Stepping into online trading can feel overwhelming but with the right approach, it becomes a powerful path to profit. As a new user, navigating Weex trading may seem complex at first, but this guide simplifies the process. You’ll gain clear, actionable insights to start trading with confidence, avoid common pitfalls, and make smart decisions from day one. Let’s turn uncertainty into strategy and set you up for success on Weex.

Why Choose Weex for Trading?

For beginners stepping into trading, finding the right platform is everything. You need a space that’s simple, secure, and supportive. That’s exactly what makes Weex stand out.

1. User-Friendly Interface

A clean dashboard and intuitive design are essential for a beginner. Complex setups can discourage early attempts. On Weex, the interface is streamlined, making it easy to navigate even if you’ve never placed a trade before. Real-time data is displayed clearly, with no overwhelming charts or clutter to confuse you.

2. Top-Notch Security

Trust is crucial in trading, and that begins with security. Weex implements rigorous encryption protocols. Your assets and data are safeguarded. They even make compliance effortless, offering quick Know Your Customer (KYC) verification to protect user accounts. For a smooth guide on Weex’s KYC process, check out this article.

3. Competitive Costs

Fees can quietly eat into your profits on some trading platforms. But Weex ensures transparency. Costs are clear from the start, with no surprise charges waiting for you on the backend. This helps maximize your returns as you focus on learning the ropes.

4. Learning-Focused Tools

Beginners often need a little extra guidance. Weex integrates educational materials directly into its platform. Step-by-step tutorials and demo modes let you practice trades without the risk of losing money. This builds your confidence before moving into live markets.

5. Diverse Trading Options

As you grow, you’ll likely want variety in your investment strategy. Weex lets you explore a range of trading styles spot trading, leverage tokens, and more. These choices ensure the platform grows alongside your skillset.

In the sea of trading platforms, Weex shines by prioritizing beginners. It simplifies complexity, ensures safety, and provides all the tools needed to start strong. When starting your trading journey, a supportive environment like this makes all the difference.

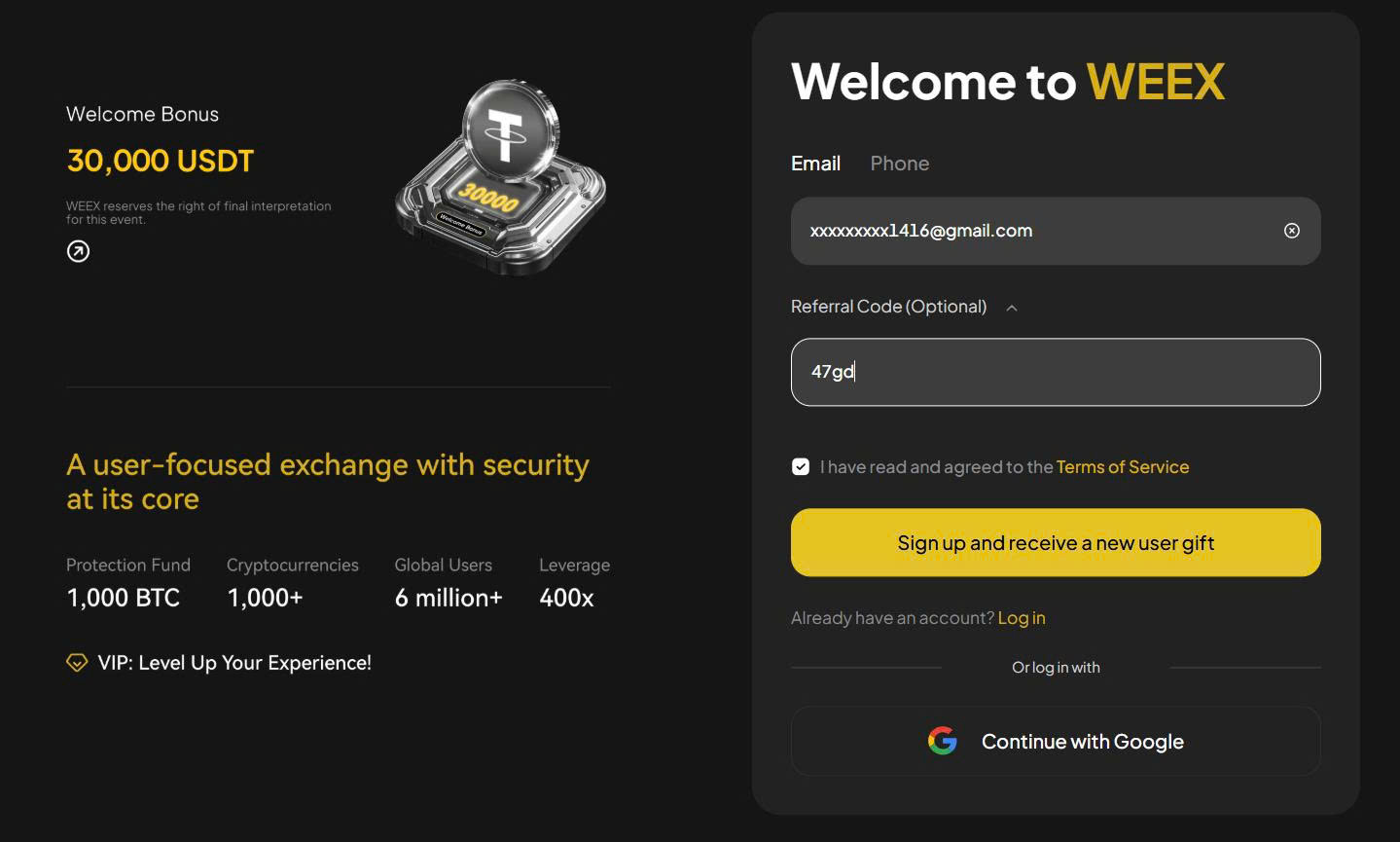

Setting Up Your Weex Account

Getting started on Weex is simpler than you might think, but attention to detail is crucial. Your trading success begins with a strong foundation setting up your account safely and efficiently. Follow these steps to jump in with confidence:

1. Create Your Account

Head to the platform’s registration page. You’ll be asked for basic details:

- Name: Use your full legal name. This is important for verification later.

- Email Address: Provide an active email you consistently use. Verification codes and updates go here.

- Password: Choose a secure mix of letters, numbers, and symbols. Avoid reusing an old password or something easy to guess.

Hit ‘Sign Up’ you’ll probably need to verify your email. Check your inbox for a code or link and confirm to move on.

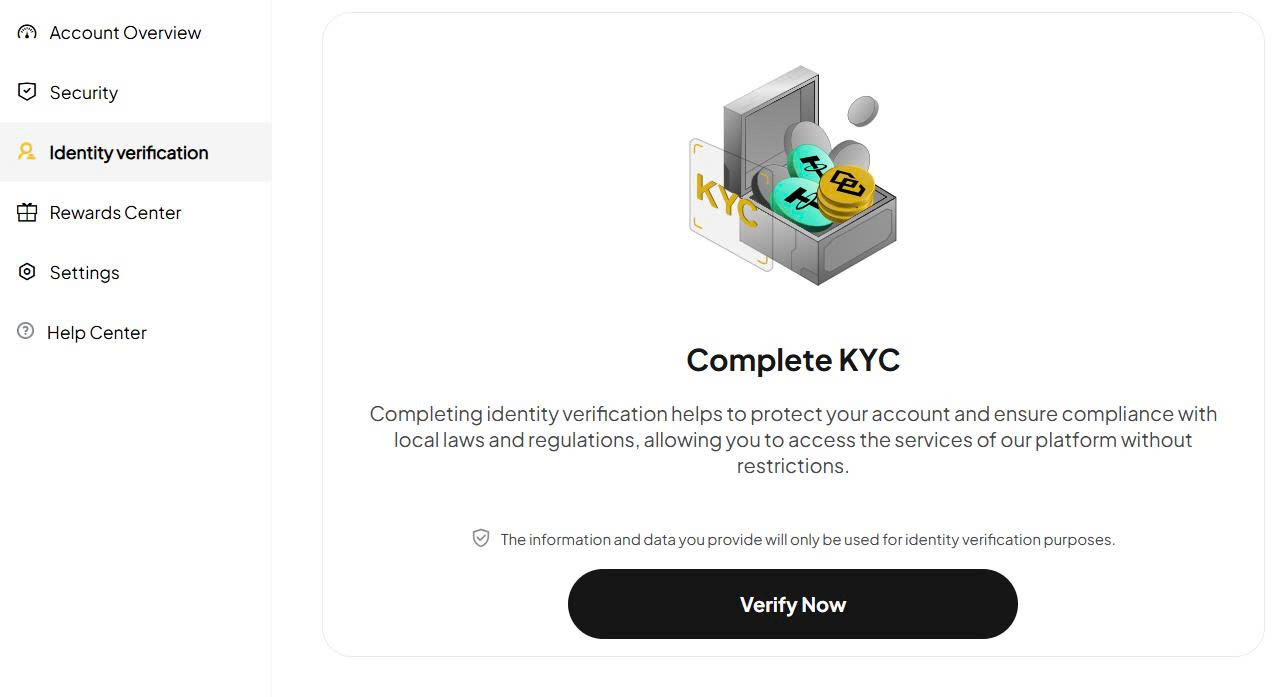

2. Verify Your Identity (KYC)

Verification isn’t optional; it’s necessary for both security and compliance. Here’s what to expect:

- Proof of Identity: Upload a clear photo of your government-issued ID or passport. Ensure all corners and details are visible.

- Selfie Verification: You may be required to take a live selfie or upload one to confirm you’re the same person on the ID. Follow the instructions carefully lighting and clarity matter.

- Proof of Address: Occasionally, platforms may ask for an address document like a utility bill or bank statement. It can’t be older than three months.

This process might take a few minutes or up to 24 hours. Check this guide on verifying accounts efficiently if you run into delays.

3. Link a Payment Method

Once verified, link a payment method so you can deposit and withdraw funds:

- Bank Account: Typically the safest option for larger transfers. Make sure the account matches your name on the platform.

- Debit or Credit Card: Perfect for quick deposits but may come with higher fees.

- Crypto Wallet (Optional): If you prefer using cryptocurrency, connect a wallet address. Double-check accuracy—mistakes here can be costly.

4. Activate Security Features

Trading involves your money, so extra security is non-negotiable. Here’s what to enable:

- Two-Factor Authentication (2FA): Use an app like Google Authenticator. It adds an extra layer by requiring both your password and a code to log in.

- Anti-Phishing Code: Many platforms allow you to set a unique code sent with official emails. It helps confirm emails are legit.

- Withdrawal Whitelist: This feature restricts withdrawals to verified wallet addresses or accounts. It reduces the risk of unauthorized transactions.

- Device Management: Check and manage which devices are logged in. If something looks off, log it out immediately.

Each step matters. By setting up everything properly, you build trust in the platform and set yourself up for smooth trading ahead. Preparation done right makes navigating your dashboard and executing trades far less stressful.

Understanding Crypto and Markets on Weex

Trading on any platform begins with knowing what you’re dealing with. At its core, trading is about exchanging one asset for another to profit from price movements. But before you dive in, you need to understand the types of assets available and how to navigate the market.

Assets Available on Trading Platforms

Platforms like Weex offer a wide range of assets, primarily falling into two categories:

- Cryptocurrencies: Digital currencies like Bitcoin, Ethereum, and many altcoins. Each cryptocurrency has different uses, technologies, and market behaviors.

- Fiat-to-Crypto Trading Pairs: These allow you to trade traditional currencies, such as USD or EUR, against cryptocurrencies. For example, BTC/USD tracks how much Bitcoin is worth in dollars.

Each asset behaves differently due to market volatility, liquidity, and underlying utility. Understanding these nuances can help you spot potential opportunities.

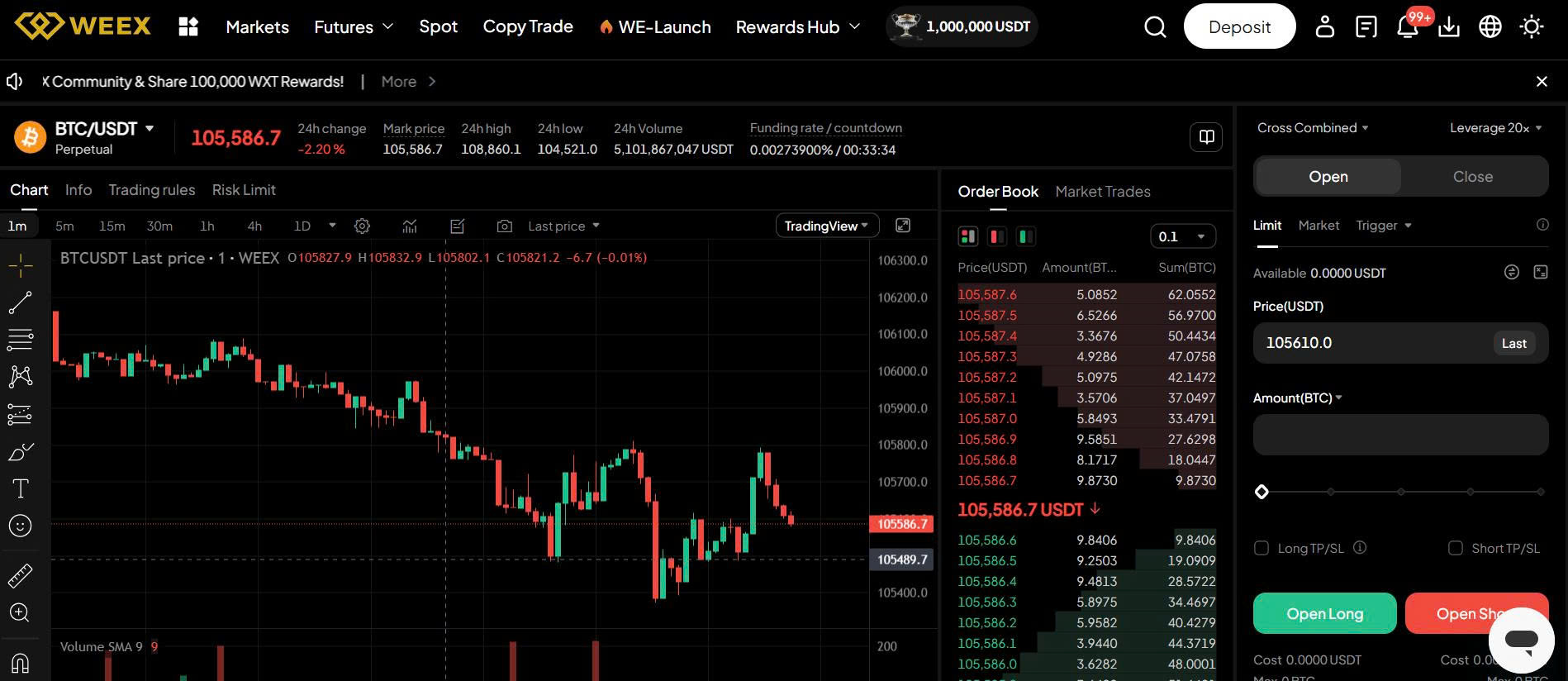

Decoding Market Charts

When you first open a trading chart, it might feel intimidating. But it doesn’t have to be. Here’s what you’ll encounter:

- Candlesticks: These are the building blocks of market charts. Each candlestick shows a price movement within a specific time frame. Candlesticks have four components:

- Open price: Where the price started.

- Close price: Where the price ended.

- High price: The peak value during that period.

- Low price: The lowest value during that period.Pro Tip: Red candles show the price dropped. Green candles mean it rose.

- Volume Bars: These sit below the chart and show how much of the asset was traded during a specific time frame. High volume often signals strong interest or market movement.

- Trends and Patterns: Learn to spot trends (up, down, or sideways). Patterns like triangles or head-and-shoulders can indicate possible moves.

Mastering Order Types

Executing trades isn’t just about clicking “Buy” or “Sell.” Order types let you control how and when your trades happen. Here are the most common ones:

- Market Orders: Buy or sell instantly at the current price. Quick but lacks precision.

- Limit Orders: Set a specific price to buy or sell, and the trade happens only if the market hits that price. Great for planning.

- Stop Orders: Automatically buy or sell when the price crosses a specific point. Helpful for protecting profits or minimizing losses.

Choosing the right order type is crucial. It can mean the difference between a successful and a failed trade.

Key Trading Concepts to Keep in Mind

To succeed, you need to grasp some essential principles:

- Volatility: Prices in crypto markets can change fast. Bigger swings mean higher risks but also greater rewards.

- Liquidity: Assets with high liquidity are easier to trade without drastic price changes. Look for pairs with significant trading volume.

- Risk Management: Never trade more than you’re willing to lose. Use tools like stop-loss orders to protect your investments.

- Diversification: Don’t put all your money into one asset. Spread your bets to reduce overall risk.

Understanding these basics will help you navigate the complexities of the market. Keep practicing, and don’t rush trading is a marathon, not a sprint.

Getting Started

Grasping these concepts sets a solid foundation for your trading journey. If you’re completely new to platforms like these, check out this guide to creating your account to get started on the right foot. Once you’re in, practice by observing the markets before making your first trade.

First Trade: Step-by-Step Guide

Making your first trade might feel intimidating at first, but it’s simpler than it seems. Here’s a clear, actionable guide to ensure you feel confident during your first experience.

Step 1: Selecting an Asset

When choosing what to trade, stick to the familiar. It could be a widely-known cryptocurrency, a commodity, or a currency pair. Beginners might find stable, high-volume assets less stressful than volatile ones.

- Explore the list of available assets. At this stage, avoid assets with big price swings unless you fully understand the risks.

- Example: Choosing something like Bitcoin (BTC) or a well-performing stable coin like USD-backed crypto can help reduce uncertainty.

Take a moment to review the trading pairs available. Many platforms let you trade BTC/USD, ETH/USDT, etc.

Step 2: Analyzing Trends

Before hitting that ‘Buy’ button, you’ll want to understand the asset’s behavior.

- Look at the historical price chart: Begin with a simple time frame, like the past day or week.

- Identify key patterns: Is the price consistently going up? Falling? Moving sideways? Look for a trend before deciding.

- Use simple decision aids: Many trading platforms offer tools like support and resistance lines. These visualize where prices tend to peak or fall.

If you’re not sure where to start, consider focusing on assets with a steady upward trend – they’re often better suited to beginners.

Step 3: Placing a Buy/Sell Order

Once you’ve analyzed an asset and decided to trade, it’s time to place an order:

- Select Order Type:

- Beginners generally use Market Orders – these execute instantly at the displayed price.

- More advanced ones include Limit Orders, where you set a price and wait for the market to match it.

- Set Quantity:

- Decide how much you wish to trade. On most platforms, you can enter the amount to invest (e.g., $100) or the number of units (e.g., 0.01 BTC).

- Execute the Trade:

- Double-check the details. Confirm if you’re ready and click ‘Buy’ or ‘Sell’.

A Sample Trade Walkthrough

Imagine you’re trading Bitcoin (BTC):

- Bitcoin is currently priced at $30,000.

- You believe based on the chart analysis that the price will rise.

- You place a Market Order for $50 worth of Bitcoin.

If all goes well, you’ll now hold a fraction of BTC ready to grow with the market. If the price dips, no panic – it’s part of trading.

For those still setting up their trading account, check this handy Weex KYC guide to complete setup quickly.

In the next chapter, we’ll dive into optimizing your portfolio by balancing risk and reward. Stay tuned!

Risk Management for Beginners

Risk management is your safety net in trading. Even the most skilled traders need a plan to handle risks. For beginners, this is even more critical—those who skip it often face unnecessary losses. Here’s how you can minimize risks while keeping opportunities intact:

1. Implement Stop-Loss Orders

A stop-loss is like an exit strategy you set in advance. It automatically sells an asset if its price drops to a certain level. This limits how much you can lose on a trade.

Why it matters:

- Emotions can get in the way, especially during market chaos. A stop-loss enforces discipline.

- You protect your capital, ensuring you can trade another day.

How to do it effectively:

- Choose a stop-loss level based on your risk tolerance (e.g., 2–3% of your portfolio).

- Avoid placing stop-losses too close to the entry price short-term price swings could trigger them unnecessarily.

2. Diversify Your Portfolio

Think of your investments as a basket of eggs. If one egg breaks, you still have others intact. By spreading your funds across different assets, you reduce the impact of a single bad trade.

What diversification looks like:

- Hold assets across multiple sectors or markets stocks, commodities, crypto.

- Avoid putting all your money into one trade, no matter how promising it seems.

- Balance high-risk and low-risk investments to stabilize overall returns.

Pro tip: While diversification lowers risk, over-diversification can dilute your potential gains. Aim for balance.

3. Set Realistic Goals

Unrealistic expectations often lead to risky decisions. Aim for steady, consistent growth, especially as a beginner. No trade or strategy guarantees instant wealth.

How to stay grounded:

- Start with small, achievable profit targets (e.g., 5% monthly growth).

- Accept losses as part of the game. Not every trade will work out, and that’s okay.

- Measure progress over weeks or months, not hours or days.

Final Thought on Risk Management

These strategies form the cornerstone of smart trading. Combine them for a solid foundation to maximize returns while keeping risks manageable. Trading responsibly is the first step to truly enjoying the journey. If you’re new and need to explore platform tools to set up your trading strategy, check tips like those in this account setup guide.

Tools and Resources to Succeed on Weex

Success in trading hinges on having the right tools and resources at your fingertips. Here’s how Weex equips you with the essentials to take your trading to the next level. More importantly, I’ll show you how to make the most of these features.

Analytics Tools for Smart Decision-Making

Weex offers a suite of analytics tools designed to simplify market data. These tools break down complex trends using visual aids like charts, graphs, and heatmaps.

- Real-time Market Trends: Stay updated on asset prices as they move. Real-time data reduces missed opportunities and keeps you ahead.

- Customizable Indicators: Tools where you tweak variables (e.g., moving averages) give you a tailored view of the market. Tip: Start simple, using default settings before diving into advanced tweaks.

- Historical Data Insights: Want to know how certain assets behaved in the past? Extensive history helps identify patterns that might repeat.

Actionable Tip: Begin by identifying one or two key indicators that make sense to you. Sticking to too many analytics tools at once can overwhelm. Master simplicity, then layer on complexity as your confidence grows.

Educational Resources to Boost Confidence

Nobody gets trading “right” on day one. Education bridges the gap between beginner and confident investor. Weex offers resources that cater to varying skill levels:

- Interactive Tutorials: Walkthroughs on how to execute basic trades, leverage analytics, and understand market mechanics. These bite-sized lessons prevent overload.

- Webinars with Pros: Experts demystify advanced topics like risk management or technical analysis in live conversation formats. Engage with Q&A to clarify your doubts.

- Regular Blog Updates: Articles offering insights into current trends, new features, or evolving global economic factors. Think of them as your cheat sheet for staying informed.

Actionable Tip: Dedicate consistent time weekly to learning. Bookmark one tutorial or webinar, and revisit it until you actively apply the concept. Learning doesn’t stop after the first few trades make it a habit.

Reliable Customer Support for Quick Problem Solving

Even the best tools mean little if you hit roadblocks without a way out. That’s where effective support plays a game-changing role. Features available include:

- 24/7 Live Chat: Stuck mid-trade or confused about functionalities? Immediate assistance can save both time and money.

- FAQs and Help Center: Before calling for help, browse their FAQs. Many common hurdles like account setup or payment issues already have solutions listed. (Pro tip: Bookmark this page for emergencies.)

- Community Forums: A goldmine for real-world tips, where users share insights or strategies not covered in official guides.

Actionable Tip: Keep a record of your most common queries or trading mishaps. Build your personal FAQ list for quick resolutions, so you spend less time troubleshooting and more time trading.

To maximize your Weex experience, mastering these tools isn’t optional. It’s the foundation for success. Combining analytics, education, and responsive support can transform your approach from guessing to informed decision-making. Need help setting up a Weex account? Check out this simple sign-up guide.

Final words

Weex opens the door for aspiring traders by providing an intuitive interface, powerful tools, and reliable support to make trading both accessible and rewarding. Whether you’re just starting out or aiming for long-term profitability, the platform equips you with everything you need to succeed in the fast-changing digital markets. By mastering Weex’s tools, applying thoughtful risk management, and leveraging its resources, you can transition from a beginner to a confident trader in no time. Don’t wait for an opportunity to pass by start small, plan strategically, and take your trading journey to the next level today.

Ready to trade like a pro? Sign up on Weex and unlock your trading potential today!

Learn more: https://cryplinker.com/

About us

CrypLinker offers a seamless gateway to trading with Weex, providing tools, insights, and support to maximize your investing success.