Excited to start crypto trading but stuck at ID verification? You’re not alone. For many beginners, KYC feels like a frustrating barrier but it’s actually the key to protecting your account and ensuring platform trust. With Weex KYC, the process is faster, simpler, and more secure than ever. This guide walks you through each step to verify your identity with ease, eliminate common roadblocks, and unlock full access to Weex’s trading features. Get verified, get confident, and start trading smarter today.

Why KYC is Critical for Weex Users

When it comes to using any platform where money is involved, trust isn’t built overnight. Know Your Customer (KYC) is one of the most effective ways to create that trust both for users and platforms. It’s not just a bureaucratic hurdle; it serves deep, vital purposes.

The Security Element

First and foremost, KYC is a shield. By verifying your identity, the platform ensures you are who you say you are not an impersonator or a fraudster. Consider this: if the platform didn’t verify users, it would be an inviting playground for scams. Fake accounts, stolen identities, or worse, could flood markets, leaving real users like you vulnerable. KYC helps put up a strong barrier where only legitimate users can interact.

Also, knowing each user’s identity means your funds are safer from bad actors. If someone tries unauthorized access to your account, a verified identity gives both you and the platform additional tools to stop them in their tracks.

Compliance With Laws That Protect You

Stricter global regulations aim to curb illegal financial activities like money laundering and terrorist financing. That’s where compliance comes in. KYC isn’t the platform putting unnecessary rules on you it’s the law. More importantly, it ensures that customer safety is a priority.

Imagine a marketplace overwhelmed with illicit activity. It could eventually face shutdowns from regulatory bodies, putting all user assets at risk. By implementing KYC, the platform aligns itself with legal standards, providing a safer environment for everyone.

Building User Trust

KYC is also about creating confidence. For traders, there’s comfort in knowing the ecosystem is clean, regulated, and transparent. A verified community feels more trustworthy because you know you’re transacting among real people not bots or shady entities.

At the same time, it signals to you as a user that the platform takes this responsibility seriously. They’re not willing to cut corners when it comes to safeguarding users and ensuring ethical practices.

It’s a Win-Win Situation

Here’s a simple way to look at it: KYC eliminates risks both for users and for the platform. You get a secure trading space and the peace of mind that every interaction comes with checks and balances. Meanwhile, the platform ensures its community remains compliant, protected, and trustworthy allowing it to grow sustainably.

So, while the process might feel like an extra step during onboarding, it’s a small effort for a huge payoff. For a step-by-step guide to getting your account verified, check out this KYC guide for users.

Preparing for a Smooth Weex KYC Process

Getting your documents and tools ready makes all the difference. You want the KYC process to be smooth and fast, but incomplete or incorrect information can slow things down or even lead to rejections. Here’s how to set yourself up for success:

What You Need to Prepare

- A Government-Issued ID

- This could be a passport, driver’s license, or national ID card.

- Ensure it’s not expired validity is non-negotiable.

- The ID should clearly display your photo, name, and date of birth.

- Your Email Address

- It must be active and accessible to you.

- Double-check for typos; KYC updates and confirmations will arrive here.

- A Stable Internet Connection

- A reliable connection avoids disruptions when uploading documents or filling out forms.

- Unexpected disconnects could result in incomplete submissions.

- Your Smartphone or Computer

- The device should have a functioning camera or webcam.

- This is crucial if the process includes a live verification step, like a selfie or video.

- Proof of Address (optional)

- Some platforms may request a utility bill or bank statement to confirm your address.

- Documents should be recent (issued within the past 3 months) and clearly show your name and address.

Pro Tips for Accuracy

- Use Clear Scans or Photos

- Avoid blurry images. Ensure all text is legible and nothing is cropped.

- Scan or photograph your documents under good lighting.

- Match Your Details

- Double-check that the information on your ID matches the details you enter in the KYC form.

- Even small differences, like a missing middle name, could result in a rejection.

- Prepare for Selfie Verification

- If required, follow the instructions carefully like holding your ID while taking a selfie.

- Look directly at the camera and ensure your face is well-lit.

- Save Time with a Checklist

- Before you start, create a quick list of documents and cross them off as you gather each item.

By having everything ready before you begin, you’ll save time and set yourself up for a successful submission.

Need help creating your account before starting KYC? Check out the sign-up guide here.

Step-by-Step Guide to Completing Weex KYC

Step 1: Sign Up for an Account

Getting started begins with creating an account. Head to the platform’s homepage and click the Sign Up button, typically located at the top right corner. You’ll need to provide a valid email address and create a secure password. Use a strong password with a mix of letters, numbers, and symbols for security.

Once you’ve entered your details, check your email for a verification link. Sometimes, it lands in the spam folder don’t forget to check there too. Click the link to activate your account, and you’re ready to move to the next step.

Step 2: Locate the KYC Section

After verifying your email, log in and go to the account settings. You’ll usually find it under a profile icon or in the sidebar menu. Look for a section labeled Verification or Identity Verification. This is where your KYC journey begins.

Most platforms will outline the steps required for KYC once you’re in the verification section. Expect to see stages like Basic Info, Document Upload, and sometimes a Liveness Check.

Step 3: Fill Out Basic Information

The next screen will prompt you to provide some basic details like:

- Full name (as it appears on your government ID)

- Date of birth

- Residential address

- Nationality

Double-check the information. Even a small typo can lead to a rejection. Common mistake? Entering a nickname instead of your legal name. Avoid that!

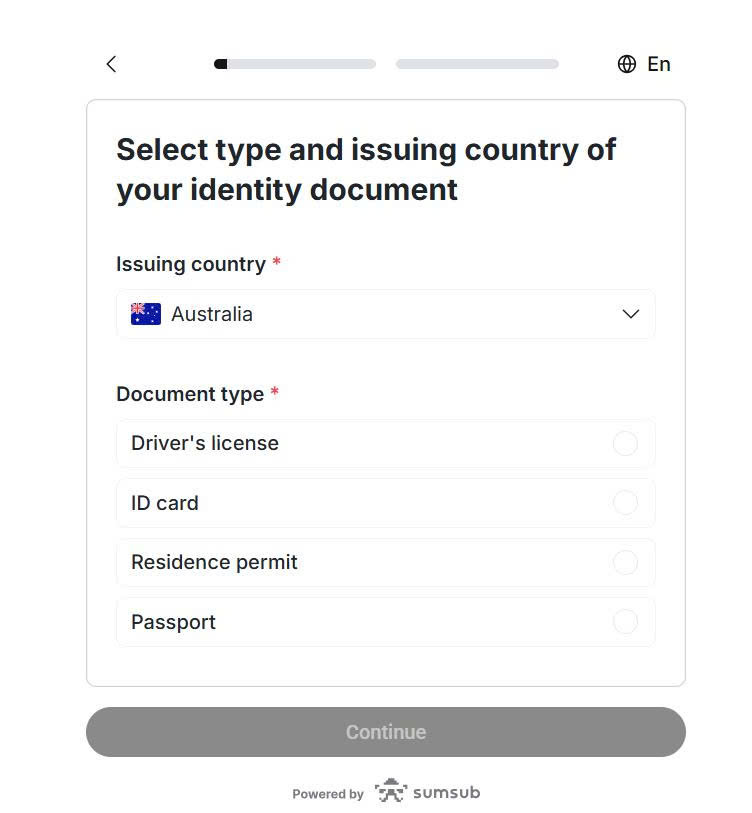

Step 4: Upload a Valid ID

Once your personal details are submitted, the platform will ask for document verification. The most common options are:

- Passport

- Driver’s License

- National ID Card

Make sure the ID is valid and not expired. The system will prompt you to either upload photos or take live pictures of your document.

Pro Tip: Use good lighting to ensure the text and photo on your ID are clearly visible. Blurry or shadowed images are a top reason for delays or rejections.

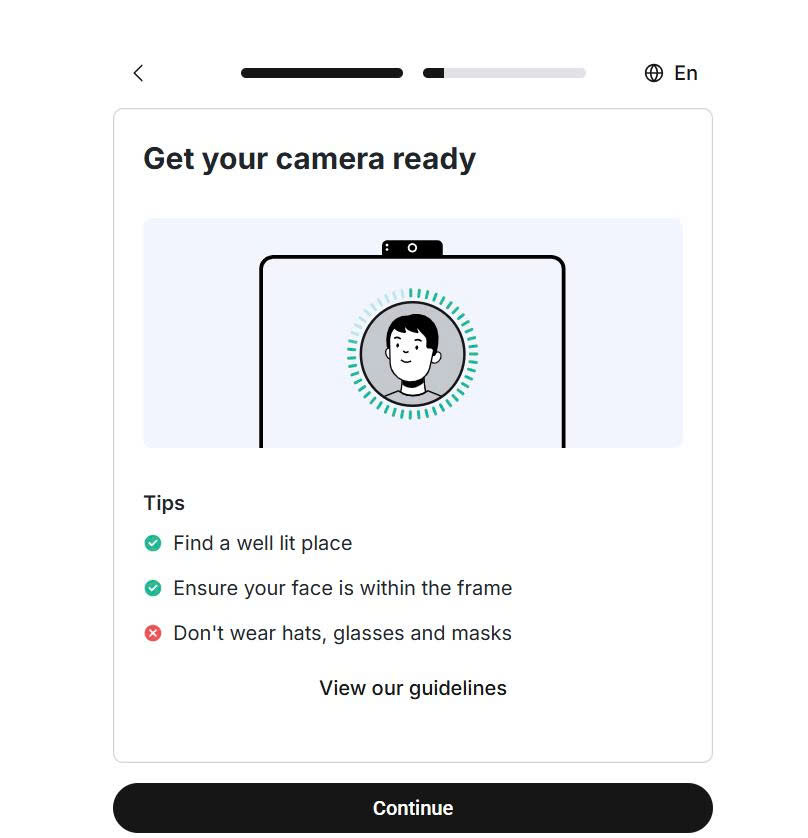

Step 5: Take a Selfie or Liveness Check

Here comes the final stretch: facial verification. The platform might request a selfie to match your photo ID. Some systems use advanced AI, so they’ll ask you to do a liveness check like turning your head or blinking while recording. Follow the on-screen instructions carefully.

If you’re nervous about failures here, don’t be. The interface usually points out errors in real-time, like poor lighting or misalignment. Just stay in a well-lit spot and keep your face relaxed.

Common Pitfalls to Avoid

To breeze through the process, watch out for these pitfalls:

- Documents with visible damage or wear: This may trigger rejection, especially if text or numbers are obscured.

- Mismatched details: Ensure the name on your ID matches what you entered earlier.

- Ignoring emails: Sometimes, a platform may request additional documentation through email. Check your inbox regularly.

Step 6: Wait for Approval

After completing these steps, you’ll enter the review stage. This can take anywhere from a few minutes to a couple of hours, depending on traffic. You’ll receive an email or notification once your account is verified.

If you’re still exploring how to get started with crypto trading, this step-by-step sign-up guide breaks it down even further.

Troubleshooting Common KYC Issues

Rejected Uploads? Handle It Like a Pro

Rejections often happen when the uploaded document doesn’t meet the platform’s requirements. Here’s how to fix it:

- File Format Issues: Stick to supported formats like JPEG or PDF. Screenshots or obscure file types? Avoid those.

- Image Quality Matters: Ensure the photo isn’t blurry. Good lighting, clear text, and all corners visible that’s the rule.

- Document Expired? Sadly, that’s an instant no. Use current, valid ID only.

If you’ve double-checked everything and it’s still rejected, check the platform guidelines again. Sometimes a tiny overlooked detail can trip you up.

Mismatched Details? Here’s the Fix

Your name, address, or other details must match your uploaded documents. Mismatched data can brick your attempt. Follow these tips:

- Cross-Check Your Profile: Is ‘John Doe’ on your profile but ‘Jonathan Doe’ on your ID? They have to match exactly.

- Typos Are Trouble: A small spelling mistake can cause rejection. Double-check every field for accuracy.

- Legal Name Changes: If you recently updated your name, provide official proof like a name change certificate.

When in doubt, edit your profile to reflect the exact name or address on your identification document before resubmitting.

Tired of Waiting? Speed Up Verification

Delays happen, but some actions can nudge the process along:

- Avoid Peak Times: Late at night or weekends might mean longer queues.

- Stay Available: Some platforms may request further clarification via email. Respond fast.

- Correct Early Errors: If you receive feedback (like a rejected upload), tackle it immediately. Your delay compounds the timeline.

Still waiting? Most verification teams handle inquiries via support tickets or direct chat. Use this chance to follow up on your case.

Customer Support Saves the Day

When nothing works, the platform’s support team is your lifeline. Here’s the smart way to contact them:

- Detailed Tickets Are Key: Write down your issue clearly. Include timestamps, error codes, and any official responses.

- Use Official Channels: Avoid random third-party support offers online. Stick to official chat systems or email.

Need guidance on your initial sign-up process too? Here’s a helpful guide to get started: Step-by-Step Sign-Up Instructions. It’s a great resource for addressing setup challenges as well.

No Luck? Final Steps

Still stuck? Consider retrying the process from scratch. Some platforms allow you to restart verification entirely, but confirm this option with support first. A fresh submission sometimes clears stubborn roadblocks.

Remember, patience will pay off. Once verified, you’ll unlock full access to the benefits the platform offers.

Post-KYC: Unlocking Full Weex Benefits

Completing your KYC isn’t just a formality it’s a gateway to a whole new level of convenience. Once verified, several exclusive features become accessible, making your trading experience smoother and more rewarding. Here’s what you gain post-KYC:

1. Higher Withdrawal Limits

Unverified accounts often come with strict limits for safety. While small withdrawals are nice for casual users, they can hold you back as your portfolio grows. Completing KYC lets you withdraw significantly higher amounts daily giving you the flexibility to manage large trades or transfers when needed. No more scrambling around trying to adjust to rigid caps.

2. Advanced Security

KYC isn’t just for compliance; it’s also about keeping your investments safe. Post-KYC, your account benefits from enhanced layers of protection that only verification can unlock. These security measures make it harder for unauthorized parties to compromise your account. Even if a hacker laid hands on your credentials, KYC verification gives you an extra cushion of safety.

3. Access to Advanced Trading Features

From margin trading to staking and exclusive trading pairs, verification opens up extra features tailored to more ambitious traders. Advanced tools that were previously unavailable are suddenly in reach, letting you leverage your strategies and optimize returns. Without KYC, you’d miss out on these perks completely.

4. Priority Customer Support

Issues happen. But being verified often puts you on a fast track when you need help. Verified users typically enjoy prioritized support or direct contact options to resolve problems faster. Whether it’s a stuck transaction or a general query, you’re not left waiting in line.

These benefits aren’t just nice-to-have perks they transform your account into a more secure, dynamic, and flexible trading hub. It’s no wonder they’re considered a must for taking trading seriously. Looking to create a similarly seamless account elsewhere? Check out this guide for more insights into the process.

And this is only the beginning. Beyond KYC, the platform offers powerful tools and strategies to maximize your crypto journey stay tuned for what’s next!

Final words

Completing your Weex KYC is more than just a regulatory obligation it’s the key to unlocking a secure, seamless trading experience and all the advanced features the platform has to offer. By following the steps and tips in this guide, you’ll not only save time but also avoid common pitfalls that could delay your account verification. With your KYC successfully completed, you’re now ready to capitalize on Weex’s exciting opportunities and achieve your financial goals with confidence. Start today and take control of your crypto journey with ease.

Ready to unlock the full potential of Weex? Complete your KYC in minutes and start trading today!

Learn more: https://cryplinker.com/

About us

CrypLinker empowers users with tools to simplify every step of their crypto journey from onboarding to trading with security and convenience at the forefront.