have to be volatile. They can be stable, transparent, and ready to deliver on their promise in even the most unpredictable markets.

Key Benefits of USD1 for Users

Reduced Volatility: One of the greatest frustrations with most cryptocurrencies is their unpredictable value swings. Imagine holding assets that could lose or gain 15% of their value overnight. That’s simply chaotic for anyone wanting stability in their digital wallets. USD1 eliminates this chaos. As a stablecoin, it’s tethered to the steadiness of the US dollar, ensuring users no longer lose sleep over market turbulence. For anyone planning or budgeting in crypto, this makes all the difference.

Faster Transactions: Traditional financial systems can be maddeningly slow. A simple wire transfer to another country can take days, sometimes even longer if there are hiccups. With USD1, transfers happen in minutes or even seconds. Users can send digital payments across borders without waiting and without the paperwork nightmare. Better yet, this speed pairs with reliability, so there’s no agonizing guesswork about when payments will land.

Inflation-Safe Strategies: Holding cash in economies with rising inflation is like watching ice melt on a sunny day. The value just slips away. USD1 minimizes this threat by staying pegged to the US dollar, which is more resilient to inflation than many local currencies. For users in volatile financial regions, this provides a sense of security that traditional currencies may not offer.

Beyond these aspects, users also appreciate the increased access and convenience USD1 offers. Whether transferring money to family overseas or settling business transactions, fewer fees, faster speeds, and reduced worries about value loss make it a practical choice. Plus, for anyone interested in trading leveraged products or participating in decentralized finance, pairing USD1 with platforms like this guide on navigating KYC can open up streamlined, frictionless opportunities.

How USD1 Addresses Current Crypto Challenges

Cryptocurrency might feel revolutionary, but it drags some baggage. Price swings, security breaches, and trust issues hold it back. USD1 sets out to fix these problems with a sharp focus on stability and transparency.

The Problem: Price Swings

Most cryptocurrencies live on extremes. One day they’re surging. The next, they’re crashing. This makes using them for everyday payments impractical. Imagine buying a coffee priced at $5 worth of crypto, only to find out its value has dropped to $3 by the time the transaction clears. That unpredictability scares away users and businesses alike.

USD1 changes the game by anchoring its value. Its design ties the currency to reliable reserves, keeping it stable. That means no gut-wrenching dips or wild highs. You’d know exactly what your money is worth and trust it for payments.

The Problem: Security Risks

Hackers target cryptocurrency wallets and transaction systems relentlessly. Billions have been lost to attacks, leaving users wary of how secure their funds really are. While these attacks don’t always reflect on the currency itself, they tarnish the ecosystem.

USD1 tackles this by implementing next-level encryption and robust wallet protections. It also leverages smart auditing systems to detect and prevent fraud. By focusing on safety, it fosters peace of mind for both users and investors.

The Problem: Trust Deficit

Crypto’s reputation has taken hits, thanks to fraudulent projects and unclear operations. Many hesitate to adopt it, wondering if their money is safe or if the system is rigged.

Here’s where USD1 shines. Transparency is built into its very foundation. With regular third-party audits and clear, accessible reports, you know exactly where the reserves stand. This doesn’t just boost trust it sets a new industry standard.

By tackling these critical issues head-on, USD1 is not just a solution; it’s a reimagining of what cryptocurrency can be. From stability to security, it invites a broader audience into the digital asset space with confidence. If you’re new to trading and looking for a secure platform to start exploring, here’s a comprehensive guide to trading on Bybit.

Applications and Use Cases of USD1 Stablecoin

USD1 Stablecoin is more than just a digital token it’s a tool for real-world problems. Its design makes it feel accessible for diverse applications where stability and trust are critical. Here’s how it stands out in practical scenarios:

1. Cross-Border Payments Without Headaches

Anyone who has sent money overseas knows the pain: high fees, delays, and endless paperwork. Stablecoins like USD1 cut through this mess.

- Instant Transactions: Transfers using USD1 happen in minutes not days. No need to wait for traditional banking hours or deal with intermediary approvals.

- Lower Fees: Conventional platforms charge significant commissions for international remittances. USD1 transactions occur on decentralized networks, trimming fees to fractions of a dollar.

- Example Use: Imagine a freelancer in Southeast Asia being paid by a client in Europe. Using USD1, they avoid crippling fees and receive their payment almost instantly.

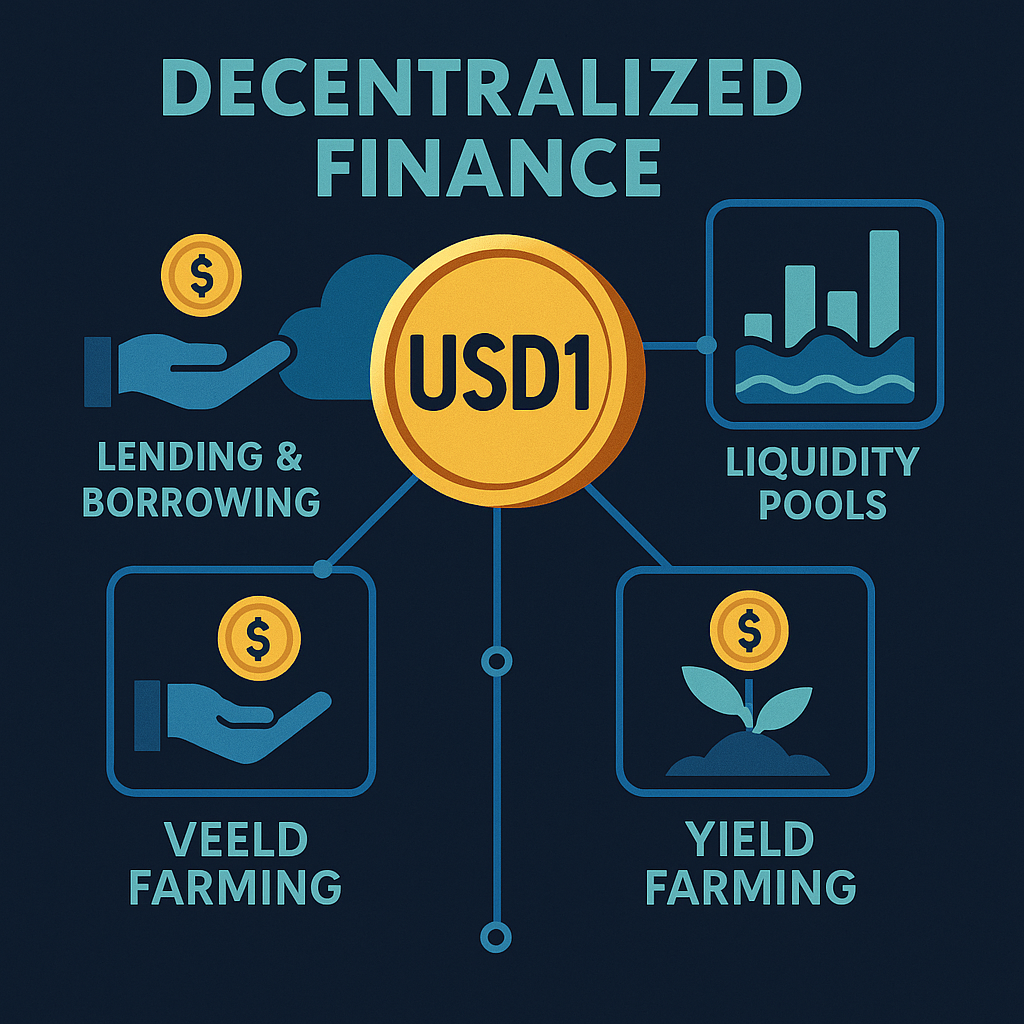

2. The DeFi Powerhouse

USD1 doesn’t just live in wallets it plays a central role in decentralized finance (DeFi). Its stability makes it the backbone for many financial experiments without the usual volatility risks.

- Lending and Borrowing: Users can lend USD1 to earn interest without worrying about the price fluctuation of their capital. Borrowers, in turn, get a predictable repayment experience.

- Liquidity Pools: Stablecoins drive consistent liquidity. Traders operating in automated exchanges rely on assets like USD1, which don’t swing wildly in value.

- Yield Farming: Want consistent returns? Farming with USD1 reduces risks compared to volatile tokens.

These systems make crypto-native banking far more accessible to everyday users a game-changer.

3. Hedge Against Inflation

In regions plagued by currency instability, savings can lose value overnight. USD1 acts as a lifeboat by maintaining purchasing power.

- Reliable Savings: A saver in an inflation-heavy economy can convert their unstable currency into USD1, preserving its value.

- Protective Shield: Unlike traditional banks that can freeze assets or restrict withdrawals, USD1 isn’t tied to centralized entities. This grants savers more autonomy and peace of mind.

- Example Scenario: People in countries like Venezuela or Argentina often turn to stablecoins to shield against hyperinflation. USD1’s peg to the U.S. dollar provides more credibility and trust.

4. Everyday Transactions with Less Risk

Stablecoins like USD1 aren’t just confined to big, cross-border transfers or complex DeFi setups they’re creeping into day-to-day use.

- Payment for Goods and Services: Merchants in crypto-friendly economies are starting to adopt USD1 for its reliability. It ensures a predictable value at checkout.

- Subscriptions and E-commerce: Services with recurring payments can easily integrate USD1 for consistent billing, addressing currency conversion chaos.

- Micropayments: Imagine paying $0.10 for an article or donating small amounts to creators online without worrying about drastic value swings.

A Word on Integration

Developers looking to capitalize on USD1’s potential need the right platform for streamlined trading and functionality. If you’re eager to begin, there’s a helpful KYC guide for using leading platforms that enhances your smooth onboarding.

A Building Block for a Stable Crypto Era

The everyday applications of USD1 Stablecoin prove its utility goes beyond speculative trades. Whether through cross-border payments, protecting savings, or a foundation for DeFi, tools like USD1 are setting new standards for what crypto assets should offer: stability, trust, and practical use.

The Future of Stablecoins: Why USD1 Leads the Way

The stablecoin market has grown from a niche curiosity into a cornerstone of the digital economy. Stablecoins provide what traditional cryptocurrencies often struggle with: price stability. However, as the landscape evolves, not all stablecoins are created equal.

Trends Shaping Stablecoins in 2024 and Beyond

Stablecoins are entering a critical era where technology and regulation intertwine. Here are the key trends shaping their future:

- Regulation is sharpening: Governments worldwide are crafting clearer stablecoin policies. The focus is on transparency, security, and protecting users. This is particularly crucial for stablecoins pegged to fiat currencies like the U.S. dollar.

- Programmability is rising: Thanks to smart contracts, next-gen stablecoins are becoming more flexible. This enables automation in payments, lending, and trading, unlocking entirely new use cases.

- Decentralized finance (DeFi) integration: Stablecoins continue to be the backbone of DeFi platforms, enabling seamless transactions without volatility risks.

Despite growth, two issues persist: maintaining a reliable peg amidst economic turmoil and building trust. Solving this equation is critical.

Solving Inflation and Trust Challenges

Inflation is a reality. Even the world’s strongest currencies can lose value over time. Stablecoins that fail to mitigate inflation risk face an uncertain future.

Here’s where innovation steps in. Leading stablecoins are exploring hybrid systems that combine algorithmic stability mechanisms with traditional reserves. These solutions are designed to maintain purchasing power over time.

Trust is paramount. Blockchain makes transactions transparent, but users also demand clarity on reserve assets. Proven audits and regulatory compliance inspire confidence, ensuring no surprises for holders.

Why USD1 Stands Out

USD1 leans into these trends with precision. Picture a stablecoin that embodies technological adaptability while securing user confidence. It takes everything great about traditional stablecoins and future-proofs it with enhancements.

- Regulatory alignment: USD1 complies with global standards, ensuring it remains accessible and trustworthy across markets.

- Inflation resilience: Its innovative model isn’t just about pegging to a fiat currency. Instead, it focuses on maintaining long-term purchasing power.

- Cross-chain versatility: USD1 integrates with multiple blockchain ecosystems, simplifying transfers and reducing friction for users and businesses alike.

These traits position USD1 as a potential leader in the stablecoin race. Its ability to merge cutting-edge tech with evolving user needs ensures relevance even in unpredictable financial landscapes.

To make your entry into digital spaces seamless, check out this Bybit review. It’s packed with insights that can help you navigate the world of stablecoin trading and beyond.

The stablecoin movement is pressing forward, and USD1 is setting the gold standard for what’s next.

Final words

USD1 is more than just a stablecoin; it’s a pioneering solution offering stability, trust, and a hedge against economic uncertainties. By leveraging its reliable peg to the US dollar, advanced transparency measures, and real-world applications, USD1 positions itself as an essential asset in the modern economy. For those navigating the unpredictable world of cryptocurrencies, USD1 can be your anchor of certainty. As stablecoins evolve, USD1 paves the way for a smarter, more secure financial future.

Unlock the benefits of USD1 explore its applications and stability today at CrypLinker!

Learn more: https://cryplinker.com/

About us

CrypLinker simplifies your quest for reliable crypto insights, connecting users with stability-focused solutions like USD1 and beyond.